Hi,

With some volatility before and after Japan election on next sunday, i'm expecting large movement on Gold (highly correlated with yen)

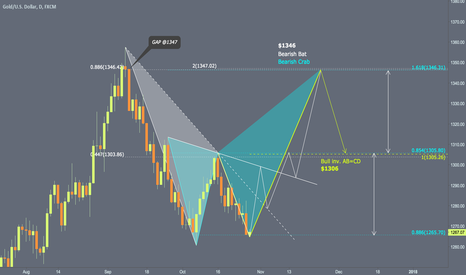

All patterns are on chart.

I added long on 0.618 retracement with confluence of inverted AB=CD pattern at $1277.

TP $1298 to reach the bearish trendline and to complete a bearish inverted AB=CD pattern.

Pullback to $1270 to complete a bullish gartley in order to confirm the low made in early october.

Then, start of CD leg to complete a bearish Bat and fill the gap opened in early september (PRZ between $1345/1350)

Below 126x, just forget ;)

With some volatility before and after Japan election on next sunday, i'm expecting large movement on Gold (highly correlated with yen)

All patterns are on chart.

I added long on 0.618 retracement with confluence of inverted AB=CD pattern at $1277.

TP $1298 to reach the bearish trendline and to complete a bearish inverted AB=CD pattern.

Pullback to $1270 to complete a bullish gartley in order to confirm the low made in early october.

Then, start of CD leg to complete a bearish Bat and fill the gap opened in early september (PRZ between $1345/1350)

Below 126x, just forget ;)

Note

$1282 has been reached.From now, 2 options from my side to complete the gartley :

Today gold drops until $1270 and should open with an gap up on monday.

Else, gold reach $1298 until close and open with a gap down on monday to reach 1270$ to complete the gartley.

In both cases, i think 1270$ should be reached to push prices to the north.

Again, below $1260, just forget :)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.