Today's Forex News: Global upheaval boosts the dollar

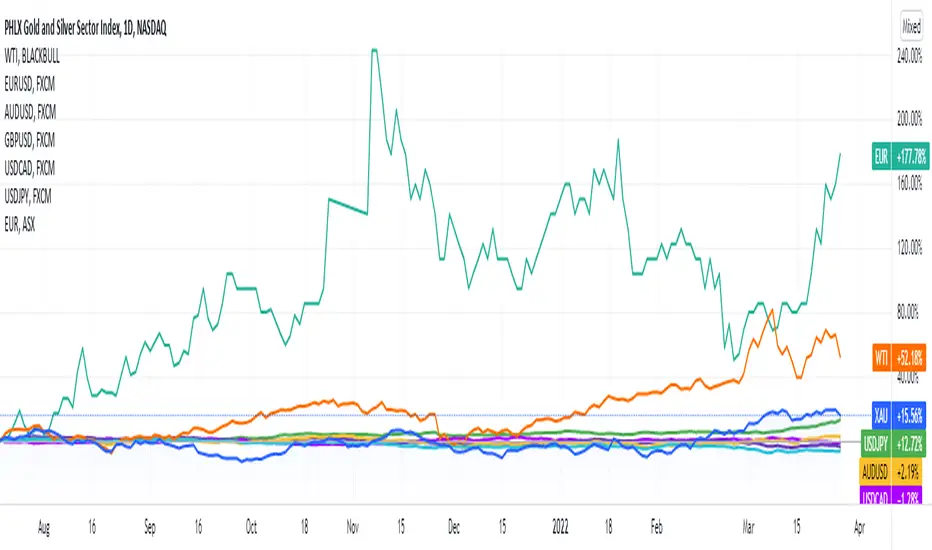

EUR/USD ⬆️

GBP/USD ⬆️

AUD/USD ⬇️

USD/CAD ⬆️

USD/JPY ⬇️

XAU ⬇️

WTI ⬇️

The market tone remained gloomy, which helped the US dollar close the day with gains against the majority of its key rivals.

The Bank of Japan provided the first impetus. The central bank said that it would purchase an unlimited quantity of 10-year JGBs at 0.25 percent to protect the yield cap. This is the central bank's second intervention in the foreign exchange market this year. The decision drove the JPY into a sell-off spiral, which aided the greenback's rise across the foreign exchange market. USD/JPY reached a high of 125.05 before settling at 123.60.

The yield on the 10-year Treasury note reached a new multi-year high of 2.557 percent before falling to 2.46 percent and precipitating a bearish reaction in the dollar.

On the battlefield, Russian legislator Ivan Abramov stated Monday that the G7's unwillingness to pay for Russian gas in roubles would result in an unambiguous halt to shipments. German Finance Minister Christian Lindner stated that his country is prepared if Moscow retaliates against the G-7 and that businesses must fight Russia's requests for RUB-denominated gas payments.

Wall Street ended the day in the red, but rebounded ahead of the close on news that Russia is willing to make some concessions, including dropping its desire for Ukraine to be "denazified" and allowing the country to join the EU if it maintains its neutrality.

Additionally, China announced additional lockdowns, this time affecting Shanghai. The news heightened fears of inflation and supply chain problems.

Andrew Bailey, Governor of the Bank of England, warned against fluctuations in commodity markets endangering financial stability. He also underlined that inflation poses concerns on both sides. GBPUSD dipped to 1.3065 and closed just below 1.3100 on the day. The EUR/USD pair fell to a new two-week low of 1.0944, encountering sellers as it approached the 1.1000 level.

Commodity-linked currencies posted minor losses on the day. The AUD/USD pair is trading slightly above the 0.7500 level, while the USD/CAD pair is trading higher at 1.2530. Gold prices fell and ended the day at $1,926 a troy ounce, while crude oil prices fell as well, with WTI presently trading around $104.60 a barrel.

The macroeconomic calendar, with the emphasis turning to the release of US employment statistics at the conclusion of the week.

📱 Get instant market news delivered to you in real time on Mitrade

EUR/USD ⬆️

GBP/USD ⬆️

AUD/USD ⬇️

USD/CAD ⬆️

USD/JPY ⬇️

XAU ⬇️

WTI ⬇️

The market tone remained gloomy, which helped the US dollar close the day with gains against the majority of its key rivals.

The Bank of Japan provided the first impetus. The central bank said that it would purchase an unlimited quantity of 10-year JGBs at 0.25 percent to protect the yield cap. This is the central bank's second intervention in the foreign exchange market this year. The decision drove the JPY into a sell-off spiral, which aided the greenback's rise across the foreign exchange market. USD/JPY reached a high of 125.05 before settling at 123.60.

The yield on the 10-year Treasury note reached a new multi-year high of 2.557 percent before falling to 2.46 percent and precipitating a bearish reaction in the dollar.

On the battlefield, Russian legislator Ivan Abramov stated Monday that the G7's unwillingness to pay for Russian gas in roubles would result in an unambiguous halt to shipments. German Finance Minister Christian Lindner stated that his country is prepared if Moscow retaliates against the G-7 and that businesses must fight Russia's requests for RUB-denominated gas payments.

Wall Street ended the day in the red, but rebounded ahead of the close on news that Russia is willing to make some concessions, including dropping its desire for Ukraine to be "denazified" and allowing the country to join the EU if it maintains its neutrality.

Additionally, China announced additional lockdowns, this time affecting Shanghai. The news heightened fears of inflation and supply chain problems.

Andrew Bailey, Governor of the Bank of England, warned against fluctuations in commodity markets endangering financial stability. He also underlined that inflation poses concerns on both sides. GBPUSD dipped to 1.3065 and closed just below 1.3100 on the day. The EUR/USD pair fell to a new two-week low of 1.0944, encountering sellers as it approached the 1.1000 level.

Commodity-linked currencies posted minor losses on the day. The AUD/USD pair is trading slightly above the 0.7500 level, while the USD/CAD pair is trading higher at 1.2530. Gold prices fell and ended the day at $1,926 a troy ounce, while crude oil prices fell as well, with WTI presently trading around $104.60 a barrel.

The macroeconomic calendar, with the emphasis turning to the release of US employment statistics at the conclusion of the week.

📱 Get instant market news delivered to you in real time on Mitrade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.