📊 Asset: USD/JPY — "The Ninja" Forex Bank Heist Plan (Swing/Day Trade)

🎯 USD/JPY Quick Snapshot

🔸 Daily Change: +0.39% (↑)

🔸 52-Week Range: 139.57 - 158.89

📊 Retail & Institutional Sentiment

🔹 Retail Traders: Bearish (60%) – Caution due to political uncertainty in Japan.

🔹 Institutional Traders: Bullish (70%) – Expect USD strength amid BOJ-Fed policy divergence.

🔹 Fear & Greed Index: 62/100 (Greed) – Moderate risk appetite favoring USD.

🔍 Fundamental & Macro Score

🏦 BOJ Policy Outlook:

• Rate hike uncertainty keeps JPY weak.

• Score: 3/10 (Bearish for JPY) 🐻

💵 Fed Policy Outlook:

• 90% chance of 25bps rate cut in September.

• Score: 7/10 (Bullish for USD) 🐂

🇯🇵 Political Risk (Japan):

• Leadership uncertainty weighs on JPY.

• Score: 4/10 (Negative for JPY) ⚠️

🌐 Trade War Risks:

• US tariff tensions may dampen USD strength.

• Score: 5/10 (Neutral)

🎯 Overall Market Outlook

🟢 Bullish (Long) Score: 65% ✅

🔴 Bearish (Short) Score: 35% ❌

📌 Summary: USD/JPY leans bullish due to BOJ hesitation, Fed cuts, and JPY political risks.

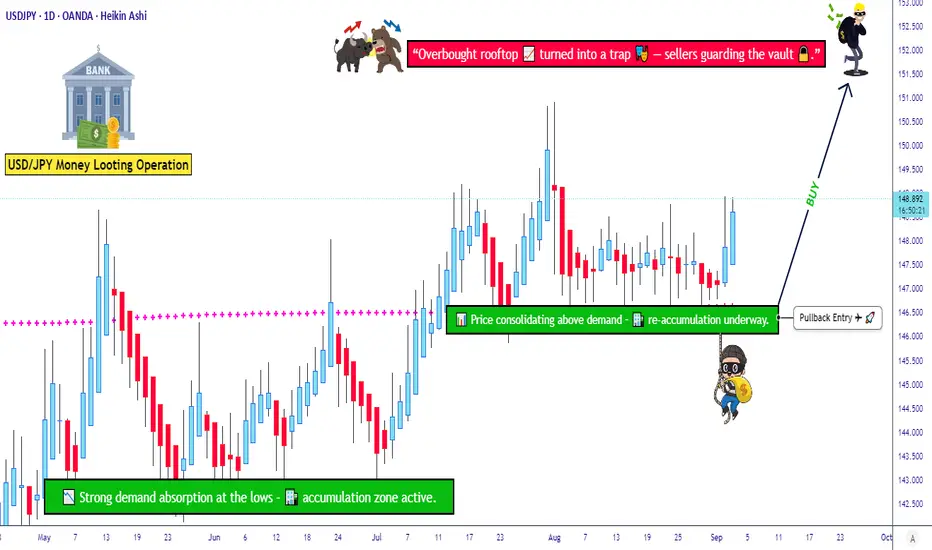

❓ WHY THIS Setup?

🔸 USD/JPY is respecting bullish structure while retail is mostly short → contrarian signal 🚨.

🔸 Institutional flow shows confidence in USD strength vs JPY weakness 📈.

🔸 BOJ hesitation + political instability in Japan continues to suppress JPY demand 🐻.

🔸 Layered entry strategy reduces risk of bad timing + maximizes capture of bullish wave ⚡.

🔸 Key target zone 151.500–152.000 offers strong risk/reward for swing & day traders 🎯.

✅ Thief Trading Plan: Bullish Setup

🔸 Entry (Thief Style Layer Strategy 🪤):

• 147.500

• 148.000

• 148.500

• 149.000

(Increase/adjust layers as per your own strategy.)

