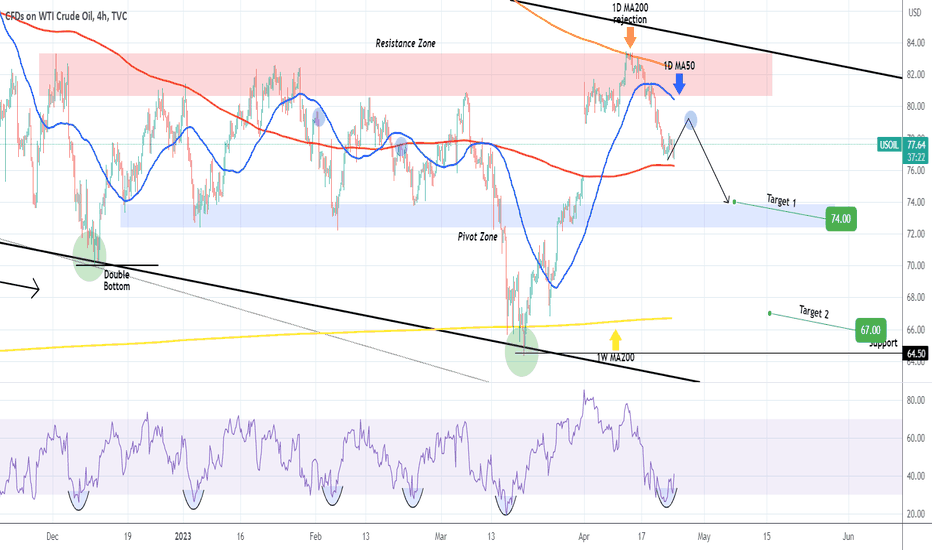

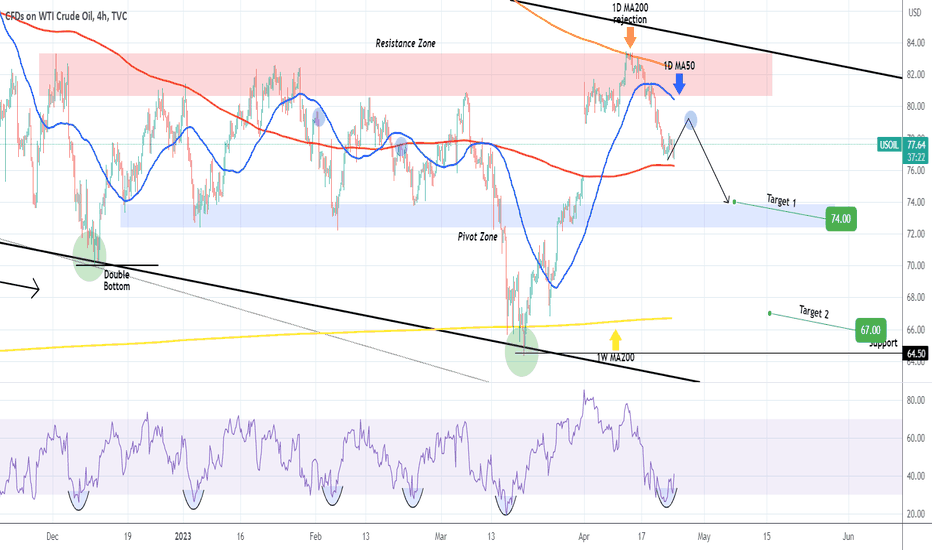

WTI Oil (USOIL) hit the last remaining targets as pointed out on our April 24 idea:

In fact, this completed our long-term 3 target approach as presented on our analysis three weeks ago:

That has come after a Double Bottom buy almost 2 months ago (March 16), which falls into our usual long-term swing trading approach that we apply successfully on our activities:

