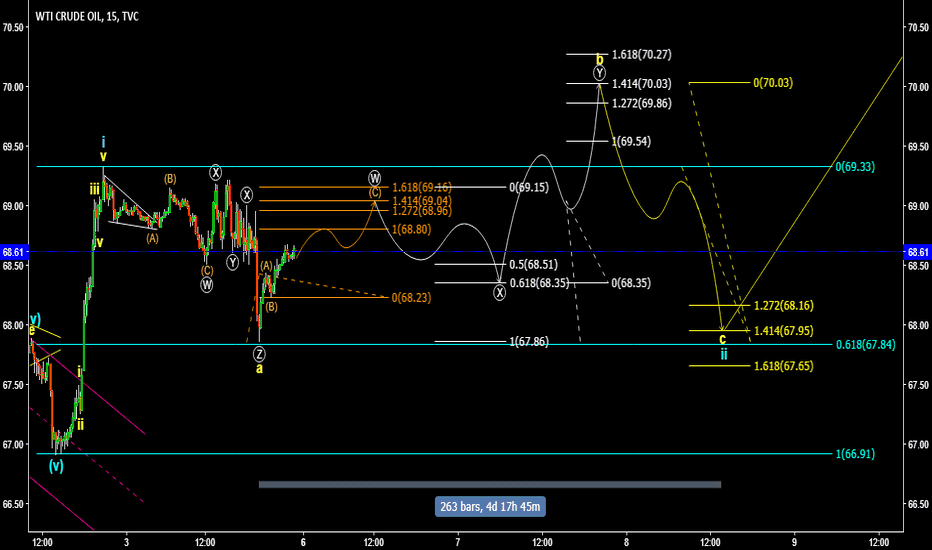

Update to previous WXYXZ idea >

I probably shouldn't get too hooked on the idea that this pattern appears the same as the one back in June as I could end up missing what's actually going on.

Below is the period between 18th June and 21st June with what appears to be a large extended flat correction with B wave a WXY >

Y extended 1.414 of W to complete B then C down to the 1.272 extension of A.

Since last Friday we appear to have a similar structure and today could be B wave >

Y of B extended to 1.272 of W to complete what could be B wave, and potentially now C to the 1.272 extension.

If it goes much higher I will have to admit defeat in my battle to master WXY and WXYXZ corrections :)

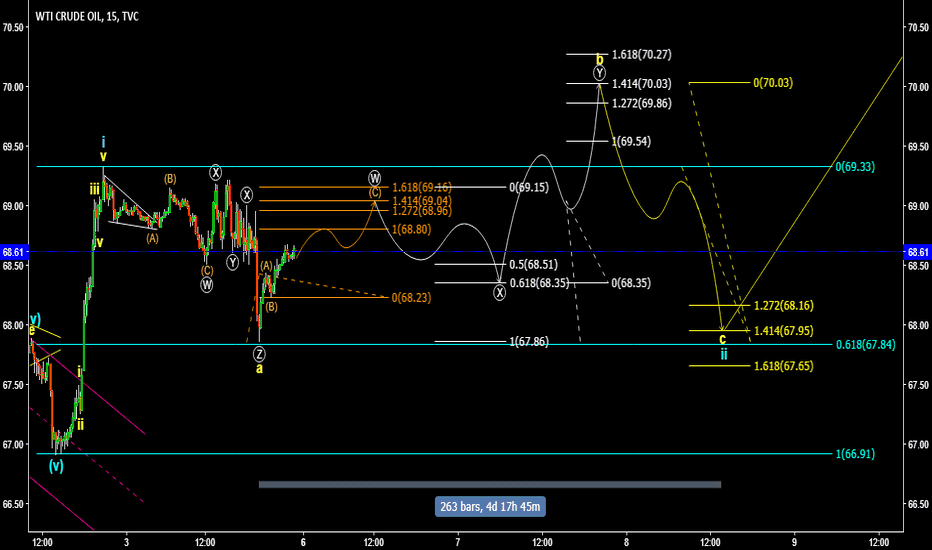

I probably shouldn't get too hooked on the idea that this pattern appears the same as the one back in June as I could end up missing what's actually going on.

Below is the period between 18th June and 21st June with what appears to be a large extended flat correction with B wave a WXY >

Y extended 1.414 of W to complete B then C down to the 1.272 extension of A.

Since last Friday we appear to have a similar structure and today could be B wave >

Y of B extended to 1.272 of W to complete what could be B wave, and potentially now C to the 1.272 extension.

If it goes much higher I will have to admit defeat in my battle to master WXY and WXYXZ corrections :)

Note

Target reachedNote

6690 broken, this bullish count invalid now.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.