🧠 Market Psychology & Structure

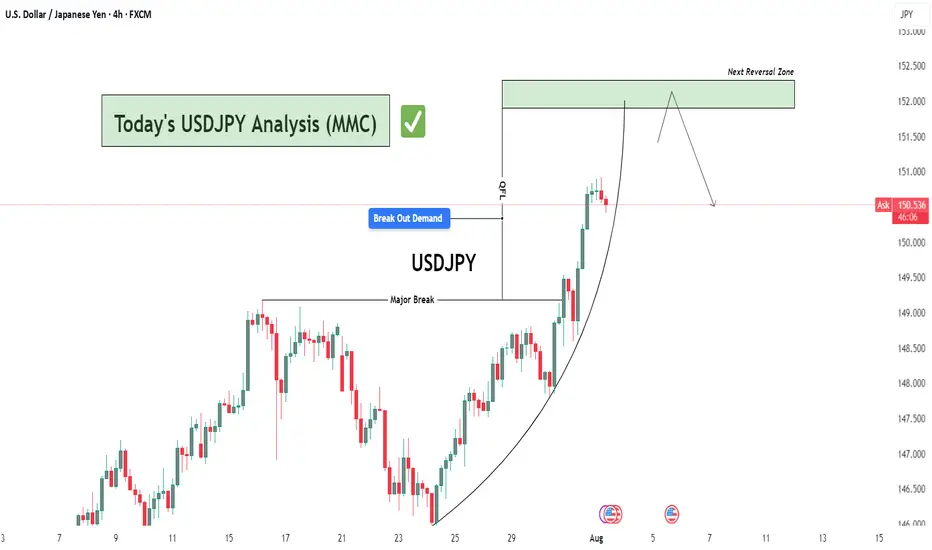

The USDJPY 4-hour chart reveals a classic parabolic curve pattern signifying an acceleration phase in bullish momentum. This phase typically occurs during the final stages of a bullish move, where price action becomes increasingly steep due to aggressive buyer participation.

The rounded curve drawn on the chart reflects momentum compression—where pullbacks become shallower, and higher highs are formed rapidly. However, this pattern often ends in a blow-off top or a sharp correction, especially when approaching key supply zones.

🧩 Key Technical Highlights

Major Break Zone: The previous resistance around 148.80–149.00 (now flipped to support) was clearly broken with strong bullish candles, confirming trend continuation.

Break Out Demand: Price retested the breakout zone (around 149.80–150.00) before launching higher, validating this level as a new demand zone.

Current Price Action: The pair is currently hovering around 150.50 after a powerful rally, showing early signs of exhaustion with smaller bullish candles and slight upper wicks.

🔍 Target Area – Next Reversal Zone (151.80–152.30)

The green highlighted zone marks a strong supply area / reversal zone, identified from:

We can expect price to reach this zone in the coming sessions, where it may:

Face strong selling pressure.

Trigger short positions from institutional sellers.

Lead to distribution or reversal back toward the demand area near 150.00.

🔄 Forecast & Trade Plan

Scenario 1 (High Probability): Price taps into 151.80–152.30, forms bearish engulfing or rejection wick, then pulls back to 150.00 or lower.

Scenario 2 (Invalidation): Strong breakout above 152.30 with momentum—bullish continuation towards 153.00+ possible.

🧠 Trader’s Mindset (MMC Insight)

This chart suggests a matured bullish trend nearing exhaustion. As smart traders, we anticipate rather than react. Wait for the price to reach the supply zone, then observe for confirmation (bearish structure, divergence, candlestick pattern) before shorting.

Avoid chasing longs at these highs—risk-to-reward is no longer favorable. Patience will offer a much cleaner entry if the reversal unfolds as expected.

The USDJPY 4-hour chart reveals a classic parabolic curve pattern signifying an acceleration phase in bullish momentum. This phase typically occurs during the final stages of a bullish move, where price action becomes increasingly steep due to aggressive buyer participation.

The rounded curve drawn on the chart reflects momentum compression—where pullbacks become shallower, and higher highs are formed rapidly. However, this pattern often ends in a blow-off top or a sharp correction, especially when approaching key supply zones.

🧩 Key Technical Highlights

Major Break Zone: The previous resistance around 148.80–149.00 (now flipped to support) was clearly broken with strong bullish candles, confirming trend continuation.

Break Out Demand: Price retested the breakout zone (around 149.80–150.00) before launching higher, validating this level as a new demand zone.

Current Price Action: The pair is currently hovering around 150.50 after a powerful rally, showing early signs of exhaustion with smaller bullish candles and slight upper wicks.

🔍 Target Area – Next Reversal Zone (151.80–152.30)

The green highlighted zone marks a strong supply area / reversal zone, identified from:

- Previous price rejections in historical data.

- Overbought conditions due to vertical rally.

- Completion of the parabolic structure (climax zone).

We can expect price to reach this zone in the coming sessions, where it may:

Face strong selling pressure.

Trigger short positions from institutional sellers.

Lead to distribution or reversal back toward the demand area near 150.00.

🔄 Forecast & Trade Plan

Scenario 1 (High Probability): Price taps into 151.80–152.30, forms bearish engulfing or rejection wick, then pulls back to 150.00 or lower.

Scenario 2 (Invalidation): Strong breakout above 152.30 with momentum—bullish continuation towards 153.00+ possible.

🧠 Trader’s Mindset (MMC Insight)

This chart suggests a matured bullish trend nearing exhaustion. As smart traders, we anticipate rather than react. Wait for the price to reach the supply zone, then observe for confirmation (bearish structure, divergence, candlestick pattern) before shorting.

Avoid chasing longs at these highs—risk-to-reward is no longer favorable. Patience will offer a much cleaner entry if the reversal unfolds as expected.

For Daily Trade Setups and Forecast: 📈 t.me/xauusdoptimizer

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

For Daily Trade Setups and Forecast: 📈 t.me/xauusdoptimizer

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Premium Signals Fr33: 💯 t.me/xauusdoptimizer

🥰🥳🤩

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.