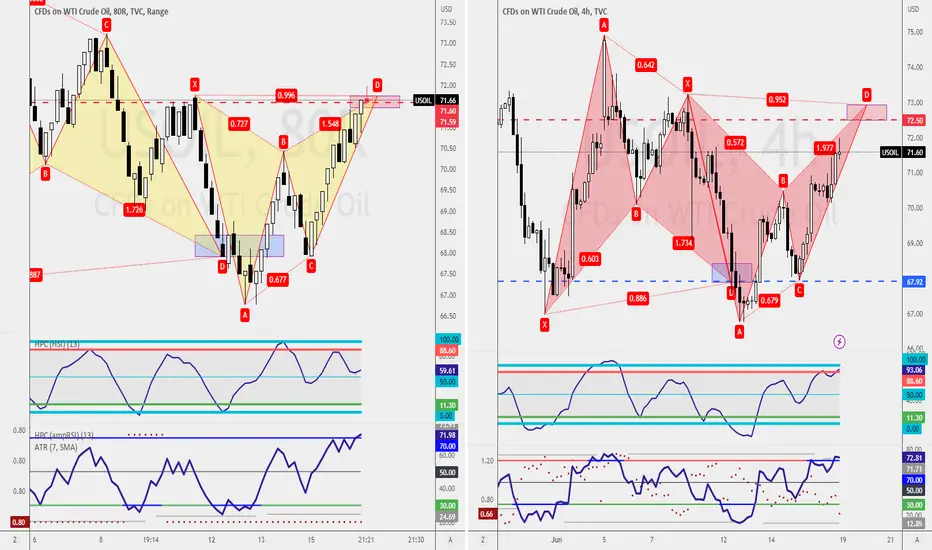

As the WTI or US Oil is on a sideway movement, it creates fantastic trading opportunities for counter-trend traders like myself.

There are 2 approaches I'm looking at in the following week. A Bearish Gartley Pattern at X, a shorting opportunity on the 8-range bar chart, or a Bearish Bat Pattern on the 4-hourly chart.

The important candlesticks confirmation on the Gartley Pattern at X requires the next candlestick to touch 71.47 before the pattern is valid; failure to do so, I'll be waiting for the Bearish Bat Pattern.

Magic Candle has to appear at 72.94 for the Bat Pattern on the 4-hourly chart(right) to be valid.

This is how trading should be. Plan your trade, and wait for candlestick pattern confirmation before engaging the trade.

What's your trade plan for WTI?

There are 2 approaches I'm looking at in the following week. A Bearish Gartley Pattern at X, a shorting opportunity on the 8-range bar chart, or a Bearish Bat Pattern on the 4-hourly chart.

The important candlesticks confirmation on the Gartley Pattern at X requires the next candlestick to touch 71.47 before the pattern is valid; failure to do so, I'll be waiting for the Bearish Bat Pattern.

Magic Candle has to appear at 72.94 for the Bat Pattern on the 4-hourly chart(right) to be valid.

This is how trading should be. Plan your trade, and wait for candlestick pattern confirmation before engaging the trade.

What's your trade plan for WTI?

🕒 15mins workday for Young Parents

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🕒 15mins workday for Young Parents

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.