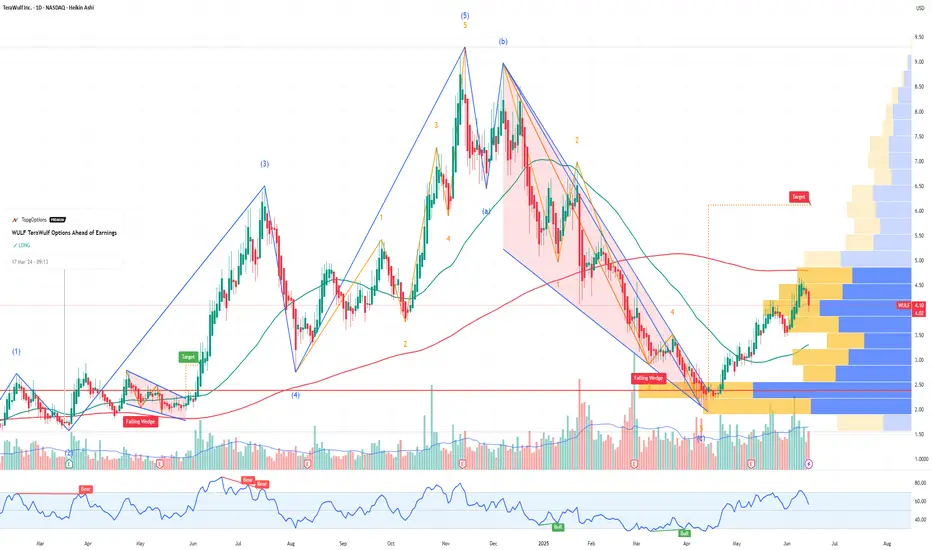

If you haven`t bought WULF before the rally:

Now TeraWulf WULF is emerging as a compelling growth story in the digital infrastructure and cryptocurrency mining sectors, distinguished by its commitment to zero-carbon energy and expanding high-performance computing (HPC) hosting capabilities. Despite near-term financial challenges, the company’s rapid capacity growth, strong cash position, and strategic initiatives position it well for substantial upside in 2025 and beyond.

1. Rapid Expansion of Mining Capacity and Hashrate Growth

TeraWulf energized Miner Building 5, increasing its total mining capacity to 245 MW and boosting its Bitcoin mining hashrate to 12.2 exahashes per second (EH/s), a 52.5% increase year-over-year.

This significant growth in self-mining capacity enhances revenue potential and operational scale, positioning TeraWulf among the more efficient and sizable clean-energy miners.

The company’s vertically integrated model, powered primarily by zero-carbon energy, aligns with increasing regulatory and investor demand for sustainable crypto mining.

2. Strategic Buildout of High-Performance Computing (HPC) Infrastructure

TeraWulf commenced the buildout of dedicated HPC data halls and remains on track to deliver 72.5 MW of gross HPC hosting infrastructure to Core42 in 2025.

The company is actively pursuing additional HPC customers, targeting 200–250 MW of operational HPC capacity by the end of 2026, which diversifies revenue streams beyond crypto mining.

HPC infrastructure is a high-growth segment driven by demand for AI, big data, and cloud computing, offering TeraWulf exposure to secular technology trends.

3. Strong Financial Position and Capital Allocation

As of March 31, 2025, TeraWulf held approximately $219.6 million in cash and bitcoin holdings, providing liquidity to fund expansion and weather market volatility.

The company has repurchased $33 million of common stock in 2025, signaling management’s confidence in the business and commitment to shareholder value.

While total outstanding debt is around $500 million, TeraWulf maintains a strong current ratio (~5.4), indicating solid short-term liquidity.

4. Industry-Leading Sustainability Profile

TeraWulf’s focus on zero-carbon energy for its mining operations differentiates it in an industry increasingly scrutinized for environmental impact.

This green positioning not only appeals to ESG-conscious investors but may also provide access to incentives, partnerships, and preferential contracts as governments and enterprises emphasize sustainability.

