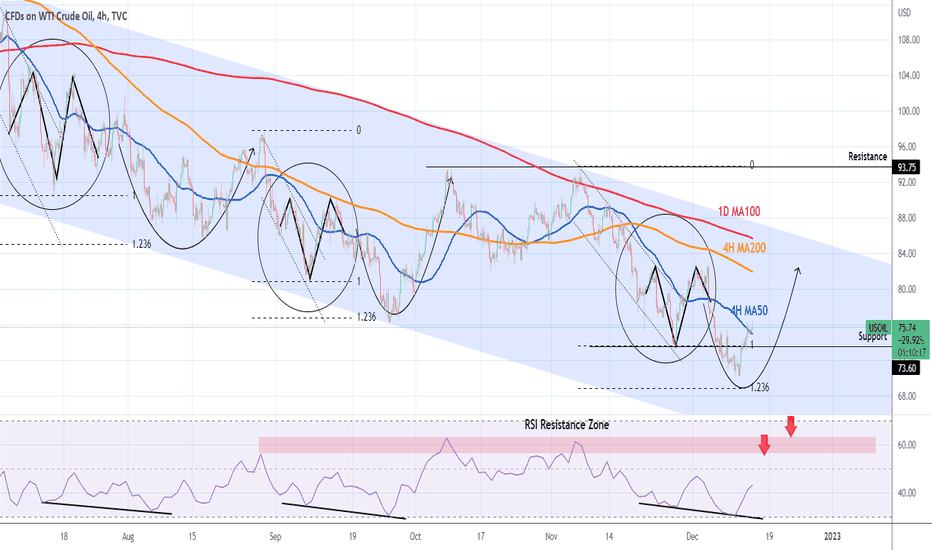

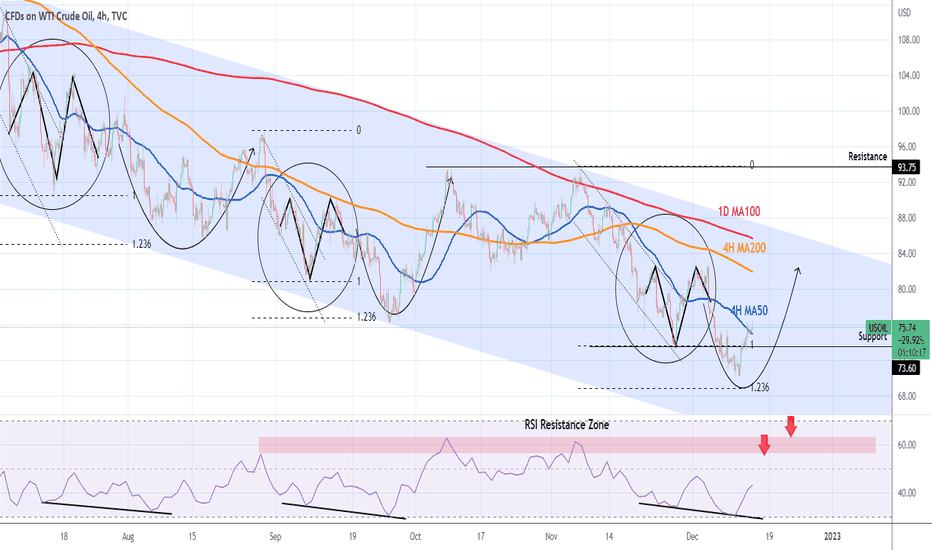

As WTI failed to close the 1D candle above the 1D MA50 (81.07) yesterday, it got rejected and turned heavily bearish after closing below the 4H MA50 (78.66). With 4H now on Lower Lows and the RSI approaching the oversold barrier (RSI = 32.360, MACD = -0.350, ADX = 39.455), we could expect a dead cat bounce to test the 4H MA50 and make the sell entry if you missed it, but on the medium-term my target remains 74.10. If 73.50 breaks, I will go again go short and target 70.30. All prices on my analysis are on CL NYMEX current contract in front.

Previous trade:

Previous trade:

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.