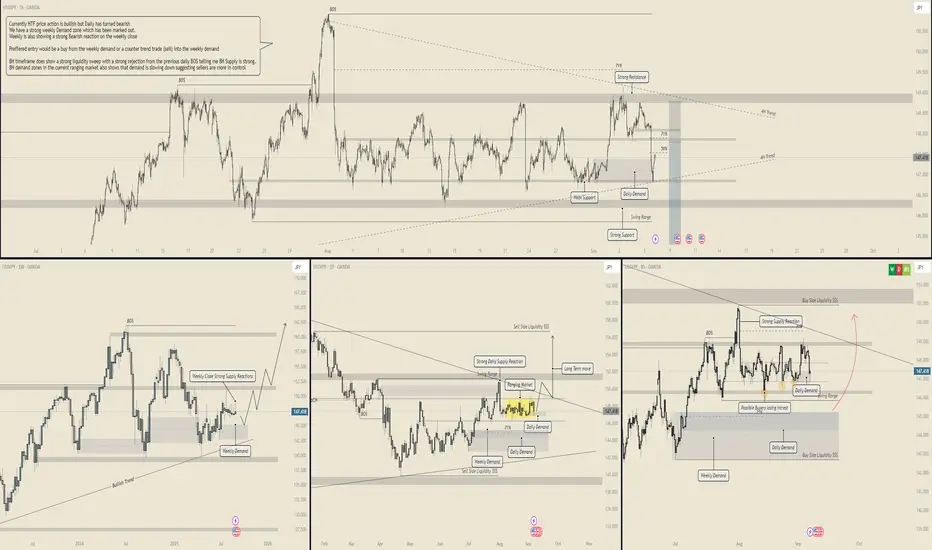

🔎 Weekly View (Macro Bias)

Trend: Long-term structure is still bullish, but the most recent weekly close reacted strongly from supply.

Demand Zones: Price is hovering above a weekly demand block around 145.0 – 146.0, which aligns with prior structure.

Implication: We could see a deeper retracement into weekly demand before the pair makes another attempt higher.

📉 Daily View (Intermediate Bias)

Shift in Sentiment: Daily chart shows a clear bearish structure, with lower highs and a supply rejection around 151.2.

Liquidity Map:

Sell-side liquidity sits below 146.0.

Buy-side liquidity rests above 151.0–152.0.

Key Demand: Daily demand zones between 144.5 – 146.0 are holding price for now.

Implication: Market is ranging. Bears have momentum, but if demand continues to hold, buyers may attempt a reversal toward 150+.

⏱ 8H View (Execution Frame)

Structure: Strong liquidity sweep into daily demand, followed by a bounce.

Supply vs. Demand:

8H supply zones are capping rallies (148.5 – 149.5).

8H demand zones at 146.0 – 146.5 remain intact.

Note: The repeated retests suggest buyers are losing interest, but demand has not fully broken yet.

📊 1H View (Fine-Tuned Entry)

Confluence Zone: Price reacted strongly from the 71% fib retracement and supply rejection.

Support: Strong support seen at 146.0–146.5, aligned with daily demand.

Resistance: Multiple layers of resistance at 148.5, 150.0, and 151.2.

✅ Trade Outlook

Preferred Setup:

Option 1 (Bullish Reversal): Look for longs from 146.0–146.5 daily demand into 150–151.2 liquidity.

Option 2 (Bearish Continuation): If 146.0 breaks clean, expect continuation toward 144.0 – 143.0 (deeper weekly demand).

Bias: Currently neutral-to-bearish unless demand proves strong. Bulls need a confirmed break above 148.5–149.5 supply to flip bias back to bullish.

Trend: Long-term structure is still bullish, but the most recent weekly close reacted strongly from supply.

Demand Zones: Price is hovering above a weekly demand block around 145.0 – 146.0, which aligns with prior structure.

Implication: We could see a deeper retracement into weekly demand before the pair makes another attempt higher.

📉 Daily View (Intermediate Bias)

Shift in Sentiment: Daily chart shows a clear bearish structure, with lower highs and a supply rejection around 151.2.

Liquidity Map:

Sell-side liquidity sits below 146.0.

Buy-side liquidity rests above 151.0–152.0.

Key Demand: Daily demand zones between 144.5 – 146.0 are holding price for now.

Implication: Market is ranging. Bears have momentum, but if demand continues to hold, buyers may attempt a reversal toward 150+.

⏱ 8H View (Execution Frame)

Structure: Strong liquidity sweep into daily demand, followed by a bounce.

Supply vs. Demand:

8H supply zones are capping rallies (148.5 – 149.5).

8H demand zones at 146.0 – 146.5 remain intact.

Note: The repeated retests suggest buyers are losing interest, but demand has not fully broken yet.

📊 1H View (Fine-Tuned Entry)

Confluence Zone: Price reacted strongly from the 71% fib retracement and supply rejection.

Support: Strong support seen at 146.0–146.5, aligned with daily demand.

Resistance: Multiple layers of resistance at 148.5, 150.0, and 151.2.

✅ Trade Outlook

Preferred Setup:

Option 1 (Bullish Reversal): Look for longs from 146.0–146.5 daily demand into 150–151.2 liquidity.

Option 2 (Bearish Continuation): If 146.0 breaks clean, expect continuation toward 144.0 – 143.0 (deeper weekly demand).

Bias: Currently neutral-to-bearish unless demand proves strong. Bulls need a confirmed break above 148.5–149.5 supply to flip bias back to bullish.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.