Hi Traders!

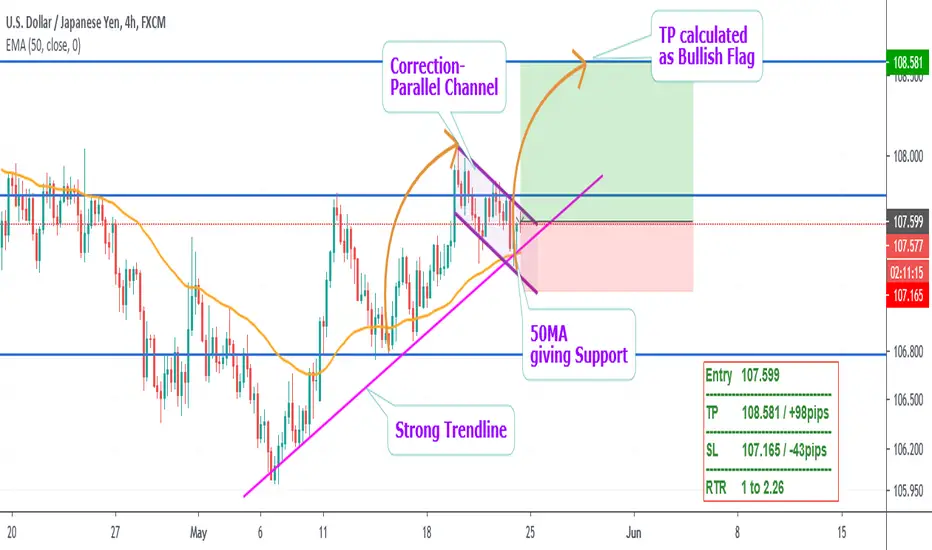

The market is in a Midterm-Uptrend.

As you can see we here have some factors giving Support to the price.

But before mentioning them, let's see where the market is at the moment:

The lowest price the market reached over the last month was the Level 106.000.

Then it started to rally.

It made a straight Upmovement towards the Resistance at 107.800.

After that it retraced.

Using the Fibonacci Retracement we found out, that price reached the 50.0% Retracement Level.

Then, another upmovement occured.

This time it even made a higher high!

The Turning-Point was the important 108.000 Level.

Now it is still in a Correction Stage.

The shape of this Correction is the most intresting part:

A Parallel Channel = a Bullish Flag.

After connecting all the lows with each other, you can see an ascending Trendline.

It is now touching the Price.

In addtion the 50MA is giving Support too.

Because of these confirmation, we recommend to trade the bullish Breakout of the Parallel Channel.

Thanks and successful Trading :)!

The market is in a Midterm-Uptrend.

As you can see we here have some factors giving Support to the price.

But before mentioning them, let's see where the market is at the moment:

The lowest price the market reached over the last month was the Level 106.000.

Then it started to rally.

It made a straight Upmovement towards the Resistance at 107.800.

After that it retraced.

Using the Fibonacci Retracement we found out, that price reached the 50.0% Retracement Level.

Then, another upmovement occured.

This time it even made a higher high!

The Turning-Point was the important 108.000 Level.

Now it is still in a Correction Stage.

The shape of this Correction is the most intresting part:

A Parallel Channel = a Bullish Flag.

After connecting all the lows with each other, you can see an ascending Trendline.

It is now touching the Price.

In addtion the 50MA is giving Support too.

Because of these confirmation, we recommend to trade the bullish Breakout of the Parallel Channel.

Thanks and successful Trading :)!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.