XAUUSD on a 120-minute chart is showing moving averages slowly converging into deth crosses

and the dual time frame RSI indicator of Chris Moody forecasted the move with bearish

divergence starting March 8th. I have closed my long positions in gold and silver and crossed

the aisle to take short positions . My target for XAUUSD is down to 2085 which is the middle

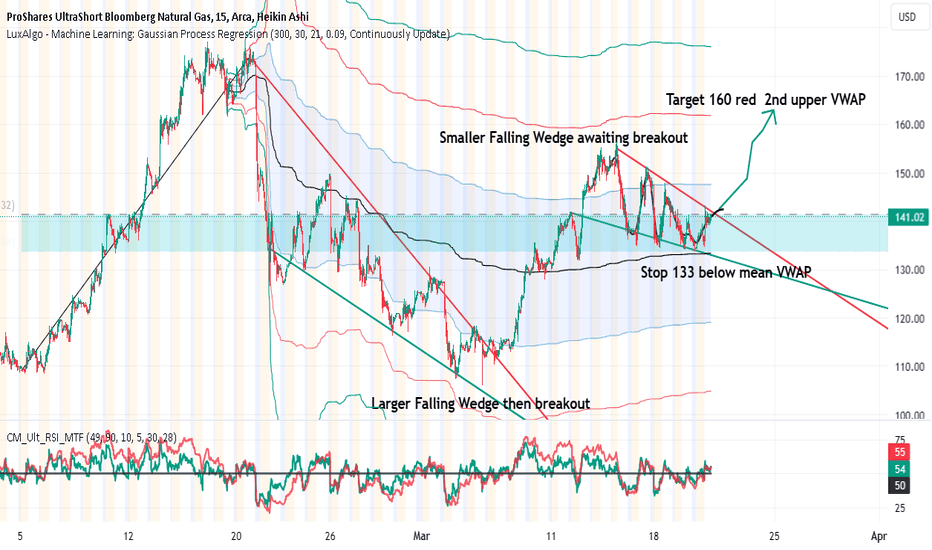

of the Fibonacci level from the prior uptrend. A predictive model based on Gaussian regression

lines by Luxalgo is showing a blue downtrending line for the remainder of the week with a

potential hihg pivot from which to take the short entry tomorrow.

and the dual time frame RSI indicator of Chris Moody forecasted the move with bearish

divergence starting March 8th. I have closed my long positions in gold and silver and crossed

the aisle to take short positions . My target for XAUUSD is down to 2085 which is the middle

of the Fibonacci level from the prior uptrend. A predictive model based on Gaussian regression

lines by Luxalgo is showing a blue downtrending line for the remainder of the week with a

potential hihg pivot from which to take the short entry tomorrow.

Note

More of a drop as expecte more due to rising dollar than gold value. Fed news couldimpact on Friday.

Note

Friday is here and gold relative to USD falling another 0.75%Note

Spot Gold more or less sideways in a narrow triangle with a failed brekout highernow with geopolitical risk at the front of it.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.