Hello traders! I hope you’ve had a productive trading week.

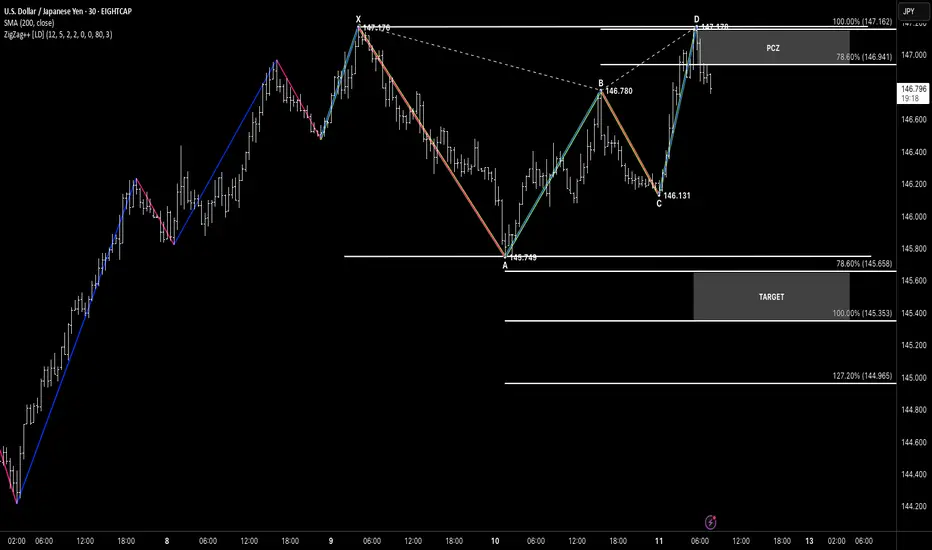

Let’s take a look at USDJPY, where we’re wrapping up the week with a textbook XABCD Double Top formation.

📍 Structure Overview

Price action completed an extended XABCD formation, with D printing a perfect double top around the 147.17 level.

The move from C to D aligns closely with the prior XA leg, showing strong symmetry in price.

D terminates precisely within the PCZ (Potential Completion Zone), aligning with both 78.6% and 100% extensions.

🎯 Bearish Targets Below

If this Double Top confirms with bearish follow-through, the structure offers a clean setup with downside targets:

Target 1: 145.35 (100%)

Target 2: 144.96 (127.2%)

A break below point C (146.13) would further validate the bearish thesis.

🧠 Pattern Highlights

XABCD geometry

Strong price symmetry

Completion into previous high (resistance)

Clear target zone for risk-defined trades

Note

USDJPY – XABC Double Top Invalidation | Volume Surge on U.S. Open

Hello traders, happy Saturday!

Hope you're enjoying your weekend and reviewing your trades. Let’s take a look at an interesting failed setup that teaches a great lesson in confirmation and risk control — the USDJPY XABC Double Top that failed cleanly on Friday.

📍 Pattern Overview

This was a well-formed XABC Double Top:

D completed right at the 100% XA projection

Aligned with the 78.6% BC retracement

Nice harmonic symmetry, all within the Potential Reversal Zone (PCZ)

The setup screamed short opportunity with a clear target zone mapped — but price action had a different plan.

📌 The Invalidation

At the U.S. open, we saw:

A sharp increase in volume

A decisive breakout above D, invalidating the double top

No bearish confirmation — no hesitation — just strength

Even if a limit sell order had been placed at the 78.6% retracement (inside the PCZ), the stop loss was minimal, well-contained relative to the downside target.

This is exactly why confirmation matters. Pattern alone ≠ trade.

🧠 Takeaways for the Weekend

XABC double tops must hold at D — or they’re invalid

Volume and session timing (like the U.S. open) provide important context

Predefined invalidation = controlled risk

Losing small is part of trading professionally

Review, refine, and reload for next week. Stay consistent.

#TradeChartPatternsLikeThePros

#USDJPY

#XABC

#DoubleTop

#PatternFailure

#VolumeSpike

#USOpen

#Harmonics

#RiskManagement

#ConfirmationMatters

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.