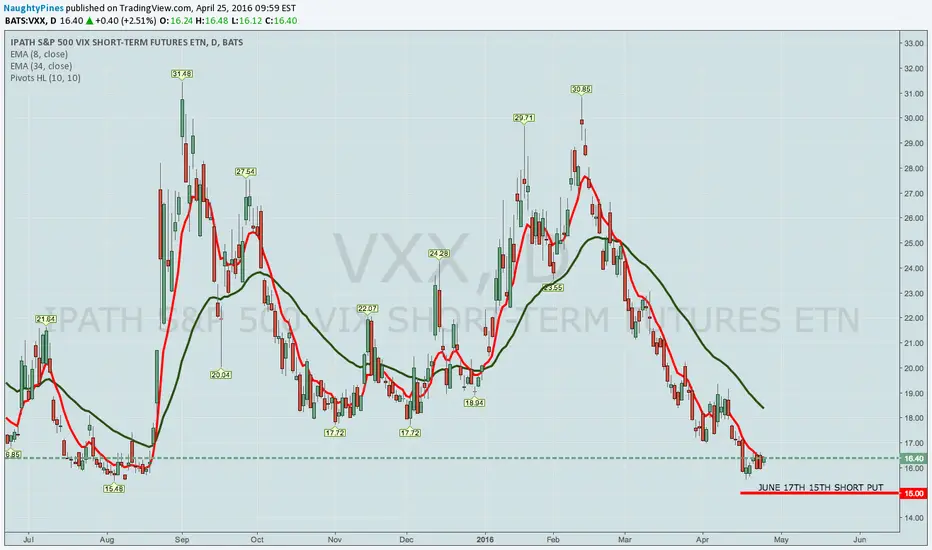

... for a $94/contract credit.

Unfortunately, I forgot to jot down the metrics here.

I wanted to ladder out spreads (see Post Below), but it didn't look like those we're going to be filled, so I opted for the more flexible naked, which I can roll down and out for duration and credit if I have to. Doing that with the spreads is a bit more cumbersome.

As with all VIX/VIX derivatives, I look to money, take, run on a pop, but am shooting for 50% max credit here if I can get it.

Unfortunately, I forgot to jot down the metrics here.

I wanted to ladder out spreads (see Post Below), but it didn't look like those we're going to be filled, so I opted for the more flexible naked, which I can roll down and out for duration and credit if I have to. Doing that with the spreads is a bit more cumbersome.

As with all VIX/VIX derivatives, I look to money, take, run on a pop, but am shooting for 50% max credit here if I can get it.

Trade closed manually

Closed for a miniature profit ... .Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.