🔸 Stop Loss (Thief SL 🔒):

• Base SL @146.000

• Adjust according to risk tolerance & personal strategy

🔸 Target 🎯:

• Trap/reversal zone near 152.000

• Safer exit before reversal @ 151.500

⚡ Strategy Breakdown

🔹 Method: Thief OG Layer Strategy = scaling with multiple limit orders instead of single-entry.

🔹 Benefit: Absorbs noise, builds positions step-by-step, reduces FOMO.

🔹 Bias: Swing/Day trade friendly with bullish momentum in higher zones.

👀 Related Pairs to Watch:

💷

GBPJPY

GBPJPY

💶

EURJPY

EURJPY

🇨🇭

CHFJPY

CHFJPY

💵

USDCHF

USDCHF

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#USDJPY #Forex #SwingTrading #DayTrading #JPY #ForexStrategy #TradingPlan #FXThief #LayerStrategy #SmartMoney

🎯 USD/JPY Quick Snapshot

🔸 Daily Change: +0.39% (↑)

🔸 52-Week Range: 139.57 - 158.89

📊 Retail & Institutional Sentiment

🔹 Retail Traders: Bearish (60%) – Caution due to political uncertainty in Japan.

🔹 Institutional Traders: Bullish (70%) – Expect USD strength amid BOJ-Fed policy divergence.

🔹 Fear & Greed Index: 62/100 (Greed) – Moderate risk appetite favoring USD.

🔍 Fundamental & Macro Score

🏦 BOJ Policy Outlook:

• Rate hike uncertainty keeps JPY weak.

• Score: 3/10 (Bearish for JPY) 🐻

💵 Fed Policy Outlook:

• 90% chance of 25bps rate cut in September.

• Score: 7/10 (Bullish for USD) 🐂

🇯🇵 Political Risk (Japan):

• Leadership uncertainty weighs on JPY.

• Score: 4/10 (Negative for JPY) ⚠️

🌐 Trade War Risks:

• US tariff tensions may dampen USD strength.

• Score: 5/10 (Neutral)

🎯 Overall Market Outlook

🟢 Bullish (Long) Score: 65% ✅

🔴 Bearish (Short) Score: 35% ❌

📌 Summary: USD/JPY leans bullish due to BOJ hesitation, Fed cuts, and JPY political risks.

❓ WHY THIS Setup?

🔸 USD/JPY is respecting bullish structure while retail is mostly short → contrarian signal 🚨.

🔸 Institutional flow shows confidence in USD strength vs JPY weakness 📈.

🔸 BOJ hesitation + political instability in Japan continues to suppress JPY demand 🐻.

🔸 Layered entry strategy reduces risk of bad timing + maximizes capture of bullish wave ⚡.

🔸 Key target zone 151.500–152.000 offers strong risk/reward for swing & day traders 🎯.

✅ Thief Trading Plan: Bullish Setup

🔸 Entry (Thief Style Layer Strategy 🪤):

• 147.500

• 148.000

• 148.500

• 149.000

(Increase/adjust layers as per your own strategy.)

🔸 Stop Loss (Thief SL 🔒):

• Base SL @146.000

• Adjust according to risk tolerance & personal strategy

🔸 Target 🎯:

• Trap/reversal zone near 152.000

• Safer exit before reversal @ 151.500

⚡ Strategy Breakdown

🔹 Method: Thief OG Layer Strategy = scaling with multiple limit orders instead of single-entry.

🔹 Benefit: Absorbs noise, builds positions step-by-step, reduces FOMO.

🔹 Bias: Swing/Day trade friendly with bullish momentum in higher zones.

👀 Related Pairs to Watch:

💷

💶

🇨🇭

💵

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#USDJPY #Forex #SwingTrading #DayTrading #JPY #ForexStrategy #TradingPlan #FXThief #LayerStrategy #SmartMoney

Trade active

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.