Greetings Traders,

In today’s analysis of USDJPY, we observe that the prevailing institutional order flow remains bearish, positioning us to focus on high-probability selling opportunities aligned with downside liquidity objectives.

Key Observations on H4:

Trading Plan:

Remain patient, allow the market to confirm your bias, and execute with disciplined risk management.

Kind regards,

The Architect 🏛️📉

In today’s analysis of USDJPY, we observe that the prevailing institutional order flow remains bearish, positioning us to focus on high-probability selling opportunities aligned with downside liquidity objectives.

Key Observations on H4:

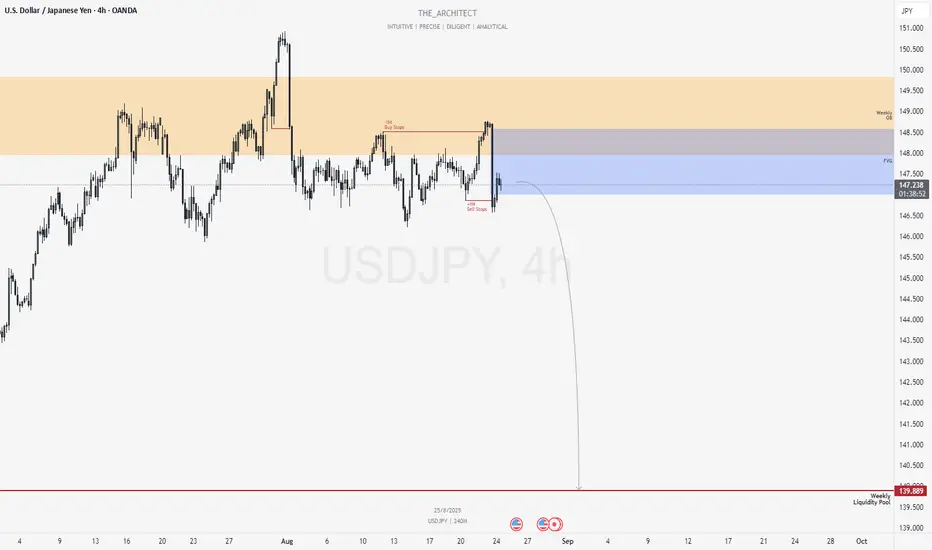

- Weekly Bearish Order Block Reaction: Price recently reacted to a weekly bearish order block, causing an H4 market structure shift (MSS) to the downside. This confirms that the H4 order flow is now in alignment with the higher timeframe bearish bias, with the weekly order block acting as a strong institutional resistance zone.

- Liquidity Dynamics: Recent price action saw sell-side liquidity swept (external range liquidity), followed by a pullback into an H4 fair value gap (FVG), representing internal range liquidity. This reinforces the expectation that the H4 FVG may hold as a firm resistance zone.

Trading Plan:

- Entry Strategy: Seek confirmation-based entries on the lower timeframes (M15 and below) within the H4 FVG to refine risk and validate the bearish continuation.

- Target Objective: Focus on discount-side liquidity pools, consistent with institutional objectives to rebalance price and capture liquidity resting below.

- The main liquidity draw is towards the weekly liquidity pool- which is our long term draw on liquidity.

Remain patient, allow the market to confirm your bias, and execute with disciplined risk management.

Kind regards,

The Architect 🏛️📉

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.