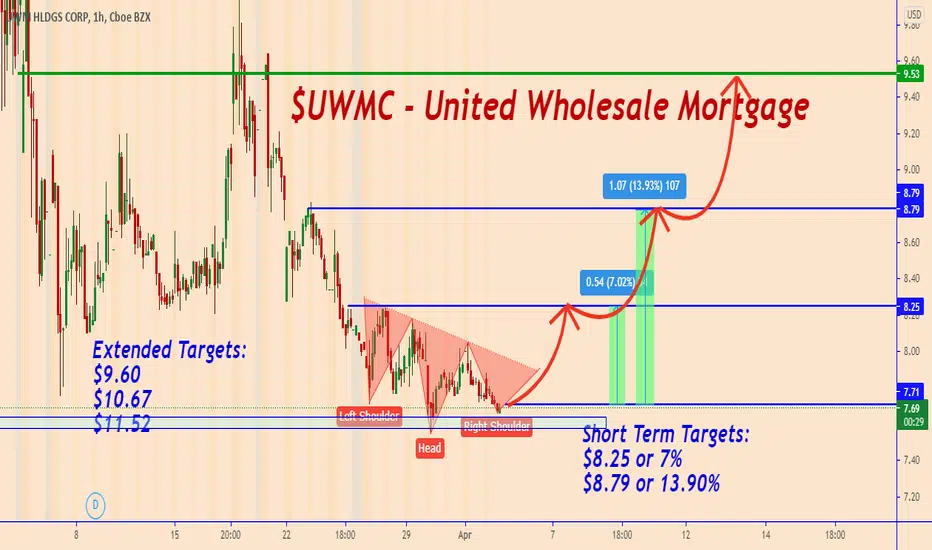

On the 60 min chart, we can see that the price is forming an "Inverse Head & Shoulders" pattern near a strong support zone. From the other side, we have also the 4-hour analysis that is supporting the reversal of the price higher from where it is actually.

Why Is This Stock Undervalued?

UWMC reported 4Q20 net income of $1.37 billion and FY20 net income of $3.38 billion, an 821% and 715% increase over 4Q19 and FY19 respectively. The Board of Directors of UWMC declared its first regular quarterly dividend of $0.10 per share on the outstanding shares of Class A Common Stock.

So we can say that the company is very solid as long as the profits are very good and they declared a regular quarterly dividend.

Short Term Targets:

$8.25 or 7%

$8.79 or 13.90%

Extended Targets:

$9.60

$10.67

$11.52

Thank you and Good Luck!

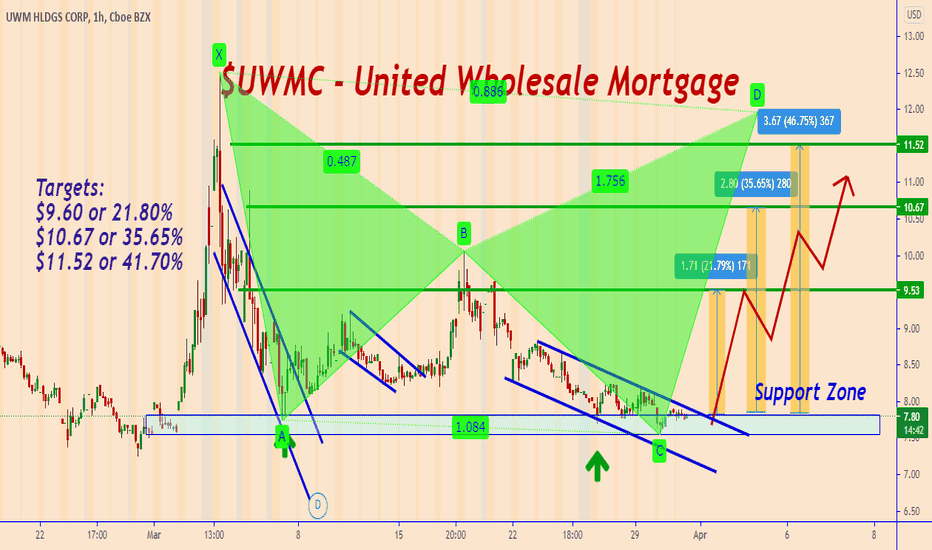

4 - hour analysis:

Why Is This Stock Undervalued?

UWMC reported 4Q20 net income of $1.37 billion and FY20 net income of $3.38 billion, an 821% and 715% increase over 4Q19 and FY19 respectively. The Board of Directors of UWMC declared its first regular quarterly dividend of $0.10 per share on the outstanding shares of Class A Common Stock.

So we can say that the company is very solid as long as the profits are very good and they declared a regular quarterly dividend.

Short Term Targets:

$8.25 or 7%

$8.79 or 13.90%

Extended Targets:

$9.60

$10.67

$11.52

Thank you and Good Luck!

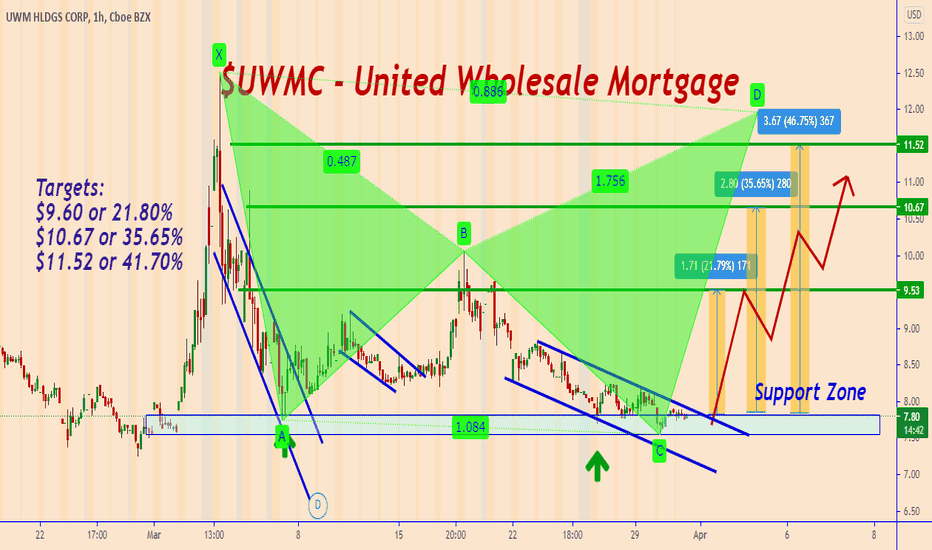

4 - hour analysis:

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.