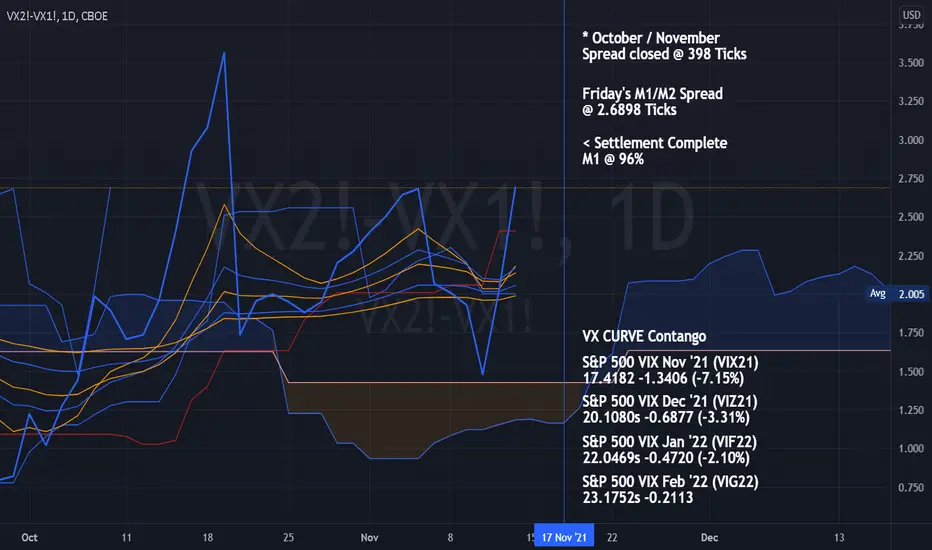

The prior 398 Tick Settlement has declined to ~269 Ticks.

__________________________________________________

Daily Low VX Price Objective remains 12.25.

It is difficult to Imagine - A VIX print this Low.

__________________________________________________

December has become a significantly distorted Settlement Month

for Equity Future Contracts

__________________________________________________

ESZ21 - S&P 500 E-Mini (Dec '21)

Implied Volatility: 12.95%

Put Premium Total $422,602.50 (Deep - Out of the Money can Mask Large Decline Potential)

Call Premium Total $10,005,752.50

Put/Call Premium Ratio 0.04 (Extreme Bullish Sentiment)

Put Open Interest Total 771,656

Call Open Interest Total 263,145

Put/Call Open Interest Ratio 2.93 ( Ratio of outstanding positions that need to be set off before or on expiry)

__________________________________________________

Dow Futures Mini Dec '21 (YMZ21)

36,013s +184 (+0.51%)

Put Premium Tota l$3,123,245.00

Call Premium Total $6,532,215.00

Put/Call Premium Ratio0.48

Put Open Interest Total 824

Call Open Interest Total 316

Put/Call Open Interest Ratio 2.61

__________________________________________________

Nasdaq 100 E-Mini Dec '21 (NQZ21)

16,192.75s +170.00 (+1.06%)

Put Premium Total $6,589,153.00

Call Premium Total $30,371,383.00

Put/Call Premium Ratio 0.22

Put Open Interest Total 47,828

Call Open Interest Total 31,758

Put/Call Open Interest Ratio 1.51

__________________________________________________

The Challenge - Who gets paid First, because both will.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.