🌍 Macro Outlook – Inflation in Focus This Week

USDJPY is entering a critical week with high-impact US economic releases, particularly inflation and retail sales data, which could strongly influence dollar momentum.

🔔 Key Events (GMT):

Tuesday (Jul 15)

– US Core CPI, CPI m/m, CPI y/y

– Empire State Manufacturing Index

Wednesday (Jul 16)

– US PPI (Core + Headline)

– UK CPI y/y

Thursday (Jul 17)

– US Core Retail Sales, Retail Sales, Unemployment Claims

– GBP Labour Market Report

Friday (Jul 18)

– US Consumer Sentiment & Inflation Expectations

⚠️ Higher-than-expected inflation could drive USDJPY toward fresh highs.

But if data cools or jobs data weakens, JPY strength may pull the pair back down sharply.

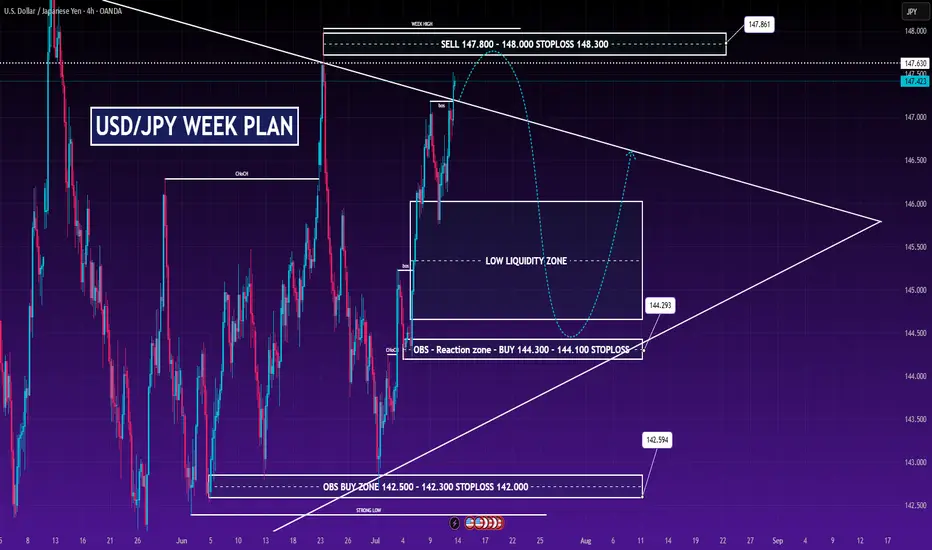

📊 Technical Analysis – H4 Smart Money Structure

🔻 SELL ZONE

147.800 – 148.000

SL: 148.300

Weekly high with strong liquidity

Diagonal resistance and BOS (Break of Structure) area

Rejection expected if CPI cools or yields drop

🟢 BUY REACTION ZONE

144.300 – 144.100

SL: 144.000

FVG + previous supply turned demand

Good for a bounce or short-term scalp

🟢 STRONG DEMAND ZONE

142.500 – 142.300

SL: 142.000

Aligned with trendline and structural low

Swing entry if price dumps post-news

🧠 Market Structure Insight:

USDJPY still trending upwards, but RSI divergence and liquidity sweep suggest correction is likely.

Price could form a lower high near 147.800 before retracing to deeper zones.

Key confluences align with macro data timing.

🎯 Trade Scenarios

🔹 Scenario 1 – Short Setup

Entry: 147.800–148.000

SL: 148.300

TP1: 146.000

TP2: 144.300

TP3: 142.300 (Open if USD weakens)

🔹 Scenario 2 – Reaction Buy

Entry: 144.300–144.100

SL: 144.000

TP1: 145.500

TP2: 146.700

TP3: Open

🔹 Scenario 3 – Swing Buy

Entry: 142.500–142.300

SL: 142.000

TP1: 144.000

TP2: 146.000

TP3: 147.800 (if trend resumes)

🔍 Key Price Levels to Watch

148.000 – Weekly Liquidity Zone

144.300 – Short-Term Support / Reaction

142.300 – Swing Buy Zone

📣 Analyst’s Note:

This week, USDJPY direction hinges on US inflation data.

A hot CPI print may push prices toward 148, while weak data could drive a deeper pullback to 144 or 142.

Trade smart, manage risk, and don’t chase breakouts before confirmation.

USDJPY is entering a critical week with high-impact US economic releases, particularly inflation and retail sales data, which could strongly influence dollar momentum.

🔔 Key Events (GMT):

Tuesday (Jul 15)

– US Core CPI, CPI m/m, CPI y/y

– Empire State Manufacturing Index

Wednesday (Jul 16)

– US PPI (Core + Headline)

– UK CPI y/y

Thursday (Jul 17)

– US Core Retail Sales, Retail Sales, Unemployment Claims

– GBP Labour Market Report

Friday (Jul 18)

– US Consumer Sentiment & Inflation Expectations

⚠️ Higher-than-expected inflation could drive USDJPY toward fresh highs.

But if data cools or jobs data weakens, JPY strength may pull the pair back down sharply.

📊 Technical Analysis – H4 Smart Money Structure

🔻 SELL ZONE

147.800 – 148.000

SL: 148.300

Weekly high with strong liquidity

Diagonal resistance and BOS (Break of Structure) area

Rejection expected if CPI cools or yields drop

🟢 BUY REACTION ZONE

144.300 – 144.100

SL: 144.000

FVG + previous supply turned demand

Good for a bounce or short-term scalp

🟢 STRONG DEMAND ZONE

142.500 – 142.300

SL: 142.000

Aligned with trendline and structural low

Swing entry if price dumps post-news

🧠 Market Structure Insight:

USDJPY still trending upwards, but RSI divergence and liquidity sweep suggest correction is likely.

Price could form a lower high near 147.800 before retracing to deeper zones.

Key confluences align with macro data timing.

🎯 Trade Scenarios

🔹 Scenario 1 – Short Setup

Entry: 147.800–148.000

SL: 148.300

TP1: 146.000

TP2: 144.300

TP3: 142.300 (Open if USD weakens)

🔹 Scenario 2 – Reaction Buy

Entry: 144.300–144.100

SL: 144.000

TP1: 145.500

TP2: 146.700

TP3: Open

🔹 Scenario 3 – Swing Buy

Entry: 142.500–142.300

SL: 142.000

TP1: 144.000

TP2: 146.000

TP3: 147.800 (if trend resumes)

🔍 Key Price Levels to Watch

148.000 – Weekly Liquidity Zone

144.300 – Short-Term Support / Reaction

142.300 – Swing Buy Zone

📣 Analyst’s Note:

This week, USDJPY direction hinges on US inflation data.

A hot CPI print may push prices toward 148, while weak data could drive a deeper pullback to 144 or 142.

Trade smart, manage risk, and don’t chase breakouts before confirmation.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔱 Trade with Smart Money – ICT Concepts & Price Action

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

🔱 Latest Daily Plan – Updated with 4–6 Free Gold Signals Daily

Join now: t.me/+BT9z8lt4yJ01OGVl

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.