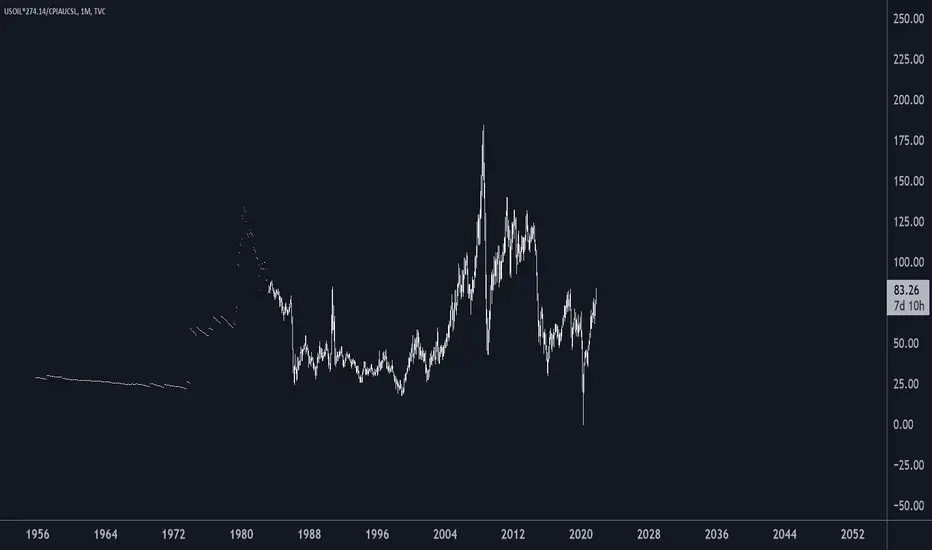

This chart is adjusted for inflation. That means it is only valid for the current value of US consumer CPI, in other words just this month. Next month it will probably have to be re-calculated.

It shows that the demand of the current fuel crisis pales in comparison to demand in the wake of the 2007 financial crisis. What if we are still at the early stages in this demand cycle? Oil at $200 (in nominal price) would bring the world to a complete stop, unless of course inflation has made $200 relatively insignificant a price.

Video on how inflation was adjusted for in this chart: https://tradingview.sweetlogin.com/chart/BLX/l3ridmWS-Adjust-for-Inflation-Real-Price-vs-Nominal-Price/

It shows that the demand of the current fuel crisis pales in comparison to demand in the wake of the 2007 financial crisis. What if we are still at the early stages in this demand cycle? Oil at $200 (in nominal price) would bring the world to a complete stop, unless of course inflation has made $200 relatively insignificant a price.

Video on how inflation was adjusted for in this chart: https://tradingview.sweetlogin.com/chart/BLX/l3ridmWS-Adjust-for-Inflation-Real-Price-vs-Nominal-Price/

Note

WOWOWOW xDyeah

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.