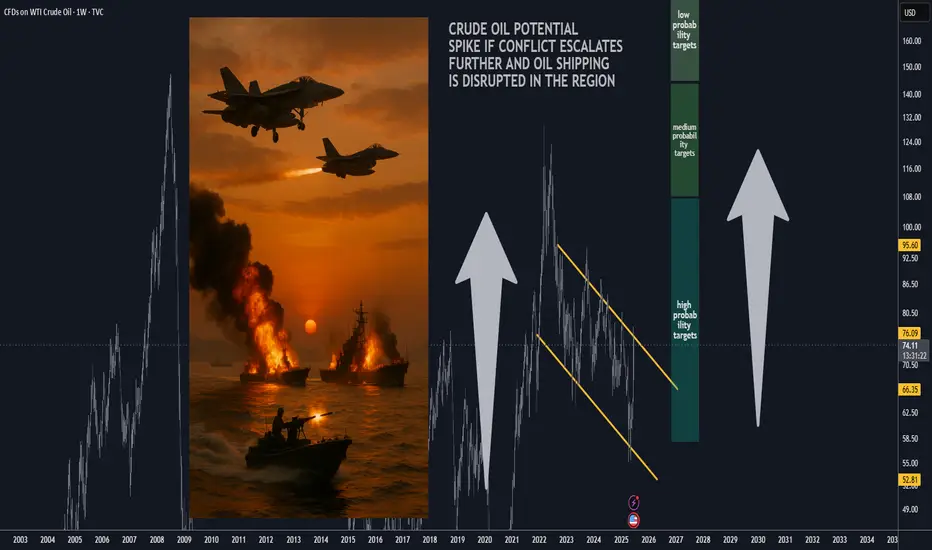

With Mid East tensions rising and overall unpredictable

situation around Strait of Hormuz, let's review potential

scenarios for the Crude Oil Prices. I've outlined three

scenarios with projected oil prices for each scenario below.

