Silver is testing the 34.85 level, a critical resistance both in the short and long term. Since 2013, a cup and handle formation has developed just beneath this level. A confirmed breakout could signal sustained long-term bullish momentum.

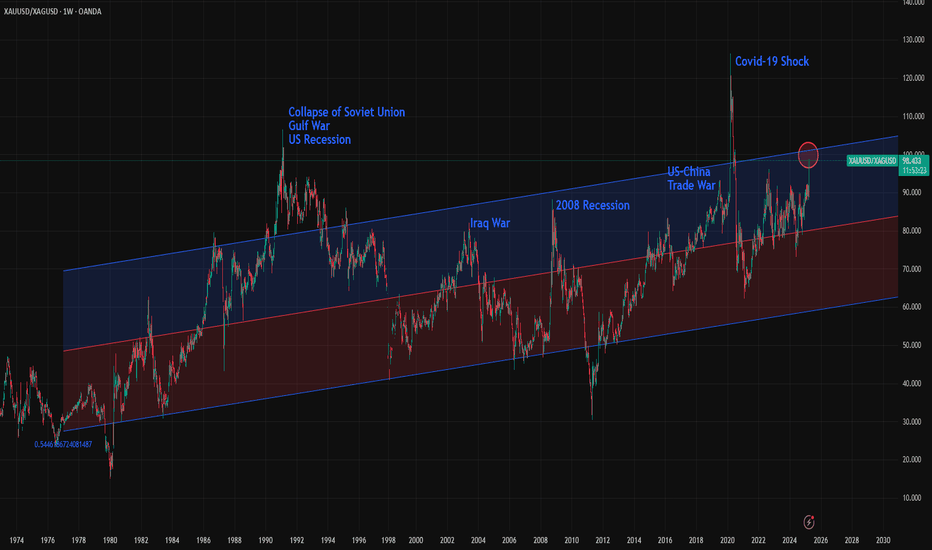

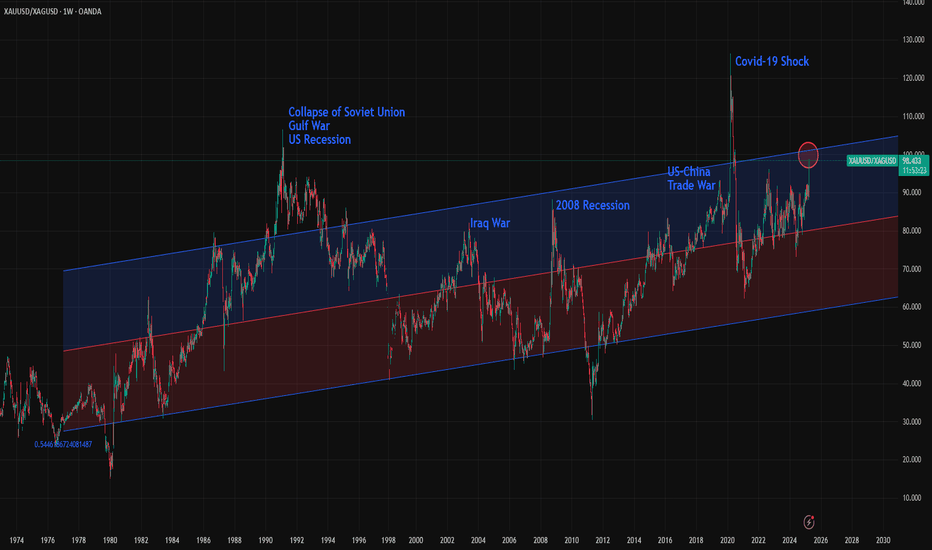

Supporting this outlook, the gold/silver ratio has recently shown a decisive tilt in gold's favor, reaching historically extreme levels. This test of 34.85 might be the catalyst silver bulls have been waiting for and a return to normal signal for gold/silver ratio with pair trade oppurtunity.

However, caution is warranted. Silver is known for sharp intraday and weekly reversals. Confirming the breakout or false breakout could become tricky.

Supporting this outlook, the gold/silver ratio has recently shown a decisive tilt in gold's favor, reaching historically extreme levels. This test of 34.85 might be the catalyst silver bulls have been waiting for and a return to normal signal for gold/silver ratio with pair trade oppurtunity.

However, caution is warranted. Silver is known for sharp intraday and weekly reversals. Confirming the breakout or false breakout could become tricky.

Trade active

After the breakout, a downward correction in progress. This correction could be a buying oppurtunity for those who missed the breakout as long as 34.85 holds on daily closes.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.