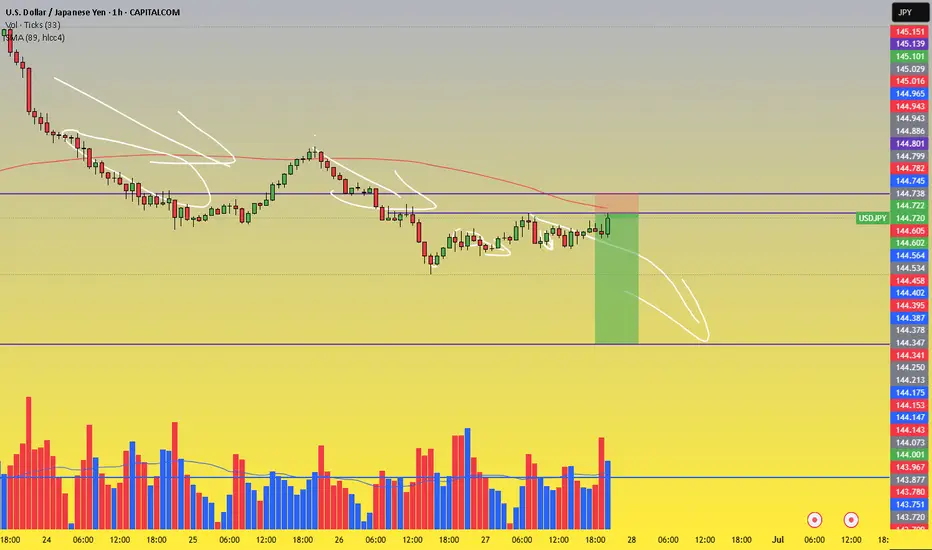

🎯 Trade Setup:

Sell Entry Zone: 144.75 – 144.78

Stop Loss (SL): 145.15

Take Profit (TP): 142.60

Risk:Reward Ratio (R:R): Approx. 1:4 → Excellent for swing or intraday setups

📊 Technical Analysis Breakdown:

1. Strong Resistance Zone – High Reversal Probability:

The 144.75–144.78 zone:

A clear historical resistance area with multiple rejections in the past

Converges with the SMA 89 (red line) → acts as a strong dynamic resistance

Price has consistently formed lower highs around this region → showing selling pressure is building

2. Volume Analysis – Distribution Signals:

Volume slightly increased as price approached the resistance but did not accompany a breakout

No “breakout volume” → Indicates possible distribution phase, not accumulation → Favoring SELL positions

3. Price Action & Pattern:

The structure is forming lower highs – a key sign of bearish momentum

After the sharp rejection from the 145.22 zone (June 26), the market has shifted toward a bearish correction cycle

4. Target Area – Key Support:

142.60 is a well-defined support level:

Matches a previous major low

Corresponds with a high-liquidity zone from prior trading sessions

Ideal area to take profit before any potential bounce

⚠️ Risk Management Notes:

Trade confirmation increases if you see bearish candlestick signals (e.g., bearish engulfing, pin bar) in the entry zone

Exit immediately if price breaks and closes above 145.15 with strong volume – that invalidates the bearish setup

Sell Entry Zone: 144.75 – 144.78

Stop Loss (SL): 145.15

Take Profit (TP): 142.60

Risk:Reward Ratio (R:R): Approx. 1:4 → Excellent for swing or intraday setups

📊 Technical Analysis Breakdown:

1. Strong Resistance Zone – High Reversal Probability:

The 144.75–144.78 zone:

A clear historical resistance area with multiple rejections in the past

Converges with the SMA 89 (red line) → acts as a strong dynamic resistance

Price has consistently formed lower highs around this region → showing selling pressure is building

2. Volume Analysis – Distribution Signals:

Volume slightly increased as price approached the resistance but did not accompany a breakout

No “breakout volume” → Indicates possible distribution phase, not accumulation → Favoring SELL positions

3. Price Action & Pattern:

The structure is forming lower highs – a key sign of bearish momentum

After the sharp rejection from the 145.22 zone (June 26), the market has shifted toward a bearish correction cycle

4. Target Area – Key Support:

142.60 is a well-defined support level:

Matches a previous major low

Corresponds with a high-liquidity zone from prior trading sessions

Ideal area to take profit before any potential bounce

⚠️ Risk Management Notes:

Trade confirmation increases if you see bearish candlestick signals (e.g., bearish engulfing, pin bar) in the entry zone

Exit immediately if price breaks and closes above 145.15 with strong volume – that invalidates the bearish setup

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.