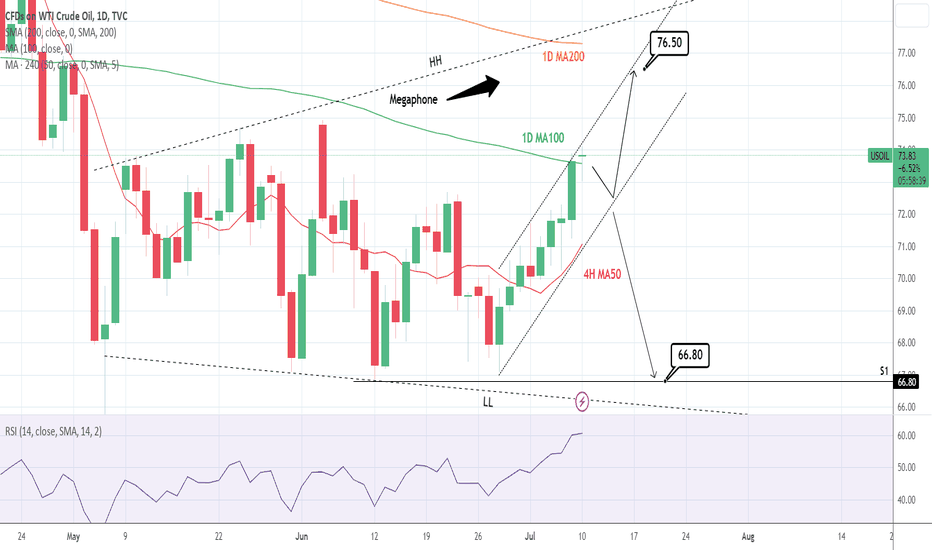

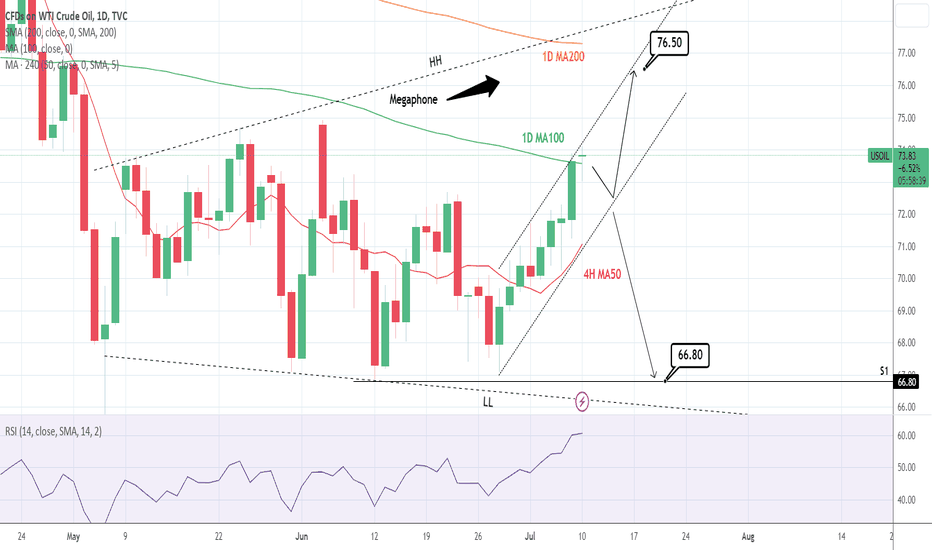

WTI Crude Oil got heavily rejected on the 1D MA200 on Friday (the 1D RSI also on the oversold 70.000 level), the long term technical Resistance of the asset, and now the 1D timeframe is very close to turning neutral (RSI = 55.9310, MACD = 1.200, ADX = 35.829) for the first time since July 5th.

Today the price has hit three key support levels, the HL trendline since the bug rally started, the 1D MA100 and the 4H MA50. Practically, a candle close under the 1D MA100, is a sell extension validation and we will see to target first the 1D MA50 (TP1 = 71.75) and secondly the S1 (TP2 = 66.80).

As long as the Triple Support holds, we will buy since the risk is very low and target the 1D MA200 again (TP = 76.90).

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Today the price has hit three key support levels, the HL trendline since the bug rally started, the 1D MA100 and the 4H MA50. Practically, a candle close under the 1D MA100, is a sell extension validation and we will see to target first the 1D MA50 (TP1 = 71.75) and secondly the S1 (TP2 = 66.80).

As long as the Triple Support holds, we will buy since the risk is very low and target the 1D MA200 again (TP = 76.90).

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.