The Bank of Japan's (BoJ) upcoming interest rate decision could be a pivotal moment for the USD/JPY currency pair, potentially driving it down to the 145 level. Here's why:

Narrowing Interest Rate Differential: If the BoJ decides to raise interest rates or signals an intent to do so in the near future, this would narrow the interest rate differential with the U.S. The U.S. has been maintaining higher interest rates compared to Japan's negative or near-zero rates. A reduction in this gap would make holding Japanese Yen (JPY) relatively more attractive, thus strengthening the JPY against the USD.

Market Expectations and Sentiment: Markets often react to expectations before they react to actual news. If there's a growing consensus or speculation that the BoJ might tighten policy, traders might preemptively adjust their portfolios, leading to a stronger JPY. Recent posts on X have hinted at expectations of BoJ rate hikes, which could fuel this sentiment.

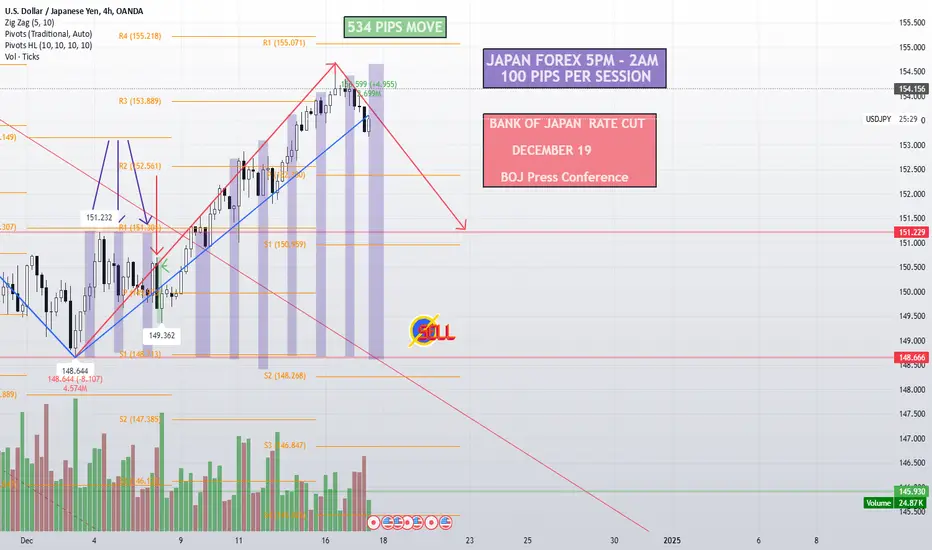

Technical Analysis Indicators: From a technical standpoint, if the BoJ surprises with hawkish comments or actions, this could trigger a sell-off in USD/JPY. The pair has been hovering around key resistance levels, and a policy shift might push it below significant support levels, potentially aiming for 145. Technical analyses often look for signs of a break below current supports, which could be catalyzed by a BoJ decision.

Global Economic Conditions: The global economic landscape, including U.S. economic data like employment figures, inflation rates, and Fed policy, will also play a role. If U.S. data suggests a softening economy or if the Fed signals rate cuts, this would weaken the USD against other currencies, including the JPY. Conversely, a dovish BoJ might not lead to as significant a drop, but the current market sentiment seems to be banking on at least some tightening from Japan.

Psychological Levels and Market Dynamics: The 145 mark could act as a psychological level for traders, where large volumes of trading might occur due to this round figure. If the BoJ's actions or statements align with market expectations of a policy shift, this could accelerate the move towards this level, especially if there's already momentum in that direction.

Narrowing Interest Rate Differential: If the BoJ decides to raise interest rates or signals an intent to do so in the near future, this would narrow the interest rate differential with the U.S. The U.S. has been maintaining higher interest rates compared to Japan's negative or near-zero rates. A reduction in this gap would make holding Japanese Yen (JPY) relatively more attractive, thus strengthening the JPY against the USD.

Market Expectations and Sentiment: Markets often react to expectations before they react to actual news. If there's a growing consensus or speculation that the BoJ might tighten policy, traders might preemptively adjust their portfolios, leading to a stronger JPY. Recent posts on X have hinted at expectations of BoJ rate hikes, which could fuel this sentiment.

Technical Analysis Indicators: From a technical standpoint, if the BoJ surprises with hawkish comments or actions, this could trigger a sell-off in USD/JPY. The pair has been hovering around key resistance levels, and a policy shift might push it below significant support levels, potentially aiming for 145. Technical analyses often look for signs of a break below current supports, which could be catalyzed by a BoJ decision.

Global Economic Conditions: The global economic landscape, including U.S. economic data like employment figures, inflation rates, and Fed policy, will also play a role. If U.S. data suggests a softening economy or if the Fed signals rate cuts, this would weaken the USD against other currencies, including the JPY. Conversely, a dovish BoJ might not lead to as significant a drop, but the current market sentiment seems to be banking on at least some tightening from Japan.

Psychological Levels and Market Dynamics: The 145 mark could act as a psychological level for traders, where large volumes of trading might occur due to this round figure. If the BoJ's actions or statements align with market expectations of a policy shift, this could accelerate the move towards this level, especially if there's already momentum in that direction.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.