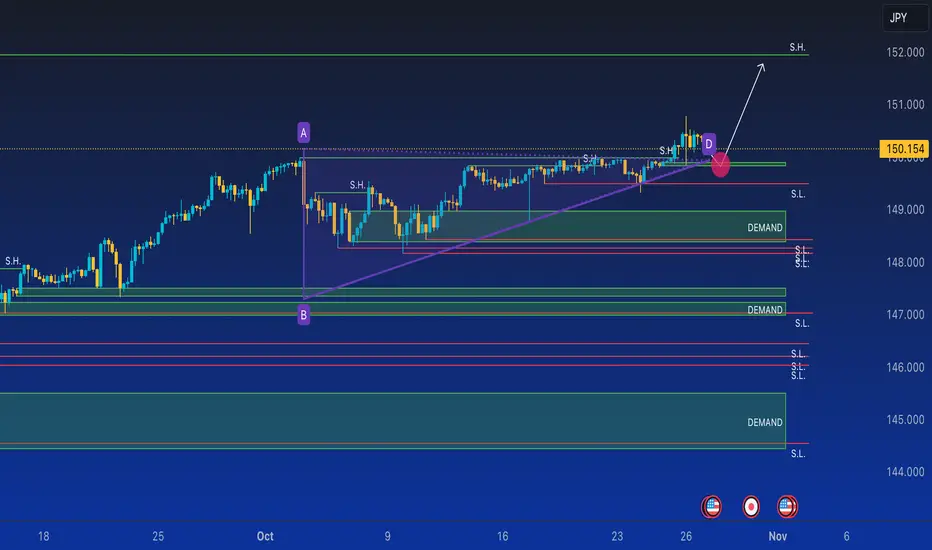

The USD/JPY exchange rate is currently declining towards 150.00 in a delayed response to the Tokyo Consumer Price Index (CPI) inflation data beat, with a modest drop in the US dollar contributing to the current descent of the pair. Attention is now focused on the US PCE inflation. The USD/JPY exchange rate recently surpassed the significant psychological level of 150.00, extending the overall uptrend. The pair is bullish on a long-term, intermediate, and short-term basis. The pair has completed what appears to be an ascending triangle on the daily chart and has broken above the October 3 highs at 150.16, confirming a breakout. Although the breakout has not been particularly decisive (Thursday's breakout candle is a 'Doji,' indicating indecision), the price will likely continue higher, given the dominant uptrend. The technical target of the triangle is around 152. The Moving Average Convergence Divergence (MACD) momentum indicator shows bearish divergence with price when compared to the October 3 high. This happens when price makes a higher high, but momentum fails to follow suit. This suggests underlying weakness in the uptrend and increases the risk that the triangle breakout may be 'false.' Further confirmation of the ongoing uptrend would come with a re-break above Thursday's highs at 150.80. It's worth noting that triangles are sometimes precursors to trend reversals, indicating that the current uptrend may be approaching its culmination point. Initially, the Japanese Yen (JPY) weakened against the US Dollar (USD), which benefited from safe-haven flows and higher US yields. Later, the JPY was supported by probable intervention from the Japanese Ministry of Finance (MoF) after the USD/JPY rate crossed the 150 defensive line, a level traditionally defended by the MoF. US data released on Thursday showed an unexpected increase in America's GDP to 4.9% in Q3 on an annualized basis, solidly beating consensus estimates of 4.2%. US Durable Goods Orders rose 4.7% versus estimates of 1.5%, and Initial Jobless Claims increased to 210K versus 208K expected. Despite being mostly positive, the data did not benefit the US dollar, and the US Dollar Index (DXY) registered a slight drop after the data, with DXY down 0.1% just over an hour after the releases. Therefore, it will be interesting to see further price reactions on the upper side of the triangle to evaluate possible trend continuations. In case of an upward move, the level of 155 seems more than achievable. Let me know what you think, comment, and leave a like. Greetings from Nicola, the CEO of Forex48 Trading Academy.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.