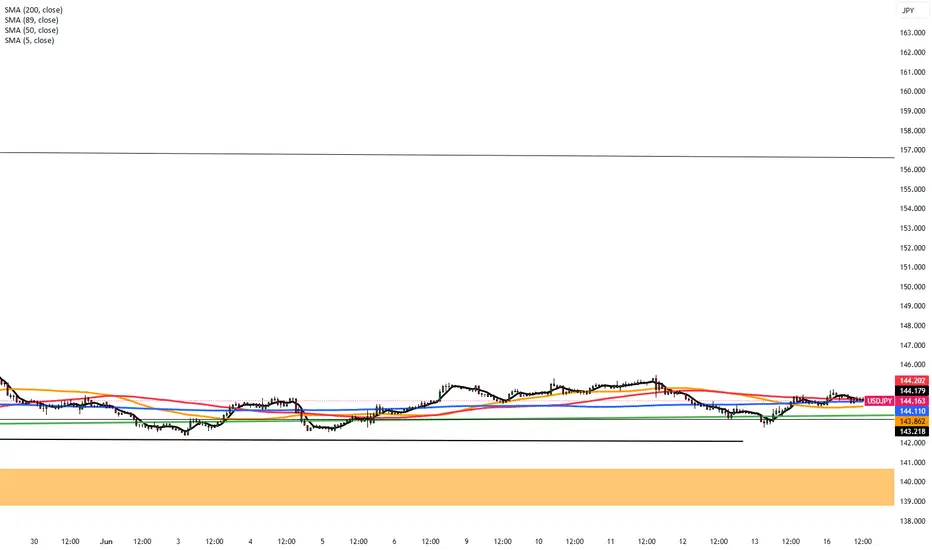

The Japanese yen fell past 144.2 per dollar on Monday, marking a second day of losses, as the U.S. dollar strengthened on increased safe-haven demand. This followed renewed conflict between Israel and Iran, with both sides targeting energy facilities and pushing oil prices higher. The rise in energy costs may reduce the chances of a near-term Fed rate cut as inflation and trade risks persist. Meanwhile, focus turns to the Bank of Japan’s upcoming policy meeting, where it is expected to keep rates unchanged while assessing the inflation impact of rising oil prices amid global uncertainty.

Resistance is at 145.30, while support stands near 142.50.

Resistance is at 145.30, while support stands near 142.50.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.