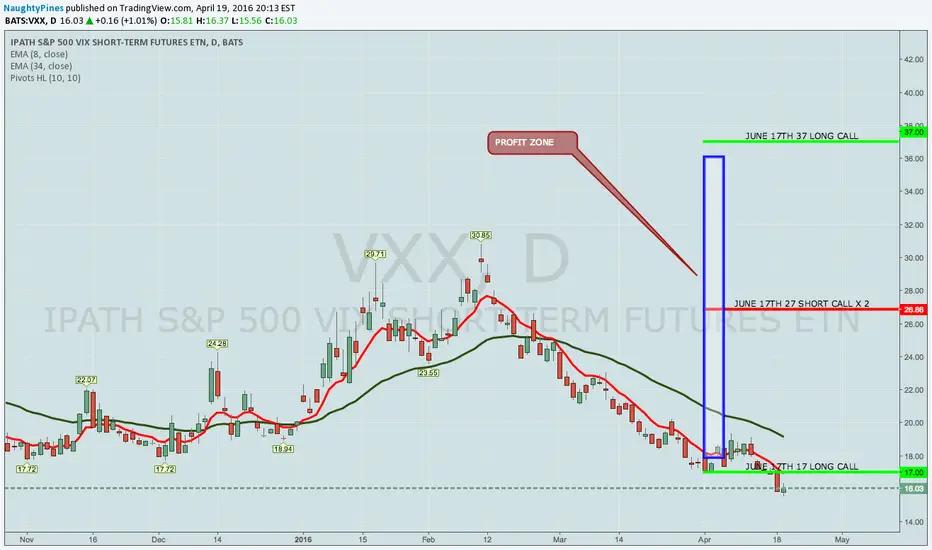

TRADE IDEA: VXX JUNE 17TH 17/27/37 LONG CALL BUTTERFLY

With low volatility having drained premium not only out of the broader market, but individual underlyings as well, I continue to look at VIX and VXX derivatives to go "long volatility" in lieu of opting for low vol strategies like debit spreads, calendars, and diagonals.

In this particular case, I'm opting to use a long call butterfly given its high risk/return ratio, its relative cheapness to put on, as well as the large profit zone the setup generates.

Here are the metrics for the setup:

Probability of Profit: 54%

Max Profit: $910/contract

Max Risk/Buying Power Effect: $90/contract

Notes: There are a couple of different ways to manage this intratrade, one of which merely involves taking the whole setup off in profit. The alternative way is to strip off the long call vertical portion of the setup (the 17/27 wing) first as price moves up, after which you would look to exit the short call vertical wing (27/37) as VXX mean reverts (as it is want to do).

In this particular case, I'm opting to use a long call butterfly given its high risk/return ratio, its relative cheapness to put on, as well as the large profit zone the setup generates.

Here are the metrics for the setup:

Probability of Profit: 54%

Max Profit: $910/contract

Max Risk/Buying Power Effect: $90/contract

Notes: There are a couple of different ways to manage this intratrade, one of which merely involves taking the whole setup off in profit. The alternative way is to strip off the long call vertical portion of the setup (the 17/27 wing) first as price moves up, after which you would look to exit the short call vertical wing (27/37) as VXX mean reverts (as it is want to do).

Note

I modified the setup here a bit and went with a VXX June 17th 16/22/28 long call butterfly, which I got filled for a $76 debit. The ideal outcome of these for max profit is for price to be around your short calls strikes (22) at expiration (good luck timing that on the nose); however, I'm going to look to take this off as a unit for 2-3x what I paid as debit ... .Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.