- Silver reversed from the support zone

- Likely to rise to resistance level 30.75

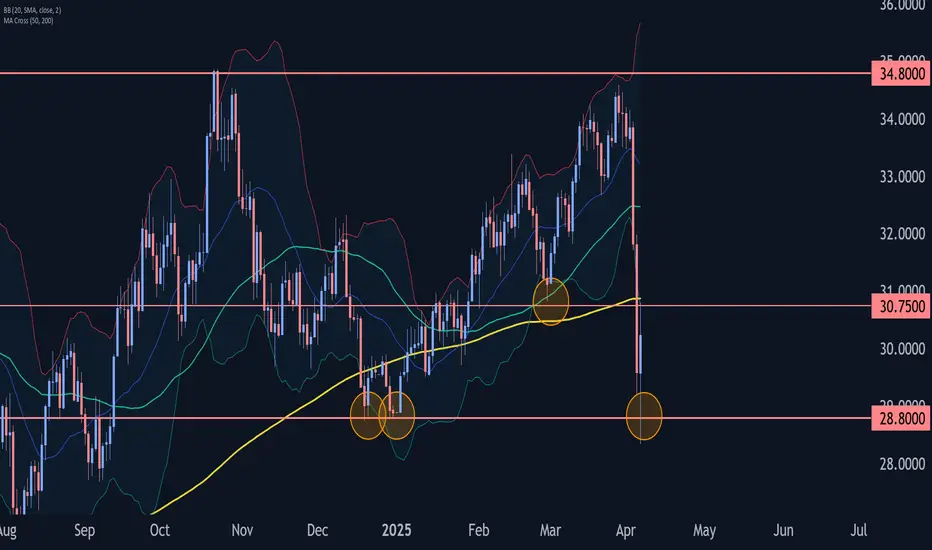

Silver recently reversed up from the support zone between the strong support level 28.80 (which formed Double Bottom at the end of December) and the lower daily Bollinger Band.

The upward reversal from this support zone stopped the previous sharp downward correction (2) from the end of March.

Silver can be expected to rise to the next resistance level 30.75 (the former monthly low from February, acting as the resistance after it was broken at the start of April).

- Likely to rise to resistance level 30.75

Silver recently reversed up from the support zone between the strong support level 28.80 (which formed Double Bottom at the end of December) and the lower daily Bollinger Band.

The upward reversal from this support zone stopped the previous sharp downward correction (2) from the end of March.

Silver can be expected to rise to the next resistance level 30.75 (the former monthly low from February, acting as the resistance after it was broken at the start of April).

Alexander Kuptsikevich,

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Alexander Kuptsikevich,

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Chief Market Analyst at FxPro

----------

Follow our Telegram channel t.me/fxpro dedicated to providing insightful market analysis and expertise.

Reach out to media.comments@fxpro.com for PR and media inquiries

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.