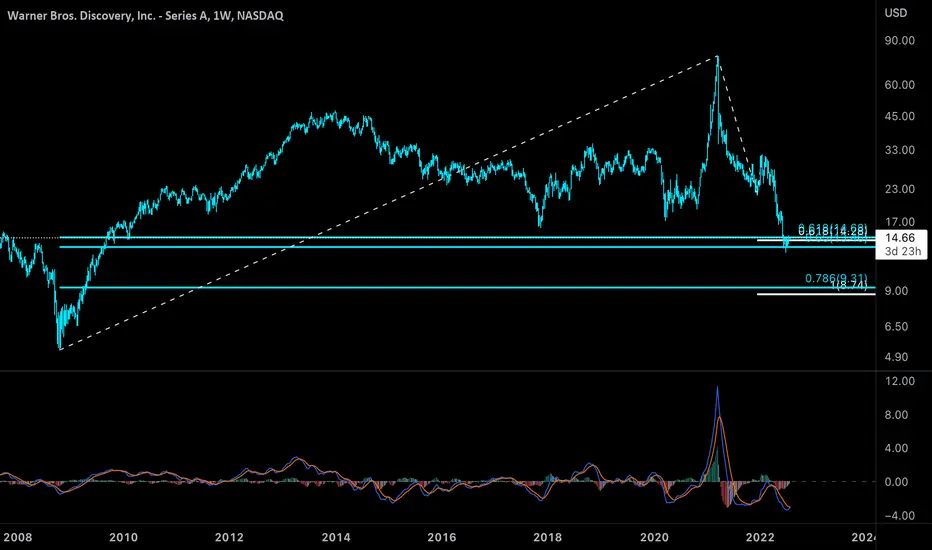

WBD trading in the golden pocket between $13.46 and $14.68 as well as the .618 trend based fib at $14.28. Bearish momentum is decreasing on the Weekly TF as well as an imminent bullish cross on the MACD. Earnings coming up. Should price continue to make new yearly lows, $9 is next. Undervalued here imo.

Note

With SPX looking to temporary reverse back to ~4,000 imo, WBD will probably drop back into the accumulation area especially after that abysmal earnings report. A lot of shorts having fun, but regardless of Debt > MC, Price to Free Cash Flow is nearing a new ATL at 4.67.Note

Scooped up some more shares at $14.8Note

So Burry completely cashes out of WBD. This is where FA contradicts with TA. If it wasn't for 1) star on weekly TF 2) S&P shitting the bed, I'd happily double down. Against my better judgement, I'm holding on here.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.