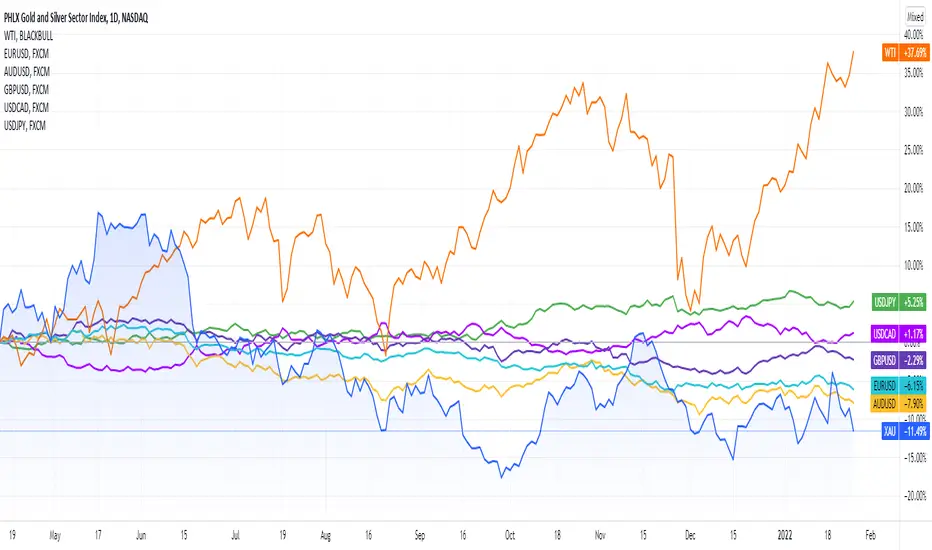

XAU🔽

WTI🔽

EUR/USD🔽

GBP/USD🔽

AUD/USD🔽

USD/CAD🔼

USD/JPY🔽

Following the US Federal Reserve's monetary policy announcement, the dollar finished Wednesday firmly higher across the board.

Rates and the taper were left unchanged, as expected, while the statement states that "the Committee anticipates it will soon be appropriate to raise the target range for the federal funds rate." Most market players had priced in a rate hike in March ahead of the event. There were no comments on the balance sheet, but the market did not expect them.

Chief Jerome Powell's news conference was a mixed bag. He expressed concern about the current epidemic of global health crisis and its potential to harm the economy while also predicting that inflation will fall this year. He went on to say that incoming data would determine the rate-hike path and that it is "difficult" to expect, but that there is plenty of room to raise rates.

Gold was one of the poorest performers, losing around $ 30.00 per troy ounce. The price of the gleaming gold was agreed at $1,816 per troy ounce. Crude oil prices managed to hold their gains, with WTI falling from a daily high of $87.92 to close at roughly $86.50 a barrel.

EUR/USD is trading at 1.1240, while GBP/USD is trading around 1.3460. The AUD/USD pair is approaching the weekly low of 0.7089, while the USDCAD is now trading at 1.2670. The USD/JPY currency pair is now trading at 114.60.

Government bond yields in the United States rose in response to the news, with the 10-year Treasury note reaching 1.857 percent.

#Mitrade #DollarIndex #YieldCurve #Inflation #Gold #USDJPY #EURUSD #GBPUSD

Find MORE on Mitrade

WTI🔽

EUR/USD🔽

GBP/USD🔽

AUD/USD🔽

USD/CAD🔼

USD/JPY🔽

Following the US Federal Reserve's monetary policy announcement, the dollar finished Wednesday firmly higher across the board.

Rates and the taper were left unchanged, as expected, while the statement states that "the Committee anticipates it will soon be appropriate to raise the target range for the federal funds rate." Most market players had priced in a rate hike in March ahead of the event. There were no comments on the balance sheet, but the market did not expect them.

Chief Jerome Powell's news conference was a mixed bag. He expressed concern about the current epidemic of global health crisis and its potential to harm the economy while also predicting that inflation will fall this year. He went on to say that incoming data would determine the rate-hike path and that it is "difficult" to expect, but that there is plenty of room to raise rates.

Gold was one of the poorest performers, losing around $ 30.00 per troy ounce. The price of the gleaming gold was agreed at $1,816 per troy ounce. Crude oil prices managed to hold their gains, with WTI falling from a daily high of $87.92 to close at roughly $86.50 a barrel.

EUR/USD is trading at 1.1240, while GBP/USD is trading around 1.3460. The AUD/USD pair is approaching the weekly low of 0.7089, while the USDCAD is now trading at 1.2670. The USD/JPY currency pair is now trading at 114.60.

Government bond yields in the United States rose in response to the news, with the 10-year Treasury note reaching 1.857 percent.

#Mitrade #DollarIndex #YieldCurve #Inflation #Gold #USDJPY #EURUSD #GBPUSD

Find MORE on Mitrade

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.