\Gold under pressure: imminent rally or programmed pullback? The 3,400\$ crossroads\

\Good evening, fellow traders – welcome back to this scorching summer… on the charts!\

Yes, it’s been a while since my last post. But you know how it goes: when gold is silent, it’s usually loading up a big move.

Meanwhile, I hope my previous analyses have kept you company — and more importantly, brought you value.

Spoiler: \I haven’t missed a single one.\

Before we begin: \drop a boost and leave a comment\. The community is our most precious gold.

📍 \Current Context\

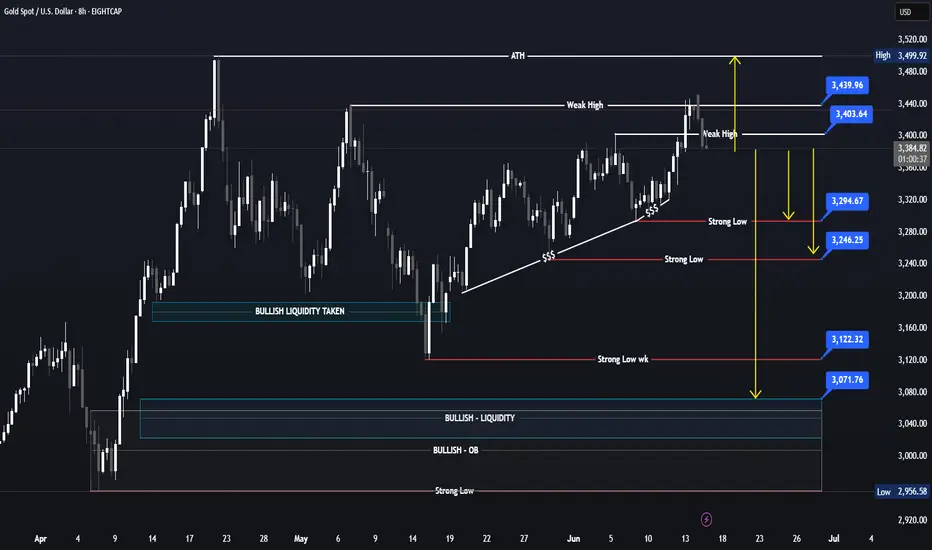

XAU/USD is walking a tightrope between \3,400\$ and 3,440$\.

This is a pivotal level, surrounded by international tension, a weakening dollar, and volatile economic expectations.

The question is simple: \Are we heading for new highs? Or dipping to refuel first?\

🐂 \Bullish Scenario: eyes on 3,440$\

A clear breakout above \3.440$\ could trigger the next leg up.

🎯 \Target: 3,500\$ (new all-time high)\

• Geopolitical stress between \Iran and Israel\ remains unresolved

• The \US dollar\ is sluggish, inflation is creeping back in

• Markets are betting on a \Fed rate cut\

• Gold? It smells fear better than anyone

🐻 \Bearish Scenario: 3,400\$ must hold\

If buyers can’t defend the \3.400$\ level, we could see a step-by-step correction toward:

📉 \Bearish Targets:\

• 3,295\$

• 3,245\$

• 3,120\$

• 3,070\$

As long as price stays below \3,440$\, every bounce remains \a selling opportunity, not a moonshot fantasy\.

🌍 \Geopolitical Snapshot (16/06/2025)\

• Iran and Israel keep exchanging “gifts” — drones, missiles, and tension

• The dollar is losing safe-haven status, giving gold the spotlight

• Oil is back above \73$\, triggering renewed inflation concerns

• The Fed is increasingly likely to \cut rates\, weakening the dollar and reinforcing gold’s strength

📊 \Operational Summary\

| \Direction\ | \Trigger Level\ | \Target\ | \Strategy\ |

| --------------------- | ---------------------- | ----------------- | ------------------------ |

| \LONG (Buy)\ | Break above 3,440\$ | 3,500\$ | New ATH |

| \SHORT (Sell)\ | Below 3,400\$ | 3,295\$ → 3,070\$ | Technical pullback setup |

🎯 \Conclusion: the plan exists – just not the one you’re expecting\

Gold is standing at a major crossroads. Either it breaks out… or catches its breath.

But remember: \we’re traders, not prophets. We don’t predict — we react.\

I’m watching closely, ready to strike… with the right foot forward. Are you?

\Share your thoughts in the comments.\

\Drop a boost and support those who help you see beyond the candles every single day.\

\PipGuard\

\Good evening, fellow traders – welcome back to this scorching summer… on the charts!\

Yes, it’s been a while since my last post. But you know how it goes: when gold is silent, it’s usually loading up a big move.

Meanwhile, I hope my previous analyses have kept you company — and more importantly, brought you value.

Spoiler: \I haven’t missed a single one.\

Before we begin: \drop a boost and leave a comment\. The community is our most precious gold.

📍 \Current Context\

XAU/USD is walking a tightrope between \3,400\$ and 3,440$\.

This is a pivotal level, surrounded by international tension, a weakening dollar, and volatile economic expectations.

The question is simple: \Are we heading for new highs? Or dipping to refuel first?\

🐂 \Bullish Scenario: eyes on 3,440$\

A clear breakout above \3.440$\ could trigger the next leg up.

🎯 \Target: 3,500\$ (new all-time high)\

• Geopolitical stress between \Iran and Israel\ remains unresolved

• The \US dollar\ is sluggish, inflation is creeping back in

• Markets are betting on a \Fed rate cut\

• Gold? It smells fear better than anyone

🐻 \Bearish Scenario: 3,400\$ must hold\

If buyers can’t defend the \3.400$\ level, we could see a step-by-step correction toward:

📉 \Bearish Targets:\

• 3,295\$

• 3,245\$

• 3,120\$

• 3,070\$

As long as price stays below \3,440$\, every bounce remains \a selling opportunity, not a moonshot fantasy\.

🌍 \Geopolitical Snapshot (16/06/2025)\

• Iran and Israel keep exchanging “gifts” — drones, missiles, and tension

• The dollar is losing safe-haven status, giving gold the spotlight

• Oil is back above \73$\, triggering renewed inflation concerns

• The Fed is increasingly likely to \cut rates\, weakening the dollar and reinforcing gold’s strength

📊 \Operational Summary\

| \Direction\ | \Trigger Level\ | \Target\ | \Strategy\ |

| --------------------- | ---------------------- | ----------------- | ------------------------ |

| \LONG (Buy)\ | Break above 3,440\$ | 3,500\$ | New ATH |

| \SHORT (Sell)\ | Below 3,400\$ | 3,295\$ → 3,070\$ | Technical pullback setup |

🎯 \Conclusion: the plan exists – just not the one you’re expecting\

Gold is standing at a major crossroads. Either it breaks out… or catches its breath.

But remember: \we’re traders, not prophets. We don’t predict — we react.\

I’m watching closely, ready to strike… with the right foot forward. Are you?

\Share your thoughts in the comments.\

\Drop a boost and support those who help you see beyond the candles every single day.\

\PipGuard\

Remember, my friend, that in the end, the important thing is risk management.

PipGuard™ t.me/PipGuard

PipGuard™ t.me/PipGuard

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Remember, my friend, that in the end, the important thing is risk management.

PipGuard™ t.me/PipGuard

PipGuard™ t.me/PipGuard

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.