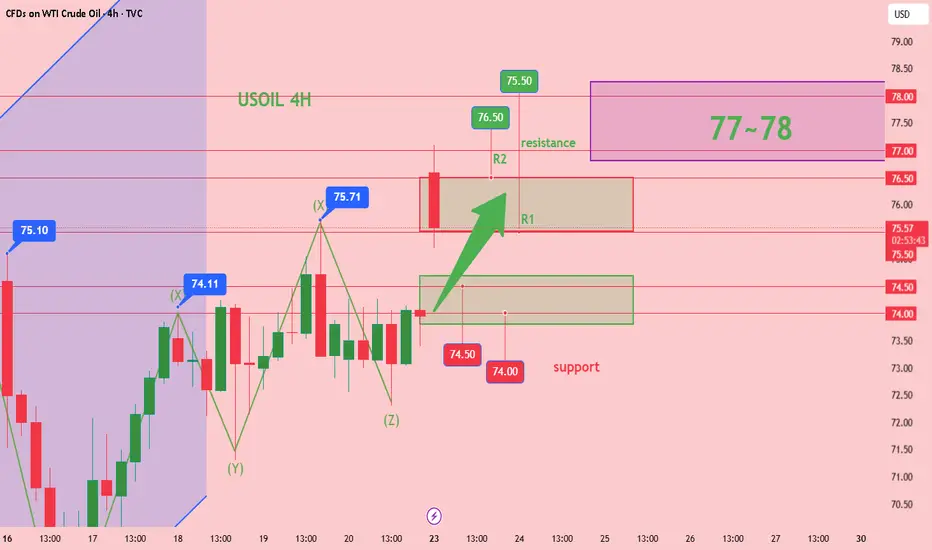

1. Technical Support at the $74 Safety Cushion

Current prices sit squarely in the $74-$78 trading range, with $74 acting as a proven safety cushion—history shows prices rebounding each time they test this level. The $75.03 dip is a hair's breadth from this buffer, testing its resilience.

2. Why the Pullback?

- **Geopolitical Fatigue**: Markets are shrugging off Iran's Strait of Hormuz blockade threats, like crying wolf too often.

- **OPEC+ Supply Jitters**: Despite Saudi Arabia potentially limiting exports due to domestic power demand, the group's production hike announcement has fueled oversupply concerns.

3. Underlying Tensions Remain

Iran's rhetoric may be empty so far, but the standoff resembles two foes clutching weapons mid-argument—any escalation could send prices surging. This dip likely reflects market indecision, as traders await the first move.

4. Trading Strategies for Different Styles

- **Aggressive Traders**:

Consider light long positions near $75, like resting your foot on the gas before a stoplight turns green. Set stop-loss below $74 (breaching the safety cushion signals a trend shift) and target $78 initially, eyeing higher levels on a breakout.

- **Conservative Traders**:

Stick to range trading: buy near $74-$75 and sell around $77-$78, like cruising on a flat road for steady gains. Keep position sizes small and take profits promptly.

5. Key Watchout: Strait of Hormuz Realities

Monitor for concrete disruptions—oil tanker attacks or navigation system glitches would confirm the "wolf has arrived." Adjust positions decisively based on pre-set plans: add to longs on threats, or cut losses if diplomacy defuses tensions.

The market resembles a ship in choppy waters—opportunities and risks coexist. Stay vigilant and flexible, like a driver scanning the road ahead while ready to brake or steer. In this game, survival outpaces quick profits.

Today's crude oil trading strategy, I hope it will be helpful to you

USOIL buy74~74.5

SL:73

TP1:75.5~76.5

TP2:77~78

Current prices sit squarely in the $74-$78 trading range, with $74 acting as a proven safety cushion—history shows prices rebounding each time they test this level. The $75.03 dip is a hair's breadth from this buffer, testing its resilience.

2. Why the Pullback?

- **Geopolitical Fatigue**: Markets are shrugging off Iran's Strait of Hormuz blockade threats, like crying wolf too often.

- **OPEC+ Supply Jitters**: Despite Saudi Arabia potentially limiting exports due to domestic power demand, the group's production hike announcement has fueled oversupply concerns.

3. Underlying Tensions Remain

Iran's rhetoric may be empty so far, but the standoff resembles two foes clutching weapons mid-argument—any escalation could send prices surging. This dip likely reflects market indecision, as traders await the first move.

4. Trading Strategies for Different Styles

- **Aggressive Traders**:

Consider light long positions near $75, like resting your foot on the gas before a stoplight turns green. Set stop-loss below $74 (breaching the safety cushion signals a trend shift) and target $78 initially, eyeing higher levels on a breakout.

- **Conservative Traders**:

Stick to range trading: buy near $74-$75 and sell around $77-$78, like cruising on a flat road for steady gains. Keep position sizes small and take profits promptly.

5. Key Watchout: Strait of Hormuz Realities

Monitor for concrete disruptions—oil tanker attacks or navigation system glitches would confirm the "wolf has arrived." Adjust positions decisively based on pre-set plans: add to longs on threats, or cut losses if diplomacy defuses tensions.

The market resembles a ship in choppy waters—opportunities and risks coexist. Stay vigilant and flexible, like a driver scanning the road ahead while ready to brake or steer. In this game, survival outpaces quick profits.

Today's crude oil trading strategy, I hope it will be helpful to you

USOIL buy74~74.5

SL:73

TP1:75.5~76.5

TP2:77~78

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.