🚨 Market Alert: Israel-Iran Conflict Impact Forecast 📈

🔴 Worst-Case Scenario: Regional War + U.S. Military Involvement

🚢 Oil (Brent): Soars to $150–$200+ if Strait of Hormuz closes

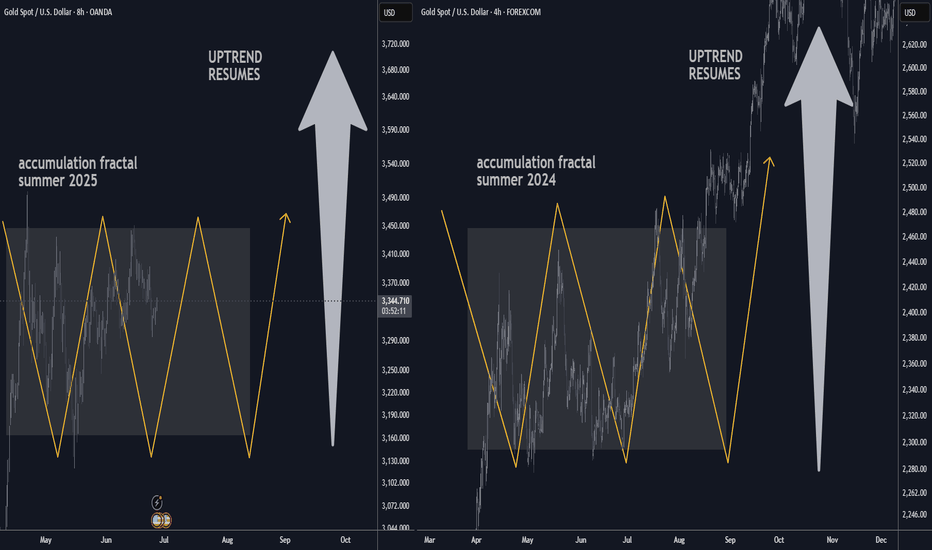

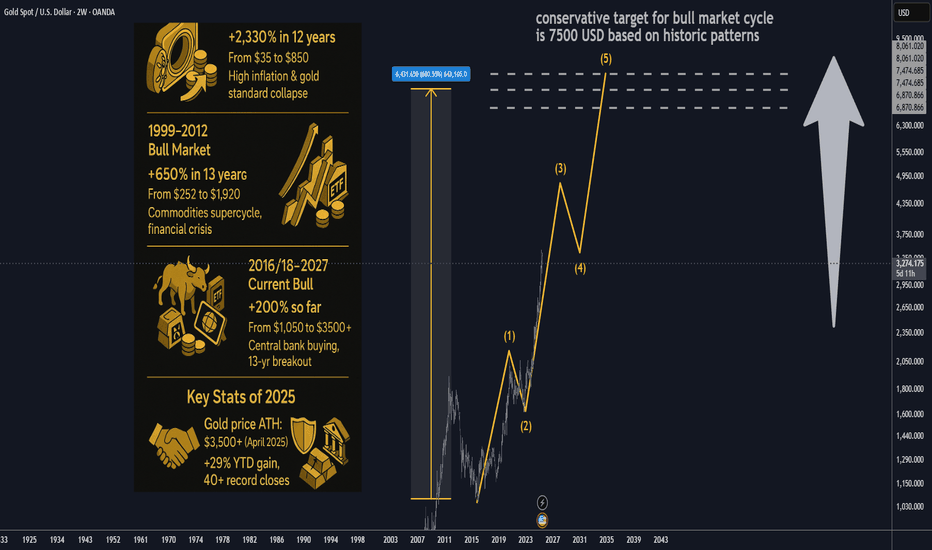

🥇 Gold: Skyrockets to $4,500–$5,000 (safe-haven rush)

₿ Bitcoin: Initial volatility; settles at $80k–$100k

📉 SPX: Crashes to 4,000–4,500

💻 NDX: Drops sharply to 15,000–16,000

🟠 Base-Case Scenario: Protracted Tension, No Major Disruption

🛢 Oil: Stabilizes at elevated $75–$95, occasional spikes

🥇 Gold: Moves higher, trading $3,500–$3,800

₿ Bitcoin: Trades steady, $90k–$110k range

📊 SPX: Pullback moderate, around 5,200–5,500

💻 NDX: Moderately lower, 18,000–19,000 range

🟢 Best-Case Scenario: Diplomatic De-Escalation

🌊 Oil: Eases down to $65–$75

🥇 Gold: Mild decline, holds at $3,300–$3,500

₿ Bitcoin: Positive sentiment, lifts to $100k–$120k

📈 SPX: Slight dip; stays strong near 5,800–6,200

💻 NDX: Minor correction, remains high at 20,000–22,000

situation around Strait of Hormuz, let's review potential

scenarios for the Crude Oil Prices. I've outlined three

scenarios with projected oil prices for each scenario below.

🚨 Market Alert: Israel-Iran Conflict Impact Forecast 📈

🔴 Worst-Case Scenario: Regional War + U.S. Military Involvement

🚢 Oil (Brent): Soars to $150–$200+ if Strait of Hormuz closes

🥇 Gold: Skyrockets to $4,500–$5,000 (safe-haven rush)

₿ Bitcoin: Initial volatility; settles at $80k–$100k

📉 SPX: Crashes to 4,000–4,500

💻 NDX: Drops sharply to 15,000–16,000

🟠 Base-Case Scenario: Protracted Tension, No Major Disruption

🛢 Oil: Stabilizes at elevated $75–$95, occasional spikes

🥇 Gold: Moves higher, trading $3,500–$3,800

₿ Bitcoin: Trades steady, $90k–$110k range

📊 SPX: Pullback moderate, around 5,200–5,500

💻 NDX: Moderately lower, 18,000–19,000 range

🟢 Best-Case Scenario: Diplomatic De-Escalation

🌊 Oil: Eases down to $65–$75

🥇 Gold: Mild decline, holds at $3,300–$3,500

₿ Bitcoin: Positive sentiment, lifts to $100k–$120k

📈 SPX: Slight dip; stays strong near 5,800–6,200

💻 NDX: Minor correction, remains high at 20,000–22,000

Note

Iran’s parliament has voted to close the Strait of Hormuz, the vital shipping channel through which around 20% of the world’s daily oil flows.The move, which could block $1 billion in oil shipments per day, is likely to send oil prices soaring.

Note

JPMorgan Chase has warned that oil prices could surge to $120-$130 per barrel in a worst-case scenario, specifically if the Strait of Hormuz is closed due to escalating tensions in the Middle East. This scenario is linked to a potential military conflict between Iran and Israel, which could disrupt global oil supply. Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.