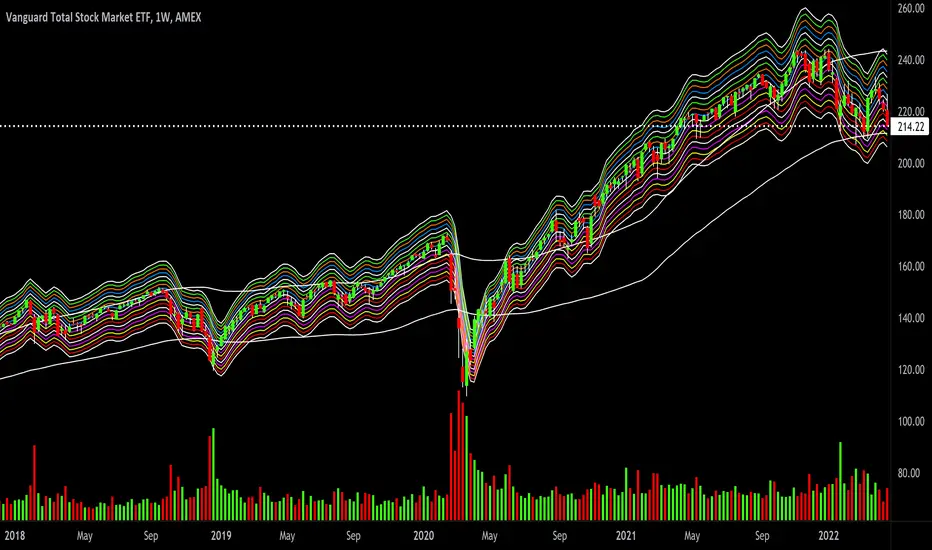

VTI is an ETF that includes the entire US equity market with 4,128 holdings. It's a great way to check the general overall tone of the United States stock markets. Here we have a 1 week chart, 4 year view, with my MTTC2.0 (still in beta) 17 levels set to SMA4 +-1% deviation per level, with the slow moving average envelope set to SMA50 with a +-8% deviation support & resistance. Technically, the US equity market (VTI) is very close to global support at $211.41 and $208.49 which is local support. The average of the two = $209.95, so if VTI gets to that level a logical technical plan would be to flip put hedges and go long with all calls until it gets back to pivot and then back to a 1 : 1 balanced hedge ratio. By my estimation that day is imminent as early as Monday or Tuesday 4/25 or 4/26. This past Friday was close, lol.

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.com/u/growerik/

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tickerTracker - MFI Oscillator

tradingview.com/u/growerik/

Note

*options use 100x leverage you could lose everything*There are many types of options trading strategies and positions, simple to sophisticated & hybrids. I group them into theta, delta or mix strategies and bull, bear or neutral positions. There's a buy side and sell side to every trade. If you check the open interest (OI), you can see how liquid it is. Check how wide the bid vs ask spread is.

Theta:

iron condor

iron fly

covered call

cash secured put

calendar spread

collar

Delta:

call

put

straddle

strangle

debit spread

credit spread

Bull:

call

put credit spread

call debit spread

cash secured put

Bear:

put

call credit spread

put debit spread

covered call

Neutral:

straddle

strangle

iron condor

iron fly

collar (often used for downside insurance)

calendar spread (short or long time)

Options important variables:

Strike = share price

itm, atm, otm = strike position

Expiry = Date of expiration

Value = H, L & Mark

Liquidity = bid vs ask spread

Direction = put or call

OI = open interest

V = volume

CP = chance of profit

IV = implied volatility

Delta = price

Theta = time

Vega = volatility

Gamma = momentum

Note

Bear trap incomingNote

Getting very close to the long triggerNote

So $209 global support is holding after all.Note

(VTI) US equity Market breaks 52 week lows.Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.