In Belgium whenever you talk to people about investing, property is the first thing on everyones mind. People really feel that once you have a job the first thing you should be doing is buy some property because property values 'always go up'.

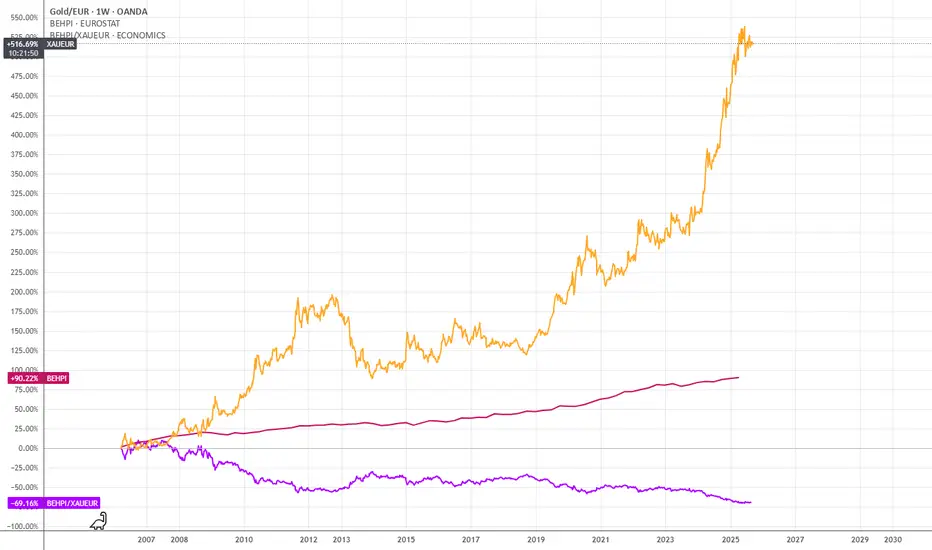

Now, I'm not here to tell you this is not true, or even that this is a bad investment decision. All I want to show that there's more nuance to this debate. So I made this chart which clearly shows that when denominated in gold (money that can't be printed and thus have its value inflated away) housing prices can definitely go down.

This chart shows:

yellow line: gold in euro's

red line: the Belgian Housing Price Index (euro's) +90%

purple line: the Belgian Housing Price index (in gold) -70%

The way people think about property in Belgium clearly shows that price-inflation is very much a phenomenon with a society-broad psychological impact. I am certainly not the biggest Keynes fan, but his quote seems quite relevant in the context of this chart:

"There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose."

Now, I'm not here to tell you this is not true, or even that this is a bad investment decision. All I want to show that there's more nuance to this debate. So I made this chart which clearly shows that when denominated in gold (money that can't be printed and thus have its value inflated away) housing prices can definitely go down.

This chart shows:

yellow line: gold in euro's

red line: the Belgian Housing Price Index (euro's) +90%

purple line: the Belgian Housing Price index (in gold) -70%

The way people think about property in Belgium clearly shows that price-inflation is very much a phenomenon with a society-broad psychological impact. I am certainly not the biggest Keynes fan, but his quote seems quite relevant in the context of this chart:

"There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose."

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.