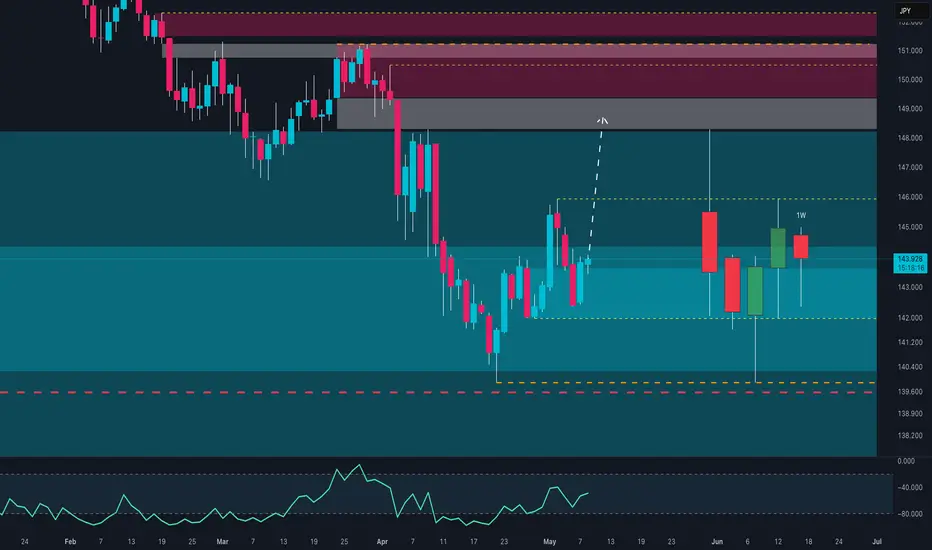

USD/JPY is at a crucial stage, with the price hovering around 143.900. After a bearish move, the market is attempting to recover, aiming for the resistance zone between 149.000 and 151.000.

COT Insight:

COT data shows a slight increase in long positions among speculative traders (+397), while commercials are increasing their short coverage (+539), indicating caution.

Seasonality:

Historically, May has been a slightly bullish month for USD/JPY (+0.42% over the last 10 years), but the trend has been negative in the last 5 years (-0.57%), indicating uncertainty.

Retail Sentiment:

65% of retail traders are long, which could indicate potential bearish pressure in case of opposite moves, given the risk of position liquidation.

Conclusion:

Carefully monitor the price reaction around 144.000. A breakout towards 149.000 could signal a significant move, but the long retail pressure might represent an obstacle.

COT Insight:

COT data shows a slight increase in long positions among speculative traders (+397), while commercials are increasing their short coverage (+539), indicating caution.

Seasonality:

Historically, May has been a slightly bullish month for USD/JPY (+0.42% over the last 10 years), but the trend has been negative in the last 5 years (-0.57%), indicating uncertainty.

Retail Sentiment:

65% of retail traders are long, which could indicate potential bearish pressure in case of opposite moves, given the risk of position liquidation.

Conclusion:

Carefully monitor the price reaction around 144.000. A breakout towards 149.000 could signal a significant move, but the long retail pressure might represent an obstacle.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.