Looking at the Turkish Lira's developing MSCI Emerging counterparts, it was very fragile in a financial quarter of time, and 10-year bond yields did not increase.(TR10Y)

This could make the Turkish Lira vulnerable to attacks.

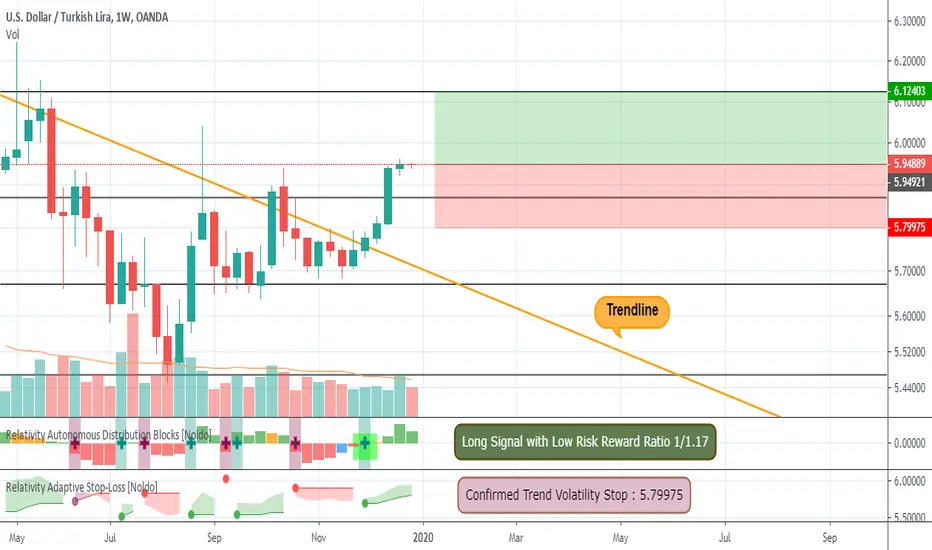

Although this analysis includes a low Risk / Reward ratio, I have shared it as a roadmap for lower time periods.

Because the risk / reward ratio can be much more profitable in lower time periods.

For the detailed information of analysis, don't forget to look at the related ideas, I wish everyone a happy New Year.

Parameters :

NOTE :

I'm still a fan of this analysis in the lower timeframes for lower Risk/Reward Ratio with decreasing Stop-Loss percent.

If I get a signal about this, I will definitely share it, and wish everyone a happy New Year.

This could make the Turkish Lira vulnerable to attacks.

Although this analysis includes a low Risk / Reward ratio, I have shared it as a roadmap for lower time periods.

Because the risk / reward ratio can be much more profitable in lower time periods.

For the detailed information of analysis, don't forget to look at the related ideas, I wish everyone a happy New Year.

Parameters :

- Risk/Reward Ratio 1/1.17

- Position Size : %1

- Stop-Loss : 5.7997

- Goal : 6.124

NOTE :

I'm still a fan of this analysis in the lower timeframes for lower Risk/Reward Ratio with decreasing Stop-Loss percent.

If I get a signal about this, I will definitely share it, and wish everyone a happy New Year.

Note

Those who want to improve their Risk / Reward ratio can raise their Stop-Loss levels to around 5.90.Note

Trade is continue , maybe i can increase position size with low tfs , i will share it if i open a position , regards.Trade closed: target reached

Target Reached with more than 294 pips!Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.