Crude Oil Market: Geopolitical Risk Premium Soars Sharply

(1) Strait of Hormuz: Global Energy Artery in Crisis

As the gateway for 20% of global crude oil transportation, every disturbance in the Strait of Hormuz grips market nerves. The Iranian Revolutionary Guard has now deployed missile boats and mine-laying vessels at the strait's narrowest point (just 33 km). The UK Maritime Security Agency warns that Iran may adopt a "gradual blockade"—first causing shipping chaos through electronic jamming, then escalating to mine blockades.

Historical experience shows that even partial blockades can drive tanker insurance premiums up by over 900% and increase transportation costs by 50-100%. Current ultra-large crude carrier (VLCC) freight rates have risen 22% from last month, with many shipping companies evaluating routes around the Cape of Good Hope, which would extend Asian crude oil arrival times by 15-20 days.

(2) Supply Side: Production Increase Plans Meet Geopolitical Storm

Although OPEC+ plans to continue increasing production by 411,000 bpd in July, market focus has fully shifted to Middle East supply disruption risks. Iran currently maintains exports of 1.1 million bpd, but if the conflict escalates, this figure could drop to zero within 48 hours. More crucially, alternative export channels for Saudi Arabia, the UAE, and other countries (such as the East-West Pipeline) have a total capacity of only 3.5 million bpd, unable to fully compensate for the shortfall from the Strait of Hormuz blockade.

U.S. shale oil also can't solve the urgent problem: although production just hit a record 9.33 million bpd, labor shortages and rising drilling costs have caused new well investments to fall by 12%, and analysts expect production growth to slow to below 3% in the second half of the year.

(3) Demand Side: Risk Aversion Overshadows Real Weakness

Despite U.S. gasoline demand hitting a five-year seasonal low and European imports falling 5.1% year-on-year, geopolitical risks have triggered panic buying. The near-month contract price of Shanghai crude oil futures jumped 12% this week, and the SC-WTI spread turned to a premium of $3.16/bbl for the first time, reflecting Asian market concerns about regional supply disruptions. More notably, Brent crude net long positions have increased to a ten-week high, with speculative funds wildly betting on geopolitical premiums.

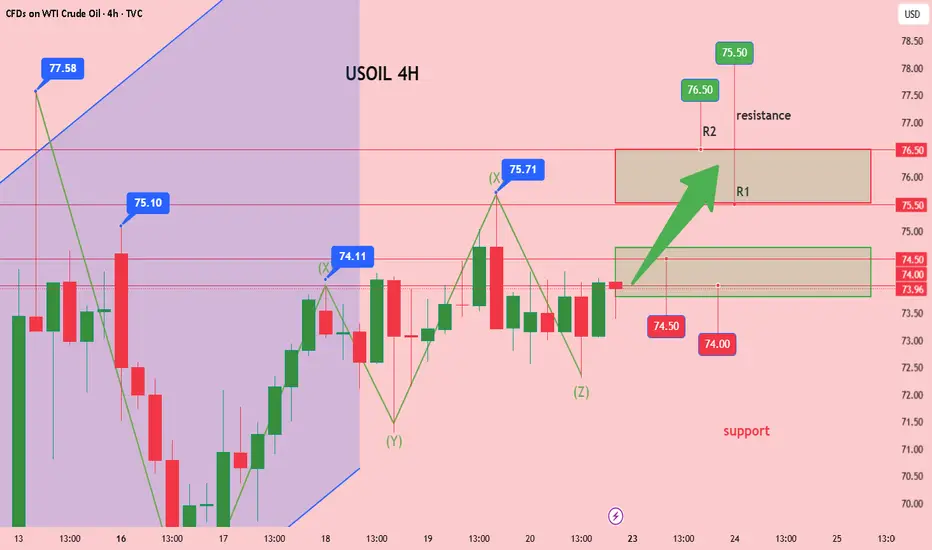

Analysis of crude oil trend next week, hope it helps you

USOIL buy74~74.5

SL:72

TP:75.5~76.5

(1) Strait of Hormuz: Global Energy Artery in Crisis

As the gateway for 20% of global crude oil transportation, every disturbance in the Strait of Hormuz grips market nerves. The Iranian Revolutionary Guard has now deployed missile boats and mine-laying vessels at the strait's narrowest point (just 33 km). The UK Maritime Security Agency warns that Iran may adopt a "gradual blockade"—first causing shipping chaos through electronic jamming, then escalating to mine blockades.

Historical experience shows that even partial blockades can drive tanker insurance premiums up by over 900% and increase transportation costs by 50-100%. Current ultra-large crude carrier (VLCC) freight rates have risen 22% from last month, with many shipping companies evaluating routes around the Cape of Good Hope, which would extend Asian crude oil arrival times by 15-20 days.

(2) Supply Side: Production Increase Plans Meet Geopolitical Storm

Although OPEC+ plans to continue increasing production by 411,000 bpd in July, market focus has fully shifted to Middle East supply disruption risks. Iran currently maintains exports of 1.1 million bpd, but if the conflict escalates, this figure could drop to zero within 48 hours. More crucially, alternative export channels for Saudi Arabia, the UAE, and other countries (such as the East-West Pipeline) have a total capacity of only 3.5 million bpd, unable to fully compensate for the shortfall from the Strait of Hormuz blockade.

U.S. shale oil also can't solve the urgent problem: although production just hit a record 9.33 million bpd, labor shortages and rising drilling costs have caused new well investments to fall by 12%, and analysts expect production growth to slow to below 3% in the second half of the year.

(3) Demand Side: Risk Aversion Overshadows Real Weakness

Despite U.S. gasoline demand hitting a five-year seasonal low and European imports falling 5.1% year-on-year, geopolitical risks have triggered panic buying. The near-month contract price of Shanghai crude oil futures jumped 12% this week, and the SC-WTI spread turned to a premium of $3.16/bbl for the first time, reflecting Asian market concerns about regional supply disruptions. More notably, Brent crude net long positions have increased to a ten-week high, with speculative funds wildly betting on geopolitical premiums.

Analysis of crude oil trend next week, hope it helps you

USOIL buy74~74.5

SL:72

TP:75.5~76.5

Free signal channel :t.me/+TV_kswto0jw3NWU0

Let me guide you to start a profitable journey! 🚀

:t.me/+TV_kswto0jw3NWU0

The accuracy rate is as high as 82 percent. ✅

:t.me/+TV_kswto0jw3NWU0

Let me guide you to start a profitable journey! 🚀

:t.me/+TV_kswto0jw3NWU0

The accuracy rate is as high as 82 percent. ✅

:t.me/+TV_kswto0jw3NWU0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free signal channel :t.me/+TV_kswto0jw3NWU0

Let me guide you to start a profitable journey! 🚀

:t.me/+TV_kswto0jw3NWU0

The accuracy rate is as high as 82 percent. ✅

:t.me/+TV_kswto0jw3NWU0

Let me guide you to start a profitable journey! 🚀

:t.me/+TV_kswto0jw3NWU0

The accuracy rate is as high as 82 percent. ✅

:t.me/+TV_kswto0jw3NWU0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.