Bakkt Expected to Go Public via Reverse-Merger with VPC

Bakkt Expected to Go Public via Reverse-Merger with VPC Impact Acquisition Holdings

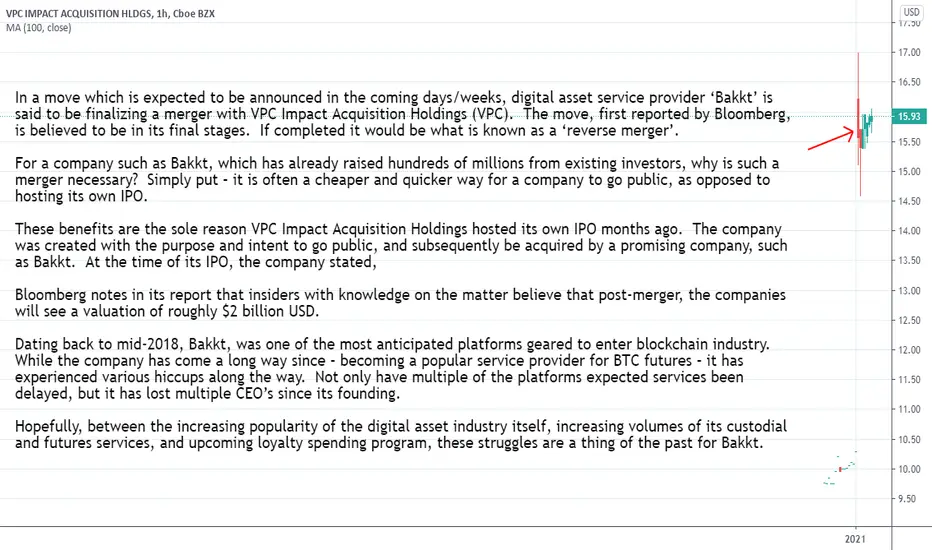

In a move which is expected to be announced in the coming days/weeks, digital asset service provider ‘Bakkt’ is said to be finalizing a merger with VPC Impact Acquisition Holdings (VPC). The move, first reported by Bloomberg, is believed to be in its final stages. If completed it would be what is known as a ‘reverse merger’.

For a company such as Bakkt, which has already raised hundreds of millions from existing investors, why is such a merger necessary? Simply put – it is often a cheaper and quicker way for a company to go public, as opposed to hosting its own IPO.

These benefits are the sole reason VPC Impact Acquisition Holdings hosted its own IPO months ago. The company was created with the purpose and intent to go public, and subsequently be acquired by a promising company, such as Bakkt. At the time of its IPO, the company stated,

Bloomberg notes in its report that insiders with knowledge on the matter believe that post-merger, the companies will see a valuation of roughly $2 billion USD.

Dating back to mid-2018, Bakkt, was one of the most anticipated platforms geared to enter blockchain industry. While the company has come a long way since – becoming a popular service provider for BTC futures – it has experienced various hiccups along the way. Not only have multiple of the platforms expected services been delayed, but it has lost multiple CEO’s since its founding.

Hopefully, between the increasing popularity of the digital asset industry itself, increasing volumes of its custodial and futures services, and upcoming loyalty spending program, these struggles are a thing of the past for Bakkt.

In a move which is expected to be announced in the coming days/weeks, digital asset service provider ‘Bakkt’ is said to be finalizing a merger with VPC Impact Acquisition Holdings (VPC). The move, first reported by Bloomberg, is believed to be in its final stages. If completed it would be what is known as a ‘reverse merger’.

For a company such as Bakkt, which has already raised hundreds of millions from existing investors, why is such a merger necessary? Simply put – it is often a cheaper and quicker way for a company to go public, as opposed to hosting its own IPO.

These benefits are the sole reason VPC Impact Acquisition Holdings hosted its own IPO months ago. The company was created with the purpose and intent to go public, and subsequently be acquired by a promising company, such as Bakkt. At the time of its IPO, the company stated,

Bloomberg notes in its report that insiders with knowledge on the matter believe that post-merger, the companies will see a valuation of roughly $2 billion USD.

Dating back to mid-2018, Bakkt, was one of the most anticipated platforms geared to enter blockchain industry. While the company has come a long way since – becoming a popular service provider for BTC futures – it has experienced various hiccups along the way. Not only have multiple of the platforms expected services been delayed, but it has lost multiple CEO’s since its founding.

Hopefully, between the increasing popularity of the digital asset industry itself, increasing volumes of its custodial and futures services, and upcoming loyalty spending program, these struggles are a thing of the past for Bakkt.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.