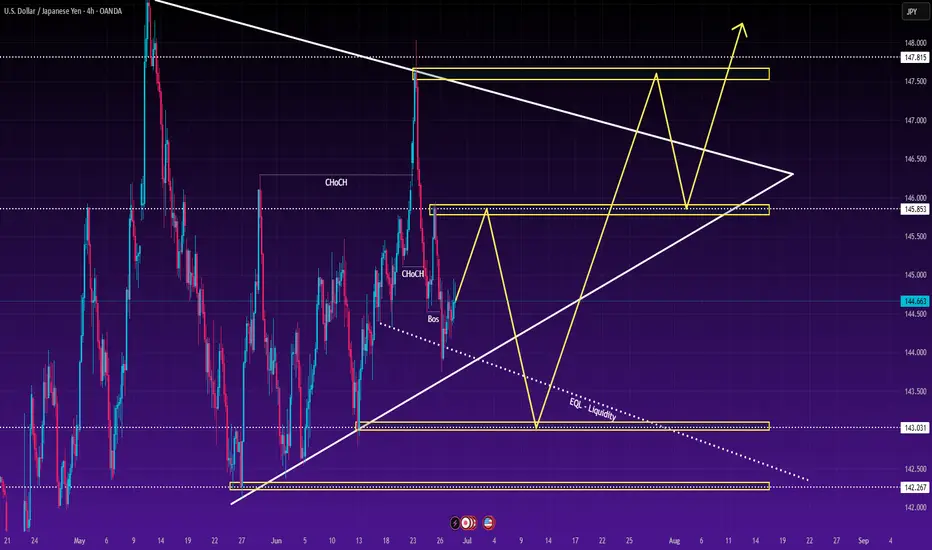

USDJPY is currently undergoing a clear redistribution phase on the 4H chart, having recently broken bullish structure and formed successive lower highs. The first week of July is packed with high-impact economic events from both the US and Japan – most notably speeches from Fed Chair Powell and BOJ Governor Ueda, alongside ADP and Non-Farm Payrolls – all of which could trigger significant volatility and a potential liquidity sweep before a true directional move takes shape.

🎯 Smart Money Concepts (SMC) Flow Analysis

✅ A Break of Structure (BOS) has just occurred following a sharp selloff from the 147.8 supply zone – a bearish structure is now clearly established.

⚠️ Change of Character (ChoCH) near the 145.8 level signals potential institutional involvement and short-term redistribution.

💧 Equal Lows (EQL) around 143.0 and 142.2 suggest prime liquidity targets likely to be swept before any genuine bullish intent emerges.

📈 Price is currently retracing toward the 145.85 – 146.00 short-term supply zone, offering a favourable area for short setups if rejection occurs.

🧠 Trade Scenarios (Planned)

🔻 Priority SELL Setups

SELL at 145.851 – 146.000

SL: 146.351

TP1: 145.351 (+50 pips)

TP2: 144.851 (+100 pips)

TP3: 143.851 (+200 pips)

TP4: Open

This is a fresh supply zone formed post-BOS, ideal for potential short entries upon confirmation.

SELL at 147.750 – 147.950

SL: 148.150

TP1: 147.250 (+50 pips)

TP2: 146.750 (+100 pips)

TP3: 145.750 (+200 pips)

TP4: Open

A key higher timeframe supply zone. If price breaks above 146.3 and rallies further, this is where Smart Money may re-enter shorts.

🔺 Potential BUY Setups Post-Liquidity Sweep

BUY at 143.031 – 142.930

SL: 142.731

TP1: 143.531 (+50 pips)

TP2: 144.031 (+100 pips)

TP3: 145.031 (+200 pips)

TP4: Open

This zone aligns with the trendline and EQL – a possible bounce zone if bullish BOS or strong price rejection appears.

BUY at 142.200 – 142.000

SL: 141.800

TP1: 142.700 (+50 pips)

TP2: 143.200 (+100 pips)

TP3: 144.200 (+200 pips)

TP4: Open

A deeper liquidity pool – likely an institutional entry point if price is flushed prior to NFP data.

📅 Key Upcoming Events – USD/JPY Traders Beware

Tuesday (1 July):

🗣️ Speeches from BOJ Gov Ueda and Fed Chair Powell – high-impact catalysts early in the week.

🧾 ISM Manufacturing PMI, JOLTS Job Openings – insight into the US economy’s momentum.

Wednesday to Thursday (2–3 July):

💼 ADP Employment & Non-Farm Payrolls – major market-moving data to shape USD sentiment.

→ Given the heavy news calendar, it's wise to react to price action at key zones with strong risk management, rather than pre-empt.

🎯 Smart Money Concepts (SMC) Flow Analysis

✅ A Break of Structure (BOS) has just occurred following a sharp selloff from the 147.8 supply zone – a bearish structure is now clearly established.

⚠️ Change of Character (ChoCH) near the 145.8 level signals potential institutional involvement and short-term redistribution.

💧 Equal Lows (EQL) around 143.0 and 142.2 suggest prime liquidity targets likely to be swept before any genuine bullish intent emerges.

📈 Price is currently retracing toward the 145.85 – 146.00 short-term supply zone, offering a favourable area for short setups if rejection occurs.

🧠 Trade Scenarios (Planned)

🔻 Priority SELL Setups

SELL at 145.851 – 146.000

SL: 146.351

TP1: 145.351 (+50 pips)

TP2: 144.851 (+100 pips)

TP3: 143.851 (+200 pips)

TP4: Open

This is a fresh supply zone formed post-BOS, ideal for potential short entries upon confirmation.

SELL at 147.750 – 147.950

SL: 148.150

TP1: 147.250 (+50 pips)

TP2: 146.750 (+100 pips)

TP3: 145.750 (+200 pips)

TP4: Open

A key higher timeframe supply zone. If price breaks above 146.3 and rallies further, this is where Smart Money may re-enter shorts.

🔺 Potential BUY Setups Post-Liquidity Sweep

BUY at 143.031 – 142.930

SL: 142.731

TP1: 143.531 (+50 pips)

TP2: 144.031 (+100 pips)

TP3: 145.031 (+200 pips)

TP4: Open

This zone aligns with the trendline and EQL – a possible bounce zone if bullish BOS or strong price rejection appears.

BUY at 142.200 – 142.000

SL: 141.800

TP1: 142.700 (+50 pips)

TP2: 143.200 (+100 pips)

TP3: 144.200 (+200 pips)

TP4: Open

A deeper liquidity pool – likely an institutional entry point if price is flushed prior to NFP data.

📅 Key Upcoming Events – USD/JPY Traders Beware

Tuesday (1 July):

🗣️ Speeches from BOJ Gov Ueda and Fed Chair Powell – high-impact catalysts early in the week.

🧾 ISM Manufacturing PMI, JOLTS Job Openings – insight into the US economy’s momentum.

Wednesday to Thursday (2–3 July):

💼 ADP Employment & Non-Farm Payrolls – major market-moving data to shape USD sentiment.

→ Given the heavy news calendar, it's wise to react to price action at key zones with strong risk management, rather than pre-empt.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.