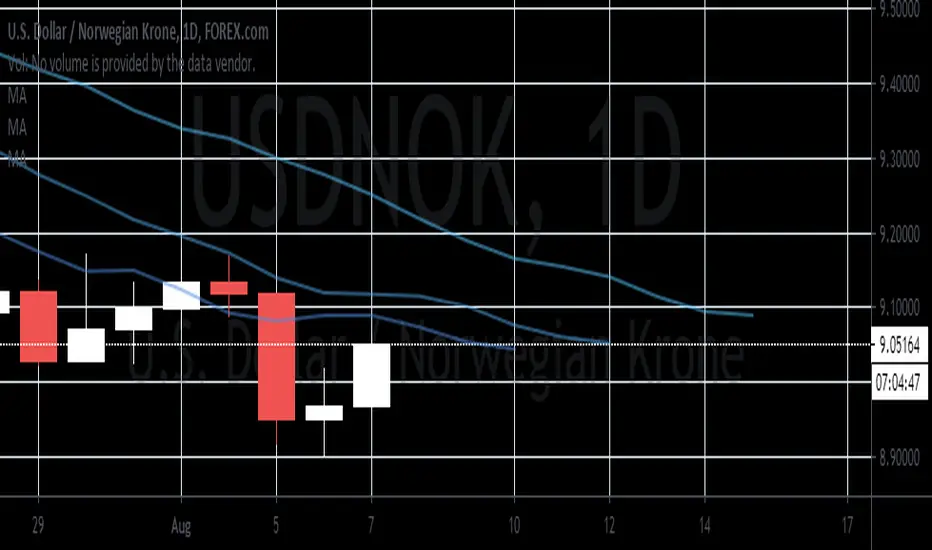

The pair is expected to break down from a major support line, sending the pair lower towards its October 2018 low. Norway’s soaring house prices and increasing flight demands highlight that recovery of once the epicenter of the coronavirus pandemic, Europe. House prices between the months of June and July increased by 0.9% or 5.0% on a year-over-year basis. This was despite the fact that most European economies are still suffering from the recession. Analysts suggest that the optimism by consumers was brought by the increasing prices of crude oil in the global market. Norway’s major export product was oil and any surplus from its trade was being added to the country’s sovereign wealth fund. The increasing per capita liquidity in Norway is making the Norwegian krone a safe-haven currency investment among investors. Meanwhile, the US still relies on huge stimulus packages to keep its economy afloat at the expense of the US dollar.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.