5. Revenue Growth Outlook and Market Opportunity

Despite a temporary revenue dip to $34.4 million in Q1 2025, the company is projected to deliver a 53% increase in revenue for the full year 2025, significantly outpacing industry averages.

The combination of expanding mining capacity and HPC hosting services positions TeraWulf to capitalize on the growing demand for digital infrastructure powered by clean energy.

6. Navigating Financial Challenges with Growth Focus

TeraWulf reported a GAAP net loss of $0.16 per share in Q1 2025, reflecting ongoing investments in capacity and infrastructure.

Operational cash flow remains positive and improving, with management focused on scaling efficiently and improving margins over time.

Now TeraWulf WULF is emerging as a compelling growth story in the digital infrastructure and cryptocurrency mining sectors, distinguished by its commitment to zero-carbon energy and expanding high-performance computing (HPC) hosting capabilities. Despite near-term financial challenges, the company’s rapid capacity growth, strong cash position, and strategic initiatives position it well for substantial upside in 2025 and beyond.

1. Rapid Expansion of Mining Capacity and Hashrate Growth

TeraWulf energized Miner Building 5, increasing its total mining capacity to 245 MW and boosting its Bitcoin mining hashrate to 12.2 exahashes per second (EH/s), a 52.5% increase year-over-year.

This significant growth in self-mining capacity enhances revenue potential and operational scale, positioning TeraWulf among the more efficient and sizable clean-energy miners.

The company’s vertically integrated model, powered primarily by zero-carbon energy, aligns with increasing regulatory and investor demand for sustainable crypto mining.

2. Strategic Buildout of High-Performance Computing (HPC) Infrastructure

TeraWulf commenced the buildout of dedicated HPC data halls and remains on track to deliver 72.5 MW of gross HPC hosting infrastructure to Core42 in 2025.

The company is actively pursuing additional HPC customers, targeting 200–250 MW of operational HPC capacity by the end of 2026, which diversifies revenue streams beyond crypto mining.

HPC infrastructure is a high-growth segment driven by demand for AI, big data, and cloud computing, offering TeraWulf exposure to secular technology trends.

3. Strong Financial Position and Capital Allocation

As of March 31, 2025, TeraWulf held approximately $219.6 million in cash and bitcoin holdings, providing liquidity to fund expansion and weather market volatility.

The company has repurchased $33 million of common stock in 2025, signaling management’s confidence in the business and commitment to shareholder value.

While total outstanding debt is around $500 million, TeraWulf maintains a strong current ratio (~5.4), indicating solid short-term liquidity.

4. Industry-Leading Sustainability Profile

TeraWulf’s focus on zero-carbon energy for its mining operations differentiates it in an industry increasingly scrutinized for environmental impact.

This green positioning not only appeals to ESG-conscious investors but may also provide access to incentives, partnerships, and preferential contracts as governments and enterprises emphasize sustainability.

5. Revenue Growth Outlook and Market Opportunity

Despite a temporary revenue dip to $34.4 million in Q1 2025, the company is projected to deliver a 53% increase in revenue for the full year 2025, significantly outpacing industry averages.

The combination of expanding mining capacity and HPC hosting services positions TeraWulf to capitalize on the growing demand for digital infrastructure powered by clean energy.

6. Navigating Financial Challenges with Growth Focus

TeraWulf reported a GAAP net loss of $0.16 per share in Q1 2025, reflecting ongoing investments in capacity and infrastructure.

Operational cash flow remains positive and improving, with management focused on scaling efficiently and improving margins over time.

Private SIGNALS patreon.com/PremiumOptionsSignals

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Private SIGNALS patreon.com/PremiumOptionsSignals

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Trading COURSE bit.ly/tradex

RESULTS bit.ly/TG10x

TradeNation bit.ly/t10X

CRYPTO partner.bybit.com/b/37880

BUY-SELL INDICATORS tradingindicators.store/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.