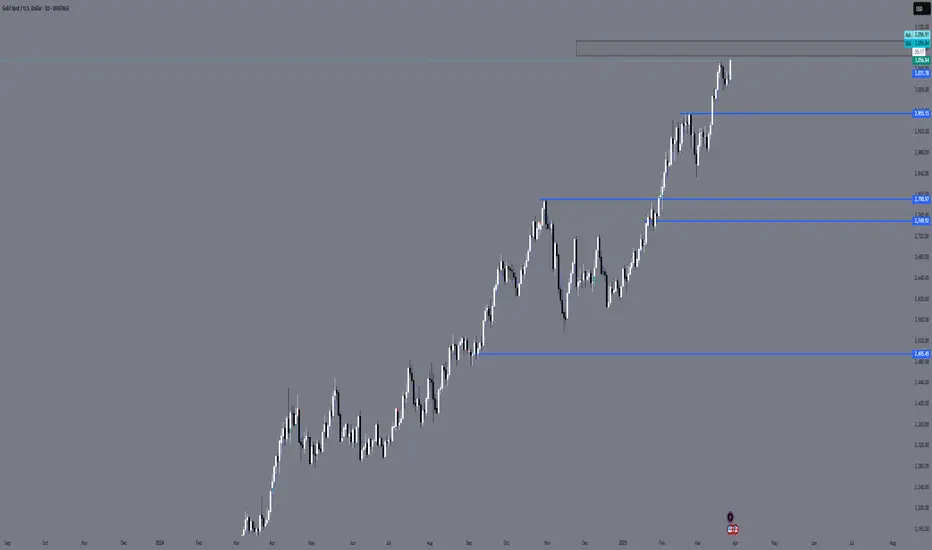

🧱 Market Structure

The D1 structure is clearly bullish – price is printing HHs and HLs consistently.

Current push is a continuation from previous consolidation, breaking structure upwards.

No CHoCH or BOS bearish yet – buyers still in control.

🔵 Key Zones (marked on your chart)

1. Near-term Liquidity / Resistance

Price is approaching a marked supply zone / premium area at the top (same one from W1).

This is likely to act as a reaction point – either:

Sweep liquidity and reverse

Break through and continue higher

2. Imbalances / Mitigation Zones Below Price

These zones are clean mitigation targets if price rejects from the top:

Zone Level Description

2955 Fair value gap / inefficiency (imbalance)

2790–2800 Strong structure zone + FVG + OB

2740–2750 Potential OB + previous consolidation

2495 Deep retracement level – less likely short-term

🧩 Order Flow Observation

Very little sign of exhaustion in candles right now.

The only reason to expect reversal is if:

Price hits the extreme premium zone

We see a strong daily rejection or

Lower timeframes shift (CHoCH / BOS)

📉 EMA Perspective (implied)

Assuming EMA 21/50/200:

Price is well above EMA 21 & 50, indicating strong short-term bullish trend.

A return to EMA 21 (probably around ~2950–2970) would be a healthy pullback.

📌 Bias – Daily

Term Bias Reason Daily

✅ Bullish Clean bullish structure, no shift Short-term

⚠️ Watchful

If price hits supply zone with reaction

Ideal setup

Rejection from premium + CHoCH on H4/H1

🧠 Trade Ideas (based on D1)

🔼 Bullish Scenario

Price holds above 3060 and breaks 3090+

Entry on breakout + retest of minor OB on H1

Target: ATH sweep and continuation

SL: Below minor HL / reaction low

🔽 Bearish Scenario

Price enters supply zone → forms bearish D1 candle (engulfing / pinbar)

Look for CHoCH on H4/H1 to enter short

Target levels: 2950 ➝ 2800 ➝ 2750

SL: Above daily high or OB

The D1 structure is clearly bullish – price is printing HHs and HLs consistently.

Current push is a continuation from previous consolidation, breaking structure upwards.

No CHoCH or BOS bearish yet – buyers still in control.

🔵 Key Zones (marked on your chart)

1. Near-term Liquidity / Resistance

Price is approaching a marked supply zone / premium area at the top (same one from W1).

This is likely to act as a reaction point – either:

Sweep liquidity and reverse

Break through and continue higher

2. Imbalances / Mitigation Zones Below Price

These zones are clean mitigation targets if price rejects from the top:

Zone Level Description

2955 Fair value gap / inefficiency (imbalance)

2790–2800 Strong structure zone + FVG + OB

2740–2750 Potential OB + previous consolidation

2495 Deep retracement level – less likely short-term

🧩 Order Flow Observation

Very little sign of exhaustion in candles right now.

The only reason to expect reversal is if:

Price hits the extreme premium zone

We see a strong daily rejection or

Lower timeframes shift (CHoCH / BOS)

📉 EMA Perspective (implied)

Assuming EMA 21/50/200:

Price is well above EMA 21 & 50, indicating strong short-term bullish trend.

A return to EMA 21 (probably around ~2950–2970) would be a healthy pullback.

📌 Bias – Daily

Term Bias Reason Daily

✅ Bullish Clean bullish structure, no shift Short-term

⚠️ Watchful

If price hits supply zone with reaction

Ideal setup

Rejection from premium + CHoCH on H4/H1

🧠 Trade Ideas (based on D1)

🔼 Bullish Scenario

Price holds above 3060 and breaks 3090+

Entry on breakout + retest of minor OB on H1

Target: ATH sweep and continuation

SL: Below minor HL / reaction low

🔽 Bearish Scenario

Price enters supply zone → forms bearish D1 candle (engulfing / pinbar)

Look for CHoCH on H4/H1 to enter short

Target levels: 2950 ➝ 2800 ➝ 2750

SL: Above daily high or OB

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

GoldFxMinds | XAUUSD Sniper Plans, Structure-Driven Bias & Execution Clarity

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Free: t.me/GoldMindsFX_AI

VIP: t.me/GoldMindsFX_A

1-on-1 Coaching: t.me/GoldFxMinds

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.