Hey traders!

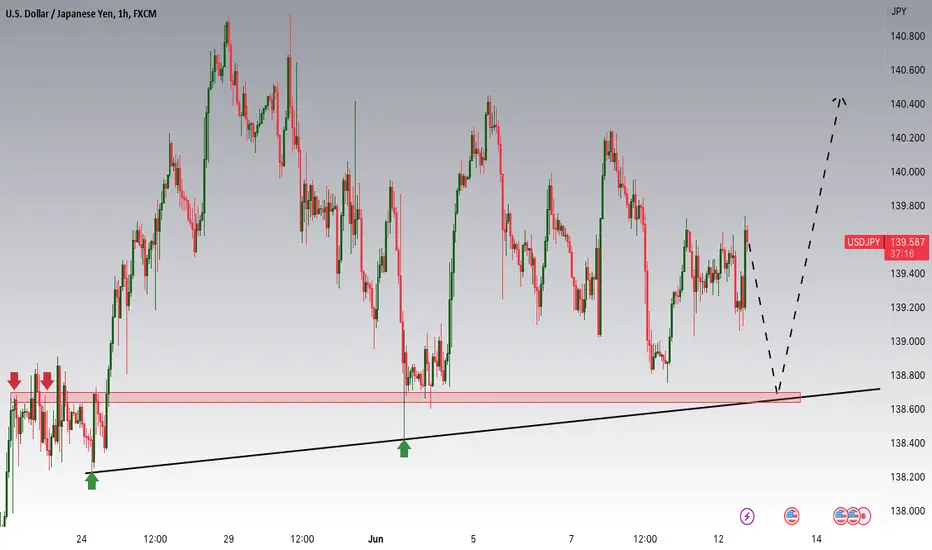

Today, our focus is on USDJPY, where we are observing a potential buying opportunity around the 138.700 zone. USDJPY is currently in an uptrend and appears to be approaching a significant support and resistance area at 138.700.

This week, we have two key events that could impact the market. First, on Wednesday, we have the Federal Open Market Committee (FOMC) meeting, where the Federal Reserve's monetary policy decisions will be announced. However, the day before the FOMC meeting, we have the release of the Consumer Price Index (CPI) data, which is important to gauge the Fed's next move and intentions.

If the CPI data shows high numbers, it may indicate the possibility of further rate hikes, signaling a bullish sentiment for the USD. However, if the CPI data comes in lower than expected, it could suggest that the Fed might delay rate hikes, potentially altering the previously anticipated long-term plan for the USD.

Therefore, keeping an eye on the CPI data before the FOMC meeting is crucial to understand the potential impact on USDJPY and adjust our trading strategy accordingly.

Trade safe, Joe.

Today, our focus is on USDJPY, where we are observing a potential buying opportunity around the 138.700 zone. USDJPY is currently in an uptrend and appears to be approaching a significant support and resistance area at 138.700.

This week, we have two key events that could impact the market. First, on Wednesday, we have the Federal Open Market Committee (FOMC) meeting, where the Federal Reserve's monetary policy decisions will be announced. However, the day before the FOMC meeting, we have the release of the Consumer Price Index (CPI) data, which is important to gauge the Fed's next move and intentions.

If the CPI data shows high numbers, it may indicate the possibility of further rate hikes, signaling a bullish sentiment for the USD. However, if the CPI data comes in lower than expected, it could suggest that the Fed might delay rate hikes, potentially altering the previously anticipated long-term plan for the USD.

Therefore, keeping an eye on the CPI data before the FOMC meeting is crucial to understand the potential impact on USDJPY and adjust our trading strategy accordingly.

Trade safe, Joe.

Free Telegram Group:

t.me/+MDJZTdS-Mw0xZTA0

The 1% Traders Club:

t.me/+C08gijSq2PMyZTVk

t.me/+MDJZTdS-Mw0xZTA0

The 1% Traders Club:

t.me/+C08gijSq2PMyZTVk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Telegram Group:

t.me/+MDJZTdS-Mw0xZTA0

The 1% Traders Club:

t.me/+C08gijSq2PMyZTVk

t.me/+MDJZTdS-Mw0xZTA0

The 1% Traders Club:

t.me/+C08gijSq2PMyZTVk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.