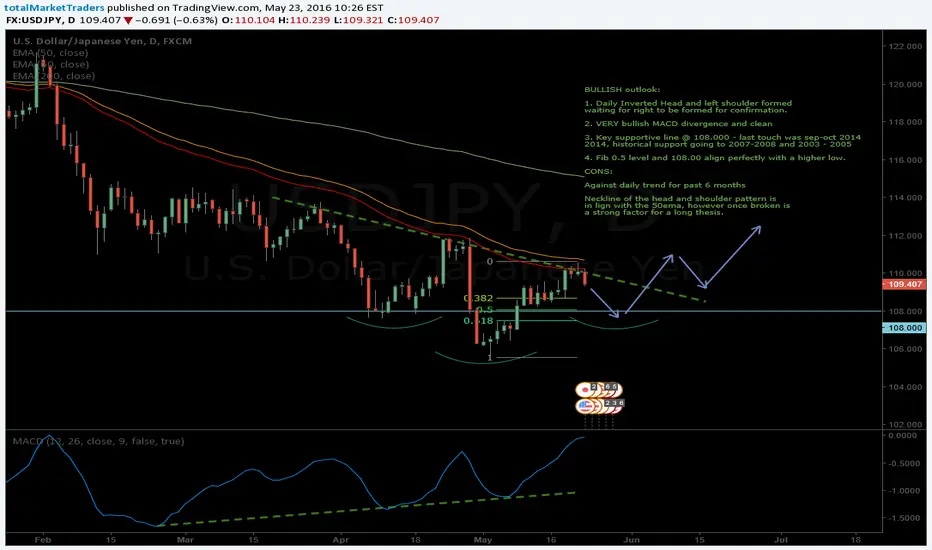

BULLISH outlook:

1. Daily Inverted Head and left shoulder formed

waiting for right to be formed for confirmation.

2. VERY bullish MACD divergence and clean

3. Key supportive line @ 108.000 - last touch was sep-oct 2014

2014, historical support going to 2007-2008 and 2003 - 2005

4. Fib 0.5 level and 108.00 align perfectly with a higher low.

CONS:

Against daily trend for past 6 months

Neckline of the head and shoulder pattern is

aligned with the 50ema, however once broken is

a strong factor for a long thesis.

1. Daily Inverted Head and left shoulder formed

waiting for right to be formed for confirmation.

2. VERY bullish MACD divergence and clean

3. Key supportive line @ 108.000 - last touch was sep-oct 2014

2014, historical support going to 2007-2008 and 2003 - 2005

4. Fib 0.5 level and 108.00 align perfectly with a higher low.

CONS:

Against daily trend for past 6 months

Neckline of the head and shoulder pattern is

aligned with the 50ema, however once broken is

a strong factor for a long thesis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.