The price of gold retreated from a two-week high on profit-taking. The correction intensified after the US imposed tariffs on imports of gold bars (1 kg), which could disrupt supplies from Switzerland and London.

Key supporting factors: Escalation of trade conflicts, concerns about the US economy and pressure on the Fed, questions about the Fed's independence after Trump's appointments

Risks: Short-term volatility ahead of US CPI data next week. However, fundamental drivers remain bullish.

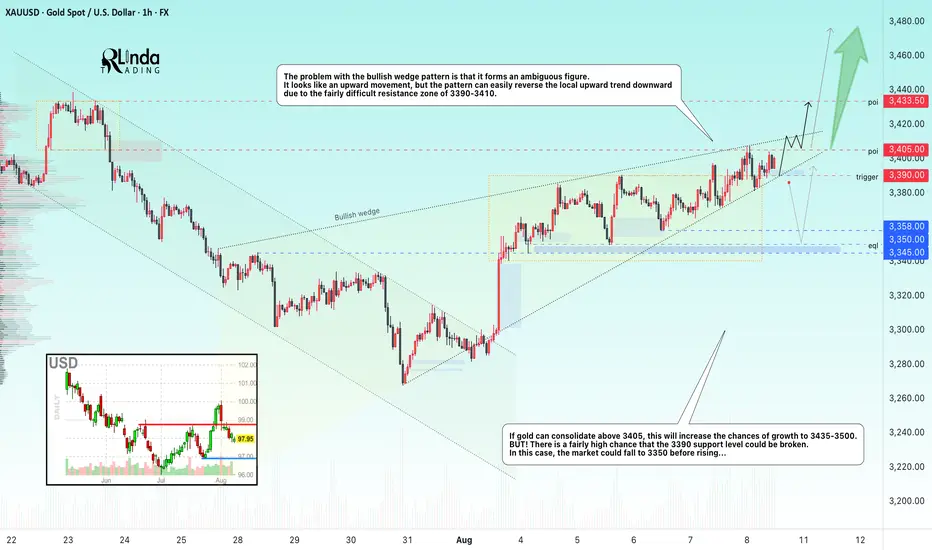

Support levels: 3390, 3350

Resistance levels: 3405, 3435

The problem with the bullish wedge pattern is that it forms an ambiguous figure. We have an upward movement, but the pattern could easily reverse the local upward trend due to the fairly difficult resistance zone of 3390-3410.

If gold manages to consolidate above 3405, this will increase the chances of growth to 3435-3500.

BUT! There is a fairly high chance that the 3390 support level could be broken. In this case, the market could fall to 3350 before rising...

Best regards, R. Linda!

Note

The situation is complicated by the emerging wedge pattern.Something is preventing gold from rising, and this can be seen from the chart.

I have highlighted two important levels, as it is quite difficult to determine the priority movement due to the current technical and fundamental situation. We need to focus on the actual circumstances.

Consolidation above 3405 could give bulls a chance for further growth to 3435.

BUT! The wedge pattern shown on the chart is a reversal pattern.

That is, if the bulls encounter pressure, thereby triggering a break of 3390, consolidation below this level could trigger a fall to the liquidity zone of 3350.

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🌹TRADING is a CASINO💔!?

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

NO‼️

Join me, I'll guide you to PROFITABLE TRADING💵!

(don't copy, click on the links!)

🟢Telegram Channel: t.me/RLindaTrade

🧿 Web: rlinda.com

🔴Contact: t.me/RLindaSignals

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.