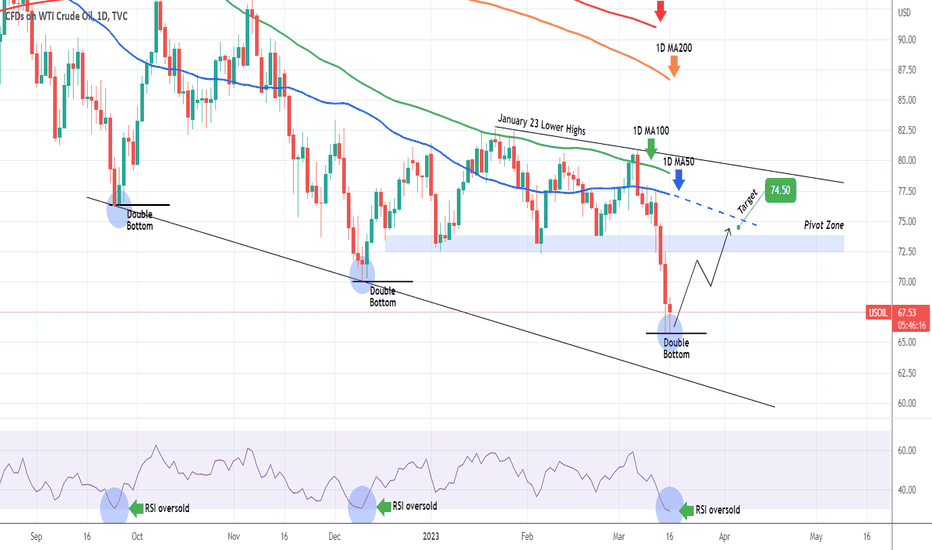

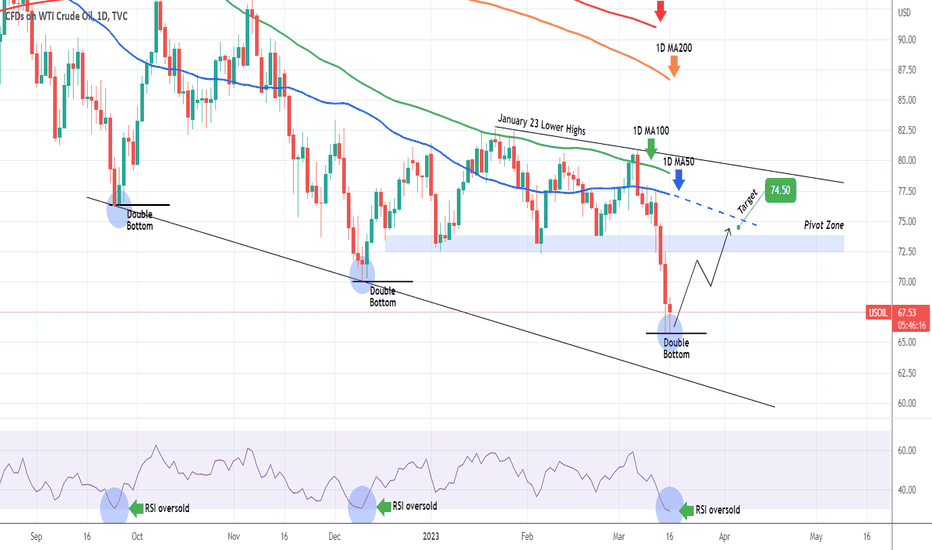

Right now we are on a similar buy opportunity like that idea above almost 2 months ago, as not only did the price bounce aggressively on the 64.50 Support (previous Low) but also the 1D RSI got oversold (30.00) and is rebounding. That has been a common feature on all previous Lower Lows within the long-term (8-month) Channel Down pattern that started on the August 30 2022 High.

Every bullish leg towards the Channel Down Top, has always hit at least the 1D MA50 (blue trend-line). That is currently at 75.66 but declining aggressively and we expect contact to be made at 73.90, which is the top of the 5-month Pivot Zone (that has been a Support for 3 months straight). The previous Lower High (April 13) was made exactly on the 1D MA200 (orange trend-line) which is the long-term Resistance, so it is very likely to hit that level also on the long-term but until then we will have our outlook updated.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

In fact, this completed our long-term 3 target approach as presented on our analysis three weeks ago:

That has come after a Double Bottom buy almost 2 months ago (March 16), which falls into our usual long-term swing trading approach that we apply successfully on our activities:

Right now we are on a similar buy opportunity like that idea above almost 2 months ago, as not only did the price bounce aggressively on the 64.50 Support (previous Low) but also the 1D RSI got oversold (30.00) and is rebounding. That has been a common feature on all previous Lower Lows within the long-term (8-month) Channel Down pattern that started on the August 30 2022 High.

Every bullish leg towards the Channel Down Top, has always hit at least the 1D MA50 (blue trend-line). That is currently at 75.66 but declining aggressively and we expect contact to be made at 73.90, which is the top of the 5-month Pivot Zone (that has been a Support for 3 months straight). The previous Lower High (April 13) was made exactly on the 1D MA200 (orange trend-line) which is the long-term Resistance, so it is very likely to hit that level also on the long-term but until then we will have our outlook updated.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑Best Signals (Forex/Crypto+70% accuracy) & Account Management (+20% profit/month on 10k accounts)

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

💰Free Channel t.me/tradingshotglobal

🤵Contact info@tradingshot.com t.me/tradingshot

🔥New service: next X100 crypto GEMS!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.