Pattern Recognition is a trader/investor asset to identify possibles trades setups.

The markets demonstrate repetitive patterns where prices oscillate between one set of price ratios to another making price projections possible.

Market trends can be defined by geometric relationships as they exhibit harmonic relationships between the price and time swings.

Many traders use "cycles" and "harmonic" relationships to project future swing price/times.

These Harmonic price movements produce symmetric rallies and declines to give traders an advantage to determine the key turning points.

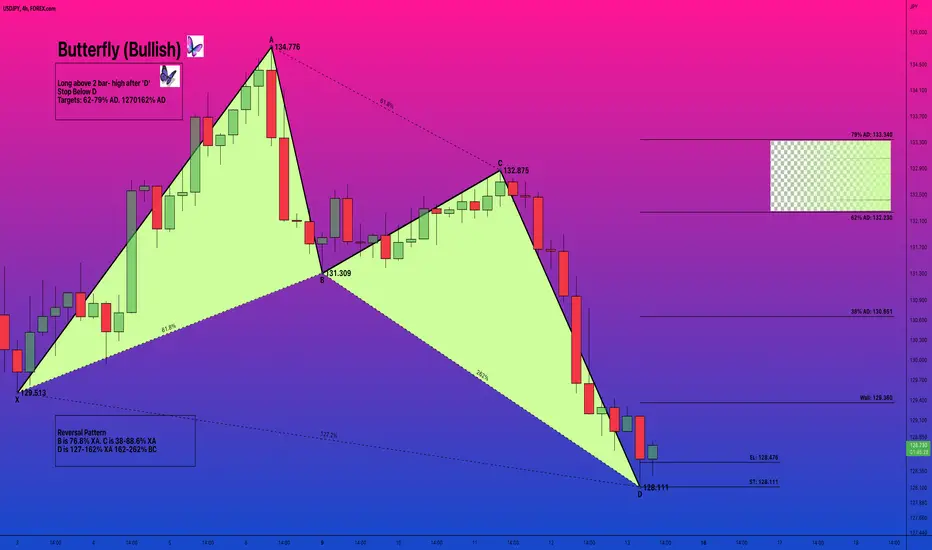

USD JPY Hourly chart We can identify a Pattern Structure ( Butterfly Bullish).

The concept of Harmonic Patterns was established by H.M. Gartley in 1932. Gartley wrote about a 5-point pattern (known as Gartley) in his book Profits in the Stock Market. Larry Pesavento has improved this pattern with Fibonacci ratios and established rules on how to trade the “Gartley” pattern in his book Fibonacci Ratios with Pattern Recognition.

There are few other authors who have worked on this pattern theory, but the best work to my knowledge is done by Scott Carney in his books of “Harmonic Trading.” Scott Carney also invented patterns like “Crab,” “Bat,” “Shark” and “5-0” and added real depth of knowledge for their trading rules, validity and risk/money management.

USDJPY Bullish Butterfly

EL: 128.476

ST: 128.111

Wall: 129.360

38% AD: 130.651

Target:

62% AD: 132.230

79% AD: 133.340

BUY above EL: 128.476 following up with a MSL (Market Structure Low) or 2-3 lines breaks

Pattern Invalidation 128.111

The markets demonstrate repetitive patterns where prices oscillate between one set of price ratios to another making price projections possible.

Market trends can be defined by geometric relationships as they exhibit harmonic relationships between the price and time swings.

Many traders use "cycles" and "harmonic" relationships to project future swing price/times.

These Harmonic price movements produce symmetric rallies and declines to give traders an advantage to determine the key turning points.

USD JPY Hourly chart We can identify a Pattern Structure ( Butterfly Bullish).

The concept of Harmonic Patterns was established by H.M. Gartley in 1932. Gartley wrote about a 5-point pattern (known as Gartley) in his book Profits in the Stock Market. Larry Pesavento has improved this pattern with Fibonacci ratios and established rules on how to trade the “Gartley” pattern in his book Fibonacci Ratios with Pattern Recognition.

There are few other authors who have worked on this pattern theory, but the best work to my knowledge is done by Scott Carney in his books of “Harmonic Trading.” Scott Carney also invented patterns like “Crab,” “Bat,” “Shark” and “5-0” and added real depth of knowledge for their trading rules, validity and risk/money management.

USDJPY Bullish Butterfly

EL: 128.476

ST: 128.111

Wall: 129.360

38% AD: 130.651

Target:

62% AD: 132.230

79% AD: 133.340

BUY above EL: 128.476 following up with a MSL (Market Structure Low) or 2-3 lines breaks

Pattern Invalidation 128.111

Note

The setup slightly change:ST: 127.553

EL: 127.825

38% AD: 130.307

62% AD: 132.008

79% AD: 133.237

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.