The markets are being underpinned by optimism over the reopening of China’s borders, which may lead to increased demand for energy products. However, gains are being limited as traders await clarity on the Federal Reserve’s plans for rate hikes, which also will have an impact on the economy and fuel demand.

A bearish factor for crude was today's action by the World Bank to cut its global 2023 GDP forecast to 1.7%, about half of what it predicted in June. The World Bank also warned that new adverse shocks could tip the global economy into a recession

A bearish factor for crude was today's action by the World Bank to cut its global 2023 GDP forecast to 1.7%, about half of what it predicted in June. The World Bank also warned that new adverse shocks could tip the global economy into a recession

Note

This week’s subdued price action suggests traders are waiting for Thursday’s U.S. Consumer Price Index (CPI) report before making a move. This is because the data will influence Federal Reserve interest rate policy.A weak inflation reading is likely to have a bullish influence on crude oil prices. Treasury yields will fall on the news, dragging the U.S. Dollar lower and making dollar-denominated crude oil more desirable for foreign buyers.

Traders will also be looking out for inventory data from the U.S. Energy Information Administration (EIA) due to be released at 15:30 GMT. Preliminary guesses are for a 2.0 million barrel crude oil draw, but there could be a surprise build given the API results. Nonetheless, traders should brace for a volatile reaction to the report.

Note

WTI oil tested new highs at $82.60 as traders bet on rising demand from China. Traders stay focused on China as recent data indicates that demand for travel in the country increased despite coronavirus-related problems.

Note

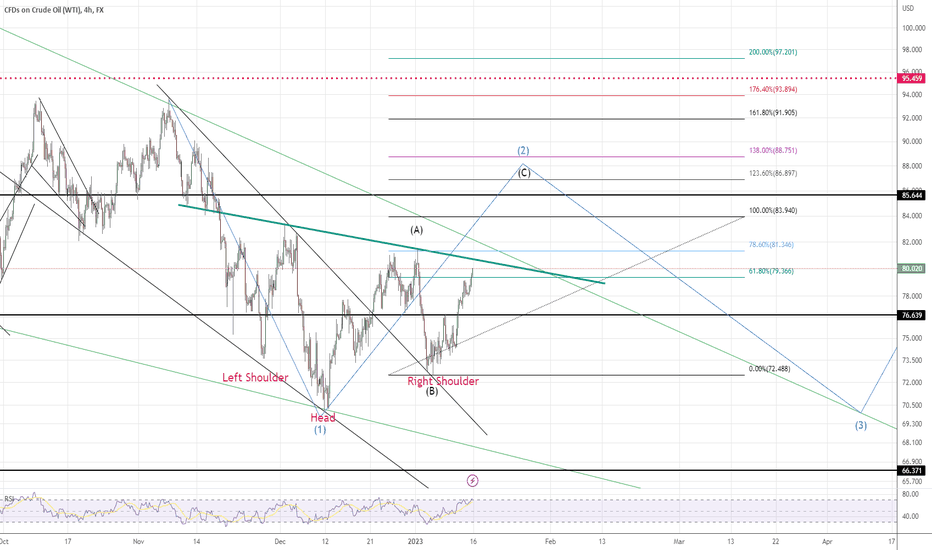

Daily WTI Crude Oil Technical ForecastTrader reaction to the short-term pivot at $76.61 is likely to determine the direction of the March WTI crude oil market on Thursday.

Bearish Scenario

A sustained move under $76.61 will indicate the presence of sellers. The first target is a short-term Fibonacci level at $75.18.

Watch for a technical bounce on the first test of $75.18, but if it fails then look for a possible acceleration to the downside with $72.74 the next likely target.

Bullish Scenario

A sustained move over $76.61 will signal the presence of buyers. The first upside target is a 50% level at $77.70. This is a potential trigger point for an acceleration into the minor top at $79.73, followed by the major resistance area at $80.23 – $82.51.

Note

On February 7, traders focused on Fed Chair Powell’s comments on the monetary policy at The Economic Club of Washington.Powell noted that the disinflationary process had begun, but there was a long way to go before Fed’s inflation target would be reached. Importantly, Powell stated that Fed would not change its 2% inflation target, which remained the global standard.

According to Powell, the road to the 2% inflation will be bumpy. The recent job market data was much stronger than expected, and the Fed must continue to raise rates to reach a sufficiently restrictive level. Powell also noted that he expected significant progress in the fight against inflation .

Speaking about the potential for a rate cut in 2023, Powell said that Fed’s decisions would depend on economic data. The Fed continues to reduce the size of the balance sheet and has no target for this reduction. As in the case of interest rates, the decision to stop the reduction of the size of Fed’s balance sheet would be data-dependent.

Note

Trader reaction to $78.69 is likely to determine the direction of the April WTI crude oil market on Thursday.Bullish Scenario

A sustained move over $78.69 will indicate the presence of buyers. If this creates enough upside momentum then look for a surge into the resistance cluster at $79.76 – $80.01. The latter is a potential trigger point for an acceleration into the Fibonacci level at $81.85.

Bearish Scenario

A sustained move under $78.69 will signal the presence of sellers. This could lead to a test of $77.77.

A failure to hold $77.77 will indicate the selling is getting stronger with the next target a minor pivot at $75.84. This is the last potential support before the $72.64 main bottom.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.