HydraFacial and Vesper Healthcare Announce Business Combination

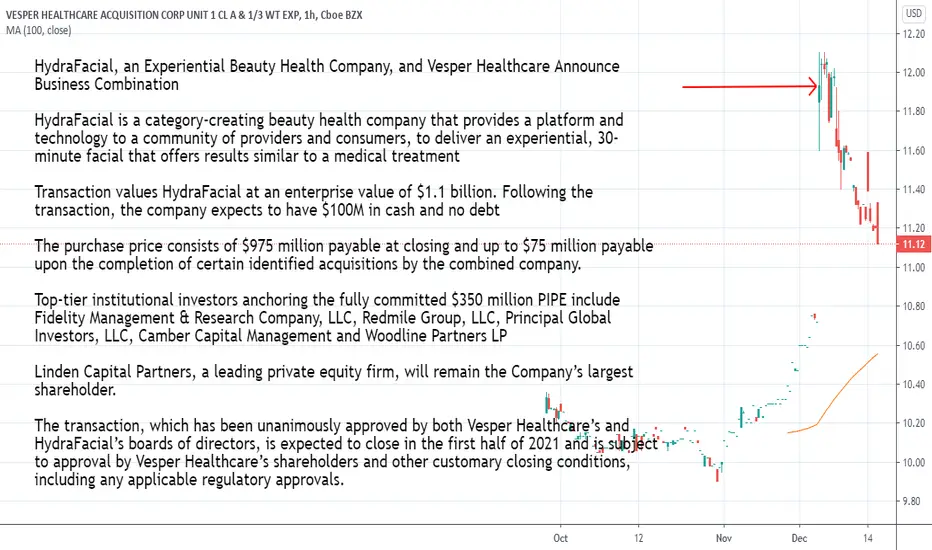

HydraFacial, an Experiential Beauty Health Company, and Vesper Healthcare Announce Business Combination

HydraFacial is a category-creating beauty health company that provides a platform and technology to a community of providers and consumers, to deliver an experiential, 30-minute facial that offers results similar to a medical treatment

Transaction values HydraFacial at an enterprise value of $1.1 billion. Following the transaction, the company expects to have $100M in cash and no debt

The purchase price consists of $975 million payable at closing and up to $75 million payable upon the completion of certain identified acquisitions by the combined company.

Top-tier institutional investors anchoring the fully committed $350 million PIPE include Fidelity Management & Research Company, LLC, Redmile Group, LLC, Principal Global Investors, LLC, Camber Capital Management and Woodline Partners LP

Linden Capital Partners, a leading private equity firm, will remain the Company’s largest shareholder.

The transaction, which has been unanimously approved by both Vesper Healthcare’s and HydraFacial’s boards of directors, is expected to close in the first half of 2021 and is subject to approval by Vesper Healthcare’s shareholders and other customary closing conditions, including any applicable regulatory approvals.

finance.yahoo.com/news/hydrafacial-experiential-beauty-health-company-115500113.html

HydraFacial is a category-creating beauty health company that provides a platform and technology to a community of providers and consumers, to deliver an experiential, 30-minute facial that offers results similar to a medical treatment

Transaction values HydraFacial at an enterprise value of $1.1 billion. Following the transaction, the company expects to have $100M in cash and no debt

The purchase price consists of $975 million payable at closing and up to $75 million payable upon the completion of certain identified acquisitions by the combined company.

Top-tier institutional investors anchoring the fully committed $350 million PIPE include Fidelity Management & Research Company, LLC, Redmile Group, LLC, Principal Global Investors, LLC, Camber Capital Management and Woodline Partners LP

Linden Capital Partners, a leading private equity firm, will remain the Company’s largest shareholder.

The transaction, which has been unanimously approved by both Vesper Healthcare’s and HydraFacial’s boards of directors, is expected to close in the first half of 2021 and is subject to approval by Vesper Healthcare’s shareholders and other customary closing conditions, including any applicable regulatory approvals.

finance.yahoo.com/news/hydrafacial-experiential-beauty-health-company-115500113.html

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.