📍 Technical Snapshot

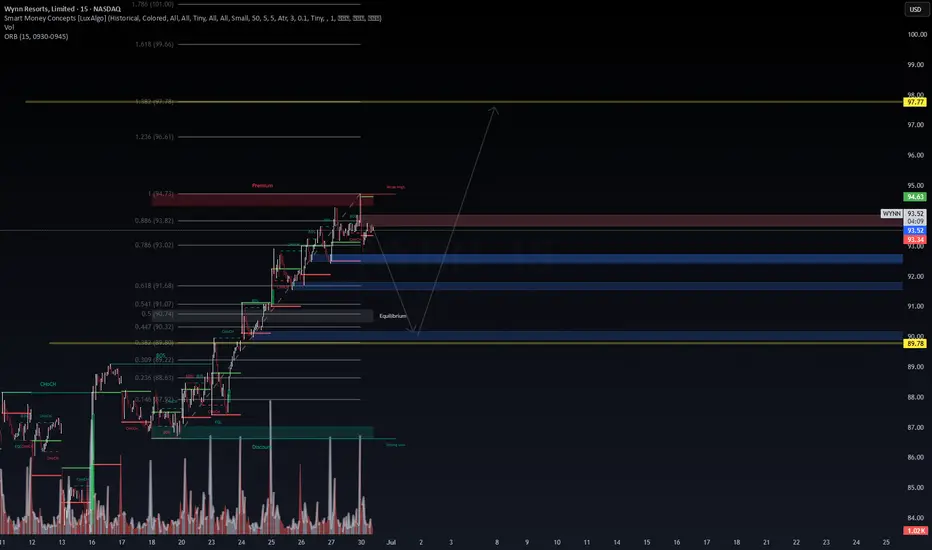

WYNN tagged the 0.886 Fib level at $93.82 and briefly wicked above the previous high into the premium zone before rejecting. Current price is hovering near $93.53, with liquidity resting just below. A key equilibrium zone sits around $91.00, with deeper demand between $89.78–$90.00, potentially offering smart money entry.

WYNN tagged the 0.886 Fib level at $93.82 and briefly wicked above the previous high into the premium zone before rejecting. Current price is hovering near $93.53, with liquidity resting just below. A key equilibrium zone sits around $91.00, with deeper demand between $89.78–$90.00, potentially offering smart money entry.

📊 VolanX Trade Scenarios

✅ Scenario A – Accumulation Pullback (70% Probability)

Price dips into the equilibrium zone or below to collect liquidity

Volume spike + SMC signal confirms demand

Targets:

T1: $94.63 (ORB high)

T2: $97.77

T3: $98.00–$99.66 (Fib 1.382–1.618 extension)

⚠️ Scenario B – Breakdown (30% Probability)

Failure to hold above $91.00 leads to structural break

Invalidation below $89.78 (marked yellow)

Next discount zone: $88.00–$86.00

📈 Execution Plan (DSS Aligned)

Long Bias if price retests blue zone (Equilibrium at $91.00–$90.00)

Volume and CHoCH confirmation required

SL: Below $89.78

RRR: ~3.5x targeting extension levels

🔍 SMC Confirmations:

Multiple CHoCH + BOS

Liquidity engineered above weak high

Compression post-sweep indicates potential launchpad setup

💡 “Weak highs don’t survive strong flows.” – VolanX Protocol

🔐 Posted by WaverVanir International LLC using DSS Market Phase Model

#WYNN #SmartMoneyConcepts #WaverVanir #VolanX #LiquidityZones #FibonacciTrading #MarketStructure #SMC #EquilibriumZones #RiskReward #BreakoutPlay

📊 VolanX Trade Scenarios

✅ Scenario A – Accumulation Pullback (70% Probability)

Price dips into the equilibrium zone or below to collect liquidity

Volume spike + SMC signal confirms demand

Targets:

T1: $94.63 (ORB high)

T2: $97.77

T3: $98.00–$99.66 (Fib 1.382–1.618 extension)

⚠️ Scenario B – Breakdown (30% Probability)

Failure to hold above $91.00 leads to structural break

Invalidation below $89.78 (marked yellow)

Next discount zone: $88.00–$86.00

📈 Execution Plan (DSS Aligned)

Long Bias if price retests blue zone (Equilibrium at $91.00–$90.00)

Volume and CHoCH confirmation required

SL: Below $89.78

RRR: ~3.5x targeting extension levels

🔍 SMC Confirmations:

Multiple CHoCH + BOS

Liquidity engineered above weak high

Compression post-sweep indicates potential launchpad setup

💡 “Weak highs don’t survive strong flows.” – VolanX Protocol

🔐 Posted by WaverVanir International LLC using DSS Market Phase Model

#WYNN #SmartMoneyConcepts #WaverVanir #VolanX #LiquidityZones #FibonacciTrading #MarketStructure #SMC #EquilibriumZones #RiskReward #BreakoutPlay

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.