Is WW3 Coming? Crude Waves Flash Warning which I DO NOT LIKE IT

I’m getting a knot in my stomach looking at this chart, it feels like a warning about what’s coming.

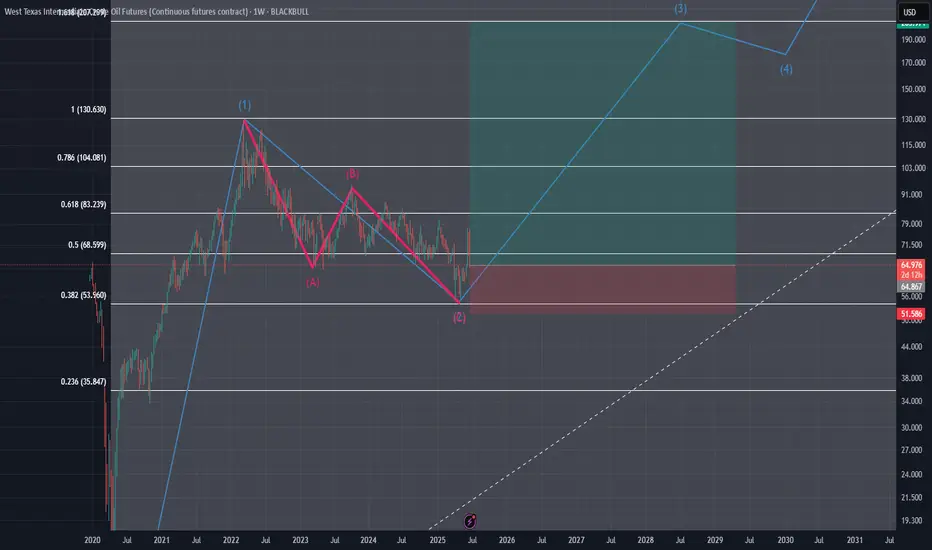

Chart Context

• WTI jumped from the pandemic low of 6.62 up to 131.02 on March 6, 2022.

• It then retraced to 59.86 (38 % Fib) by June 4, 2025.

• That pullback seems complete, and now price is pressing against a descending wedge.

Wave Map

• Wave 3 could extend toward 207

• A full five-wave run points up near 330

• The pattern is squeezed in a tightening channel that looks ready to break any day

Why It Feels Risky

Breaking above 200 normally requires a major supply shock—think trouble at the Strait of Hormuz, surprise OPEC cuts, or a hit to U.S. shale. The Iran–Israel cease-fire is shaky, drones are still buzzing storage sites, and even a brief chokepoint shutdown would send tanker traffic into chaos. To me, the chart is flashing that tail risk.

Trading Plan

• I’ll watch the wedge’s upper trendline around 83 for my first signal

• A weekly close above 93 would clear the path to 117, then 145

• If price closes below 51 on the week, this thesis is off

Your Thoughts?

Does this wave count make sense, or am I reading too much into it? Drop your views—especially if you’ve got the geopolitical angle covered. I hope this wave doesn’t play out, but pretending it’s not there feels reckless.

(Not financial advice)

Chart Context

• WTI jumped from the pandemic low of 6.62 up to 131.02 on March 6, 2022.

• It then retraced to 59.86 (38 % Fib) by June 4, 2025.

• That pullback seems complete, and now price is pressing against a descending wedge.

Wave Map

• Wave 3 could extend toward 207

• A full five-wave run points up near 330

• The pattern is squeezed in a tightening channel that looks ready to break any day

Why It Feels Risky

Breaking above 200 normally requires a major supply shock—think trouble at the Strait of Hormuz, surprise OPEC cuts, or a hit to U.S. shale. The Iran–Israel cease-fire is shaky, drones are still buzzing storage sites, and even a brief chokepoint shutdown would send tanker traffic into chaos. To me, the chart is flashing that tail risk.

Trading Plan

• I’ll watch the wedge’s upper trendline around 83 for my first signal

• A weekly close above 93 would clear the path to 117, then 145

• If price closes below 51 on the week, this thesis is off

Your Thoughts?

Does this wave count make sense, or am I reading too much into it? Drop your views—especially if you’ve got the geopolitical angle covered. I hope this wave doesn’t play out, but pretending it’s not there feels reckless.

(Not financial advice)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.