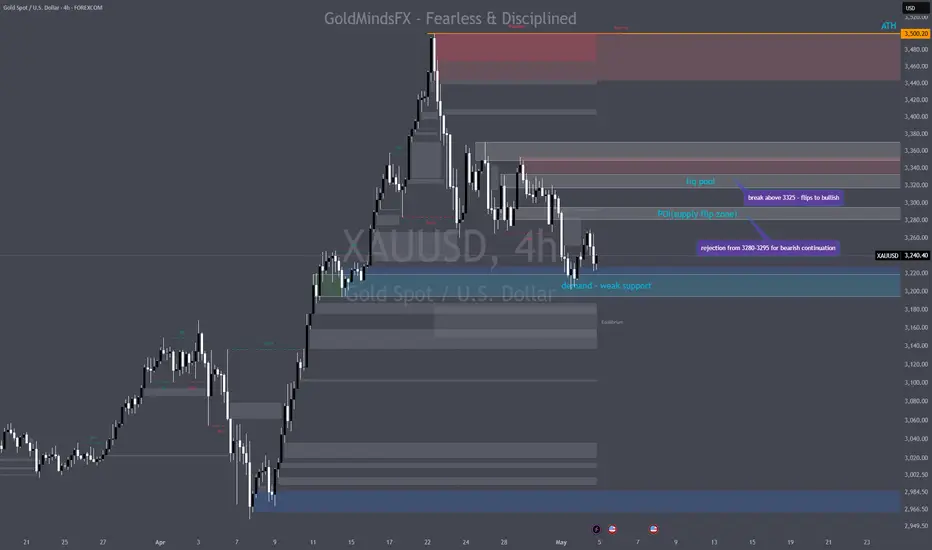

🔍 XAUUSD – H4 Outlook (May 4, 2025)

Trend:

🔻 Bearish structure still intact after the lower high at 3533 (ATH) and CHoCH at 3420.

🔹 Price is now ranging below lower high, with weak demand attempts from 3200–3240 zone.

🔸 Order flow bearish unless major BOS above 3320.

🗝 Key H4 Levels & Confluences

🔵 3195–3220 → H4 Demand + EQ + FVG

🧲 Last strong reaction zone pre-rally

🔁 Untapped OB + minor gap

🔄 EMA21 dynamic support below it

🟣 FIBO 61.8% of swing leg (April move)

🔵 3280–3295 → H4 POI (Supply Flip Zone)

📉 Reaction to this zone previously rejected bullish continuation

🧱 Confluence with 4H OB + minor FVG + EQ

⚠ If broken → clean magnet toward 3320

🔺 3315–3325 → Major LH Zone + Liquidity Magnet

💧 Internal liquidity build-up

🟤 If flipped → could induce bullish CHoCH on HTF

🚨 Final decision zone before possible premium push

🔻 3050–3075 → Weekly OB + H4 FVG

⛔ Major HTF demand below current price

🔄 EMA100 crossover area

🧲 Long-term buy interest if macro risk spikes

⚠ Summary:

Gold remains in a bearish HTF context, but is holding at key demand near 3220.

Rejection from 3280–3295 could reinforce bearish continuation.

Break above 3325 flips structure bullish — until then, sellers still in control.

🙏 Like this breakdown? Boost and follow us for sniper setups all week.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

#XAUUSD #GoldOutlook #SMC #LiquidityHunt #SmartMoneyFlow

Trend:

🔻 Bearish structure still intact after the lower high at 3533 (ATH) and CHoCH at 3420.

🔹 Price is now ranging below lower high, with weak demand attempts from 3200–3240 zone.

🔸 Order flow bearish unless major BOS above 3320.

🗝 Key H4 Levels & Confluences

🔵 3195–3220 → H4 Demand + EQ + FVG

🧲 Last strong reaction zone pre-rally

🔁 Untapped OB + minor gap

🔄 EMA21 dynamic support below it

🟣 FIBO 61.8% of swing leg (April move)

🔵 3280–3295 → H4 POI (Supply Flip Zone)

📉 Reaction to this zone previously rejected bullish continuation

🧱 Confluence with 4H OB + minor FVG + EQ

⚠ If broken → clean magnet toward 3320

🔺 3315–3325 → Major LH Zone + Liquidity Magnet

💧 Internal liquidity build-up

🟤 If flipped → could induce bullish CHoCH on HTF

🚨 Final decision zone before possible premium push

🔻 3050–3075 → Weekly OB + H4 FVG

⛔ Major HTF demand below current price

🔄 EMA100 crossover area

🧲 Long-term buy interest if macro risk spikes

⚠ Summary:

Gold remains in a bearish HTF context, but is holding at key demand near 3220.

Rejection from 3280–3295 could reinforce bearish continuation.

Break above 3325 flips structure bullish — until then, sellers still in control.

🙏 Like this breakdown? Boost and follow us for sniper setups all week.

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your plan and wait for confirmation before taking action.

#XAUUSD #GoldOutlook #SMC #LiquidityHunt #SmartMoneyFlow

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram t.me/GoldMindsFX_AI ⭐

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

⭐VIP ACCESS & Mentorship XAUUSD⭐

t.me/GoldMindsFX_A

Daily Sniper Plans| Elite Setups|Education step by step and personal guidance.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.